Unsecured Claims Form

Understanding Unsecured Claims

Unsecured claims refer to debts that are not backed by any collateral. In the event of a borrower defaulting, creditors holding unsecured claims do not have a specific asset they can claim as repayment. Common examples of unsecured claims include credit card debts, medical bills, and personal loans. Understanding the nature of these claims is essential for both creditors and debtors, as they play a significant role in bankruptcy proceedings and debt recovery processes.

Steps to Complete the Unsecured Claims Form

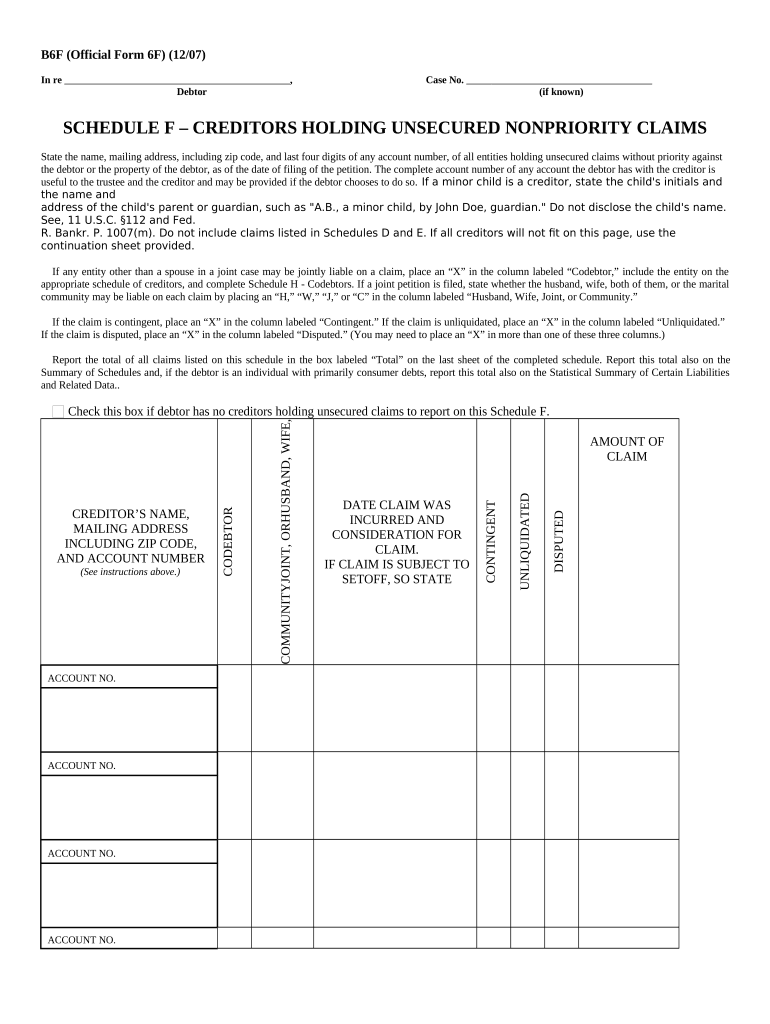

Completing the unsecured claims form requires careful attention to detail. Here are the key steps to follow:

- Gather necessary information, such as the debtor's name, address, and the amount owed.

- Clearly outline the nature of the debt, specifying that it is an unsecured claim.

- Provide any supporting documentation that verifies the claim, such as account statements or contracts.

- Review the form for accuracy before submission to avoid delays.

- Submit the completed form through the appropriate channels, whether online or via mail.

Legal Use of Unsecured Claims

The legal standing of unsecured claims is defined by various laws and regulations. In the United States, unsecured claims are treated differently in bankruptcy proceedings compared to secured claims. Creditors must follow specific legal protocols to ensure their claims are recognized in court. This includes filing the appropriate forms within designated timelines and providing adequate proof of the debt. Understanding these legal requirements is crucial for creditors to protect their interests.

Examples of Using the Unsecured Claims Form

Unsecured claims forms are commonly used in several scenarios. For instance, a creditor may file an unsecured claim during a bankruptcy case to recover funds owed. Another example is when a business seeks to collect outstanding debts from clients who have defaulted on payments. These forms help establish the creditor's right to repayment and are essential in legal proceedings.

Required Documents for Unsecured Claims

When submitting an unsecured claims form, certain documents are typically required to support the claim. These may include:

- Proof of the debt, such as invoices or contracts.

- Account statements detailing the outstanding balance.

- Any correspondence related to the debt, such as payment reminders or agreements.

Having these documents ready can facilitate a smoother claims process and increase the likelihood of recovery.

Filing Deadlines for Unsecured Claims

Filing deadlines for unsecured claims can vary depending on the specific circumstances, such as the type of bankruptcy being filed. Generally, creditors must submit their claims within a specific timeframe after the bankruptcy petition is filed. Missing these deadlines can result in the loss of the right to recover the debt. It is essential for creditors to be aware of these deadlines to protect their financial interests.

Quick guide on how to complete unsecured claims

Effortlessly Prepare Unsecured Claims on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the appropriate template and securely store it online. airSlate SignNow equips you with all the features necessary to create, modify, and eSign your documents swiftly without delays. Handle Unsecured Claims on any device using the airSlate SignNow applications for Android or iOS and simplify any document-centric workflow today.

The Easiest Way to Edit and eSign Unsecured Claims Effortlessly

- Find Unsecured Claims and click Get Form to begin.

- Make use of the available tools to complete your document.

- Emphasize important sections of your documents or hide sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to finalize your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and the need to print new copies due to mistakes. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Unsecured Claims while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are unsecured claims?

Unsecured claims are financial obligations that are not backed by collateral. In business transactions, understanding how to manage unsecured claims is crucial for maintaining cash flow and ensuring proper documentation. airSlate SignNow provides tools to easily document and sign agreements related to unsecured claims, enhancing your business's efficiency.

-

How does airSlate SignNow handle unsecured claims?

airSlate SignNow offers a streamlined process for managing unsecured claims by allowing users to send, sign, and store necessary documents securely. With our eSignature solution, you can automate your claims process, ensuring timely agreements and reducing the risk of errors in document handling. This feature is essential for businesses dealing with unsecured claims to maintain organization and compliance.

-

Is airSlate SignNow cost-effective for managing unsecured claims?

Yes, airSlate SignNow is a cost-effective solution for managing unsecured claims. Our flexible pricing plans cater to businesses of all sizes, providing access to essential features without breaking the bank. Whether you're a startup or a large corporation, our platform ensures that you can manage unsecured claims efficiently at a reasonable price.

-

What key features does airSlate SignNow offer for unsecured claims?

Key features of airSlate SignNow that benefit users managing unsecured claims include customizable templates, bulk sending, and real-time tracking of document statuses. These functionalities simplify the process of obtaining signatures and organizing documents, ensuring that unsecured claims are addressed swiftly and efficiently. Users can also request payments directly through the platform for added convenience.

-

Can airSlate SignNow integrate with other systems for unsecured claims management?

Absolutely! airSlate SignNow offers seamless integrations with popular business tools such as CRM systems and accounting software. This connectivity allows for a more comprehensive management approach to unsecured claims, as you can sync your documents and data across platforms, enhancing workflow efficiency and accuracy.

-

What are the benefits of using airSlate SignNow for unsecured claims?

Using airSlate SignNow to manage unsecured claims offers numerous benefits, including improved speed and efficiency in document processing. The eSignature capabilities reduce turnaround times for agreements, helping businesses react promptly to financial obligations. Additionally, our secure storage solutions ensure that all your claims documentation remains organized and accessible.

-

Is the airSlate SignNow platform secure for handling unsecured claims?

Yes, airSlate SignNow prioritizes security when handling unsecured claims. Our platform uses advanced encryption and compliance standards to protect sensitive data throughout the eSigning process. Businesses can confidently manage their unsecured claims, knowing that their documents are secure and compliant with industry regulations.

Get more for Unsecured Claims

Find out other Unsecured Claims

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement