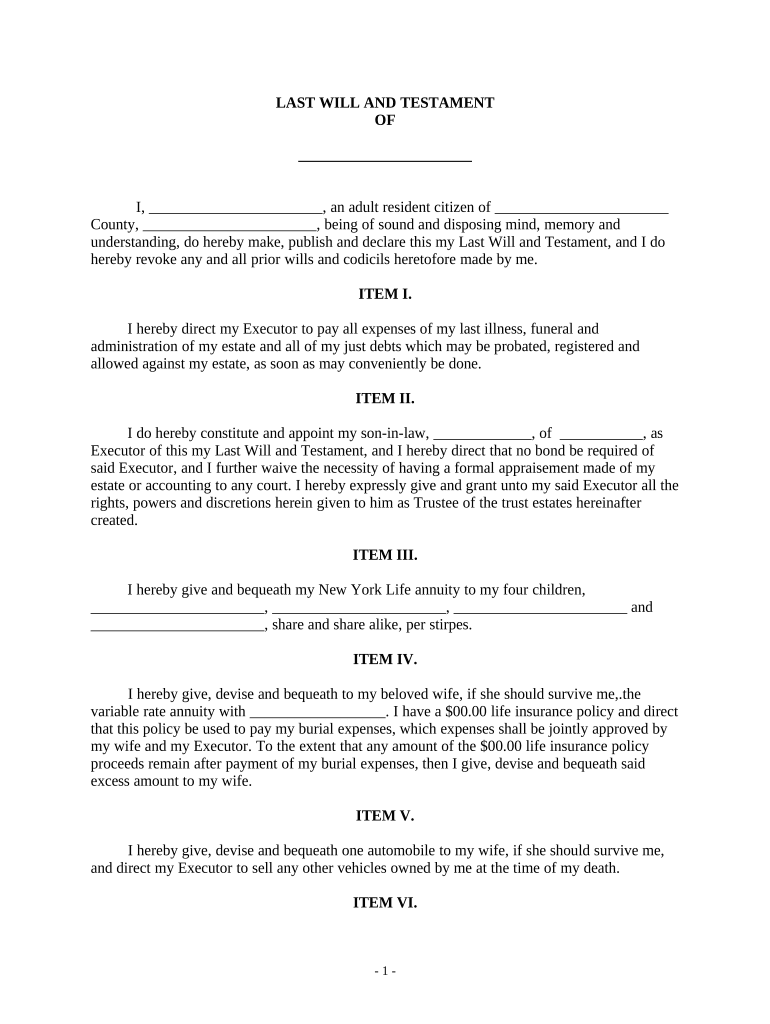

Complex Will Maximum Unified Credit to Spouse Form

What is the Complex Will Maximum Unified Credit To Spouse

The Complex Will Maximum Unified Credit To Spouse is a legal document that allows individuals to allocate their estate in a manner that maximizes tax benefits for their surviving spouse. This type of will is particularly important in estate planning as it enables the transfer of assets while minimizing tax liabilities. By utilizing the unified credit, individuals can ensure that a significant portion of their estate can be passed on to their spouse without incurring estate taxes, thus providing financial security for the surviving partner.

Key Elements of the Complex Will Maximum Unified Credit To Spouse

Several key elements define the Complex Will Maximum Unified Credit To Spouse. These include:

- Unified Credit: This allows a certain amount of an estate to be exempt from federal estate taxes.

- Spousal Exemption: Transfers between spouses are generally exempt from taxes, which can be leveraged in estate planning.

- Specific Bequests: The will may include specific instructions on how assets should be distributed to the spouse.

- Contingent Beneficiaries: It may outline what happens to the estate if the spouse predeceases the testator.

Steps to Complete the Complex Will Maximum Unified Credit To Spouse

Completing the Complex Will Maximum Unified Credit To Spouse involves several important steps:

- Gather necessary financial information, including assets and liabilities.

- Determine the amount of unified credit available based on current IRS guidelines.

- Consult with a legal professional to ensure compliance with state laws.

- Draft the will, specifying the distribution of assets and any specific bequests.

- Review the document with your spouse and legal advisor to confirm accuracy.

- Sign the will in accordance with state requirements, ensuring witnesses are present if necessary.

Legal Use of the Complex Will Maximum Unified Credit To Spouse

The legal use of the Complex Will Maximum Unified Credit To Spouse is to facilitate the smooth transfer of assets while maximizing tax benefits. This will must comply with state laws regarding wills and estate planning. It is essential that the document is executed properly, as any errors may lead to disputes or invalidation. Consulting with an estate planning attorney can help ensure that the will meets all legal requirements and effectively serves its purpose.

How to Obtain the Complex Will Maximum Unified Credit To Spouse

Obtaining the Complex Will Maximum Unified Credit To Spouse typically involves working with an estate planning attorney who can assist in drafting the document. Many legal professionals provide templates or forms that can be customized to fit individual needs. Additionally, online legal services may offer resources for creating a will. It is crucial to ensure that any form used complies with state regulations and accurately reflects the testator's intentions.

Examples of Using the Complex Will Maximum Unified Credit To Spouse

Examples of using the Complex Will Maximum Unified Credit To Spouse include scenarios where individuals wish to leave their entire estate to their spouse while minimizing tax implications. For instance, a couple with a combined estate worth two million dollars may utilize the unified credit to ensure that the first spouse's death does not trigger estate taxes on the transfer of assets to the surviving spouse. Another example could involve designating specific assets, such as a family home or investment accounts, to ensure that the surviving spouse has immediate access to necessary resources.

Quick guide on how to complete complex will maximum unified credit to spouse

Complete Complex Will Maximum Unified Credit To Spouse effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, as you can access the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Complex Will Maximum Unified Credit To Spouse on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Complex Will Maximum Unified Credit To Spouse with ease

- Locate Complex Will Maximum Unified Credit To Spouse and then click Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Complex Will Maximum Unified Credit To Spouse and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Complex Will Maximum Unified Credit To Spouse?

A Complex Will Maximum Unified Credit To Spouse is a legal document that allows individuals to allocate the maximum unified credit to their spouse upon death. This strategy helps optimize estate tax exemptions and ensures that your spouse receives the maximum benefit from your estate. By utilizing airSlate SignNow, you can easily create, send, and eSign your Complex Will documents securely.

-

How does airSlate SignNow help in creating a Complex Will Maximum Unified Credit To Spouse?

airSlate SignNow provides users with easy-to-use templates specifically designed for Complex Wills. These templates allow you to customize your will to allocate the Maximum Unified Credit To Spouse effectively. With our intuitive interface, you can simplify the drafting process and ensure that your wishes are accurately reflected in the document.

-

What are the pricing options for using airSlate SignNow for Complex Wills?

airSlate SignNow offers flexible pricing plans to cater to different users' needs, including features for managing Complex Wills and other document signing needs. A basic plan starts with essential functionalities, while advanced plans include additional features such as custom branding and integrations. Visit our pricing page for detailed information on options suitable for managing Complex Will Maximum Unified Credit To Spouse.

-

Can airSlate SignNow assist with the legal aspects of a Complex Will Maximum Unified Credit To Spouse?

While airSlate SignNow simplifies document creation and eSigning, it is important to consult with a legal professional for specific legal advice on Complex Wills. Our platform provides the tools necessary to create a valid will, but ensuring compliance with state laws regarding the Maximum Unified Credit To Spouse is best handled by a qualified attorney.

-

What are the benefits of using airSlate SignNow for my Complex Will Maximum Unified Credit To Spouse?

Using airSlate SignNow for your Complex Will Maximum Unified Credit To Spouse ensures efficiency and security in document handling. The platform allows for easy collaboration with legal advisors, quick eSigning, and secure storage of your will. This streamlines the estate planning process and guarantees that your spouse will receive the full benefit of your estate.

-

Is it easy to integrate airSlate SignNow with other tools for handling Complex Wills?

Absolutely! airSlate SignNow offers integration capabilities with various tools and platforms, enhancing your workflow for creating and managing Complex Wills. Whether you use CRM systems, cloud storage, or legal software, our integrations ensure that you can efficiently manage your documents related to Maximum Unified Credit To Spouse.

-

How secure is airSlate SignNow when handling Complex Will documents?

AirSlate SignNow prioritizes the security of your documents, including Complex Wills. We employ advanced encryption protocols and comply with GDPR and HIPAA regulations to ensure your sensitive information is protected. When addressing your Maximum Unified Credit To Spouse, you can trust that your documents are secure and confidential.

Get more for Complex Will Maximum Unified Credit To Spouse

Find out other Complex Will Maximum Unified Credit To Spouse

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage