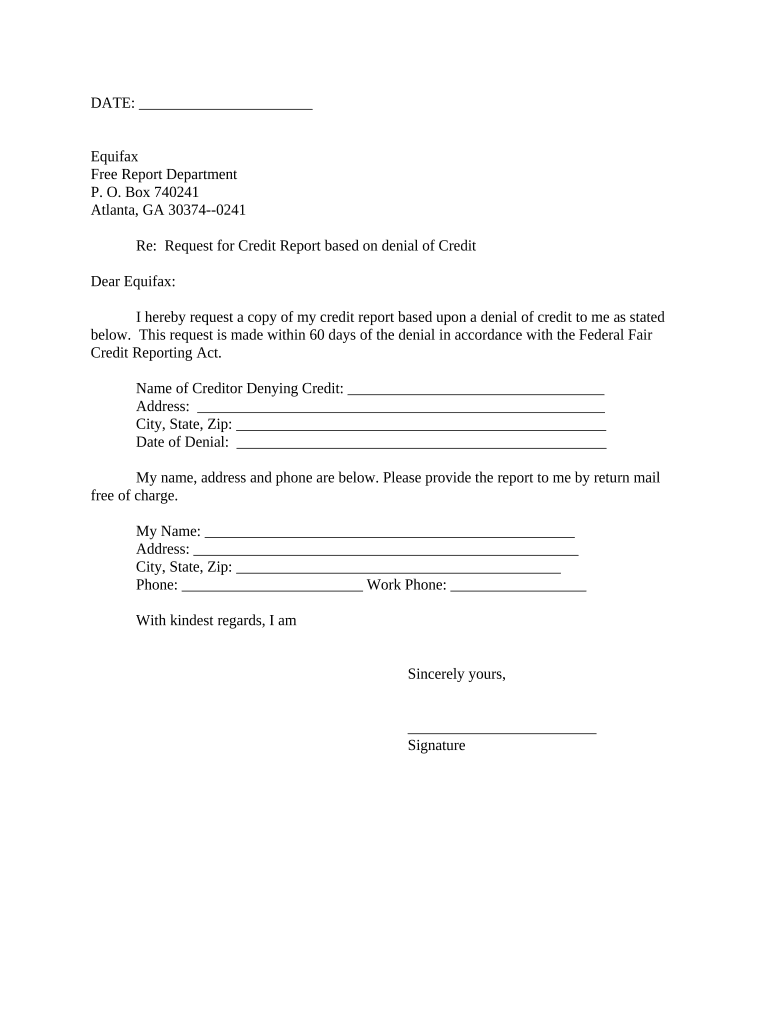

Letter Credit Form

What is the letter requesting credit?

A letter requesting credit is a formal document used to ask a financial institution or creditor for a line of credit or an increase in an existing credit limit. This letter typically outlines the reason for the request, the applicant's financial situation, and any supporting information that may help in the decision-making process. It serves as an official communication that can be reviewed by the lender to assess the applicant's creditworthiness.

Key elements of the letter requesting credit

When drafting a letter requesting credit, it is important to include several key elements to ensure clarity and effectiveness:

- Contact Information: Include your name, address, phone number, and email at the top of the letter.

- Date: Add the date when the letter is written.

- Recipient’s Information: Include the name and title of the person you are addressing, along with the institution's name and address.

- Subject Line: Clearly state the purpose of the letter, such as "Request for Credit Increase."

- Introduction: Briefly introduce yourself and your relationship with the institution.

- Body: Explain the reason for your request, providing relevant financial details and any changes in your circumstances.

- Closing: Thank the recipient for considering your request and provide your contact information for follow-up.

Steps to complete the letter requesting credit

Completing a letter requesting credit involves several steps to ensure that it is well-structured and persuasive:

- Gather Information: Collect all necessary financial documents and details that support your request.

- Draft the Letter: Begin writing the letter by following the key elements mentioned earlier.

- Review and Edit: Check for grammatical errors and ensure that the letter is clear and concise.

- Obtain Supporting Documents: Attach any relevant financial statements or documents that can strengthen your case.

- Send the Letter: Choose your preferred method of submission, whether it be email, online form, or traditional mail.

Legal use of the letter requesting credit

The letter requesting credit is a legally recognized document in the United States. It is important to ensure that the information provided is accurate and truthful, as any discrepancies could lead to legal repercussions or a denial of the request. Additionally, maintaining a professional tone and adhering to the institution's guidelines for such requests can enhance the legitimacy of the letter.

How to obtain the letter requesting credit

Obtaining a letter requesting credit can be as simple as drafting one yourself. Many templates are available online that can guide you in creating a formal request. Alternatively, you can consult with a financial advisor or legal professional to ensure that your letter meets all necessary requirements and effectively communicates your needs.

Examples of using the letter requesting credit

Examples of scenarios where a letter requesting credit may be used include:

- Requesting a Credit Increase: A customer may write to their credit card issuer to request a higher limit based on improved income or credit history.

- Applying for a New Line of Credit: Individuals may submit a letter to a bank when applying for a personal loan or mortgage.

- Business Credit Requests: Business owners can use this letter to request credit from suppliers or financial institutions to support their operations.

Quick guide on how to complete letter credit

Easily manage Letter Credit on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers a perfect environmentally friendly substitute to traditional printed and signed papers, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle Letter Credit on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Letter Credit effortlessly

- Find Letter Credit and click Get Form to begin.

- Use the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with specific tools that airSlate SignNow provides for this purpose.

- Create your electronic signature using the Sign tool, which takes moments and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Letter Credit and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a letter requesting credit?

A letter requesting credit is a formal document used to ask for credit from a lender or supplier. By using airSlate SignNow, you can easily create, send, and eSign this letter, ensuring that it meets all professional standards. The platform simplifies the process, making it efficient and straightforward.

-

How can airSlate SignNow help with sending a letter requesting credit?

With airSlate SignNow, you can quickly draft a letter requesting credit using our templates. The intuitive interface allows you to customize the letter's content and sign it digitally. This feature ensures that your request is sent promptly and securely, signNowly speeding up the credit application process.

-

Is there a cost associated with using airSlate SignNow for a letter requesting credit?

Yes, airSlate SignNow offers pricing plans that cater to different business needs. You can choose a plan that fits your budget while still having access to premium features for creating a letter requesting credit. The cost-effectiveness of our solution makes it a smart choice for businesses looking to streamline their document processes.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a variety of features including templates, eSignature capabilities, and document tracking. These features are particularly useful when crafting a letter requesting credit, as they allow you to efficiently manage and monitor the document's status. This automation makes it easier for businesses to focus on their core activities.

-

Can I integrate airSlate SignNow with other software I use?

Absolutely! airSlate SignNow easily integrates with popular applications like Google Drive, Salesforce, and Zapier. This seamless integration allows you to efficiently manage your letter requesting credit, alongside other documents and workflows, enhancing your overall productivity.

-

What benefits can I expect from using airSlate SignNow for my business?

Using airSlate SignNow provides numerous benefits, including reduced paperwork, increased operational efficiency, and enhanced security for processed documents. When creating a letter requesting credit, these advantages help ensure that your requests are handled swiftly and securely, which can result in faster approvals.

-

Is airSlate SignNow secure for sending sensitive documents like a letter requesting credit?

Yes, airSlate SignNow prioritizes document security and uses industry-standard encryption to protect your data. This ensures that your letter requesting credit is safe from unauthorized access during transmission. You can send sensitive documents with confidence, knowing they are secure.

Get more for Letter Credit

Find out other Letter Credit

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple