Form 5695 2016

What is the Form 5695

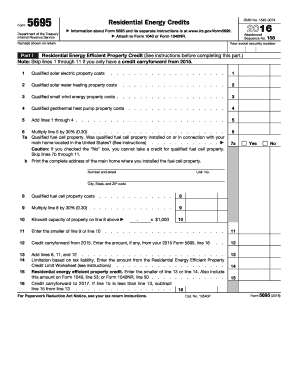

The 2016 Form 5695, also known as the Residential Energy Credits form, is utilized by taxpayers in the United States to claim tax credits for energy-efficient improvements made to their homes. This form is specifically designed to help individuals take advantage of various energy credits offered by the IRS, which can significantly reduce their tax liability. The credits may include those for solar energy systems, energy-efficient windows, doors, and other qualifying improvements that enhance a home's energy efficiency.

How to use the Form 5695

To effectively use the 2016 Form 5695, taxpayers need to follow a structured approach. First, gather all necessary documentation related to the energy-efficient improvements made, including receipts and manufacturer certifications. Next, complete the form by providing personal information and detailing the specific energy improvements. It is essential to accurately calculate the credits based on the IRS guidelines to ensure compliance and maximize potential tax savings. Once completed, the form should be submitted along with your tax return.

Steps to complete the Form 5695

Completing the 2016 Form 5695 involves several key steps:

- Gather Documentation: Collect all relevant receipts, invoices, and certifications for energy-efficient improvements.

- Fill Out Personal Information: Provide your name, address, and Social Security number at the top of the form.

- Detail Energy Improvements: List each qualifying improvement, including the cost and type of credit being claimed.

- Calculate Credits: Follow the instructions to determine the total credits you are eligible for based on your improvements.

- Review and Submit: Double-check all entries for accuracy before submitting the form with your tax return.

Eligibility Criteria

To qualify for the credits claimed on the 2016 Form 5695, taxpayers must meet specific eligibility criteria. The improvements must be made to a primary residence located in the United States, and they must meet the energy efficiency standards set by the IRS. Additionally, the taxpayer must have incurred costs for the improvements during the tax year for which they are filing. It is important to verify that the improvements are eligible under the current IRS guidelines to avoid any issues with claims.

Required Documents

When filing the 2016 Form 5695, taxpayers must provide certain documents to support their claims. These documents typically include:

- Receipts or invoices for the energy-efficient improvements.

- Manufacturer certifications that confirm the products meet IRS energy efficiency standards.

- Any additional documentation required by the IRS for specific credits claimed.

Having these documents ready will facilitate a smoother filing process and ensure compliance with IRS requirements.

IRS Guidelines

The IRS provides detailed guidelines for completing the 2016 Form 5695, which outline the types of improvements that qualify for credits, the calculation methods, and submission procedures. Taxpayers should carefully review these guidelines to ensure they understand the eligibility requirements and any changes that may have occurred since previous tax years. Adhering to these guidelines is crucial for successfully claiming energy credits and avoiding potential penalties.

Quick guide on how to complete 2016 form 5695

Effortlessly complete Form 5695 on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly and without delays. Handle Form 5695 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The simplest way to modify and eSign Form 5695 with ease

- Find Form 5695 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of missing or lost files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from your selected device. Modify and eSign Form 5695 and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 5695

Create this form in 5 minutes!

People also ask

-

What is the 2016 Form 5695 and why is it important?

The 2016 Form 5695 is used to claim the residential energy efficient property credit. This form is important for taxpayers who have invested in renewable energy sources for their homes, as it allows them to receive tax credits. Completing the 2016 Form 5695 accurately can lead to signNow savings on your tax return.

-

How can airSlate SignNow help with the 2016 Form 5695?

airSlate SignNow streamlines the process of completing and signing the 2016 Form 5695 by providing an easy-to-use platform for e-signatures. This solution ensures that your documents are securely signed and stored, which is crucial for tax compliance. Additionally, you can track the status of your form in real-time for added convenience.

-

What features does airSlate SignNow offer for tax documents like the 2016 Form 5695?

airSlate SignNow offers features such as secure e-signatures, customizable templates, and document tracking specifically for tax documents like the 2016 Form 5695. These features help eliminate the hassle of manual signing, ensuring that your paperwork is handled efficiently and professionally. Furthermore, the platform allows for easy collaboration with tax professionals.

-

Is airSlate SignNow cost-effective for filing the 2016 Form 5695?

Yes, airSlate SignNow is a cost-effective solution for businesses and individuals needing to e-sign documents like the 2016 Form 5695. With various pricing plans available, users can choose an option that fits their budget while benefiting from a robust e-signature platform. The savings in time and resources can offset the costs associated with traditional signing methods.

-

What integrations does airSlate SignNow have that can assist with the 2016 Form 5695?

airSlate SignNow integrates seamlessly with a variety of popular business applications, enhancing your ability to manage the 2016 Form 5695 with ease. These integrations allow you to import data from other platforms, automate workflows, and enhance team collaboration. This flexibility ensures that your tax documentation process is as smooth as possible.

-

Can I use airSlate SignNow on mobile devices for my 2016 Form 5695?

Absolutely! airSlate SignNow is fully mobile-compatible, allowing you to complete and sign the 2016 Form 5695 on the go. Whether you’re using a smartphone or tablet, you can access all the features you need to manage your documents efficiently. This mobile accessibility is crucial for busy professionals looking to streamline their tax filing process.

-

What security measures does airSlate SignNow have for sensitive documents like the 2016 Form 5695?

airSlate SignNow prioritizes the security of your documents, including the sensitive information on the 2016 Form 5695. The platform employs industry-leading encryption protocols and secure storage practices to protect your data. You can trust that your information is safe while you e-sign and manage your tax documents.

Get more for Form 5695

Find out other Form 5695

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application