Organization for United States Tax 2017

What is the Organization for United States Tax

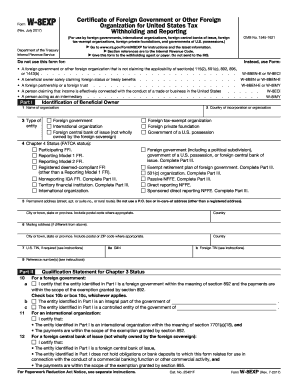

The Organization for United States Tax refers to the framework established by the Internal Revenue Service (IRS) to facilitate tax compliance for various entities, including foreign organizations and individuals. The W-8EXP form is specifically designed for foreign governments, international organizations, and other foreign entities claiming exemption from U.S. tax withholding. This form certifies the entity's status and eligibility under U.S. tax law, ensuring that they are not subject to certain taxes that would typically apply to domestic entities.

Steps to Complete the Organization for United States Tax

Completing the W-8EXP form involves several key steps to ensure accuracy and compliance. First, the foreign entity must gather necessary information, including its name, address, and taxpayer identification number, if applicable. Next, the entity needs to indicate its status as a foreign government or international organization. This is followed by providing details about any relevant tax treaties that may apply. Finally, the form must be signed and dated by an authorized representative of the entity, confirming the information provided is true and accurate.

Legal Use of the Organization for United States Tax

The legal use of the W-8EXP form is critical for foreign entities to avoid unnecessary tax withholding on U.S. source income. By submitting this form, the entity asserts its status under U.S. tax law, which can lead to significant tax savings. It is essential that the form is completed correctly and submitted to the appropriate withholding agent, as failure to do so may result in the imposition of backup withholding at the maximum rate.

Required Documents

To complete the W-8EXP form, certain documents may be required to support the entity's claims. These can include proof of the entity's foreign status, such as incorporation documents, tax identification numbers, and any relevant tax treaties. Additionally, if the entity is claiming exemption under a specific treaty, documentation that substantiates the claim may also be necessary. Having these documents ready can help streamline the completion and submission process.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the W-8EXP form. These guidelines outline the eligibility criteria for using the form, the necessary information to include, and the submission process. It is important for entities to familiarize themselves with these guidelines to ensure compliance and avoid potential penalties. The IRS also updates these guidelines periodically, so staying informed about any changes is crucial for ongoing compliance.

Filing Deadlines / Important Dates

Filing deadlines for the W-8EXP form can vary based on the specific circumstances of the foreign entity and the nature of the income received. Generally, the form must be submitted before the payment is made to ensure that the correct withholding tax rate is applied. Entities should also be aware of any annual requirements for renewing the form, as it may need to be resubmitted periodically to maintain its validity.

Quick guide on how to complete organization for united states tax

Complete Organization For United States Tax effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Organization For United States Tax on any platform using airSlate SignNow for Android or iOS and enhance any document-related process today.

The easiest way to modify and eSign Organization For United States Tax without hassle

- Find Organization For United States Tax and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or an invitation link, or download it directly to your computer.

Eliminate worries about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate reprinting new copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you prefer. Modify and eSign Organization For United States Tax and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct organization for united states tax

Create this form in 5 minutes!

People also ask

-

What is a w 8exp form and why do I need it?

The w 8exp form is used by foreign individuals and entities to signNow their foreign status for U.S. tax withholding purposes. If you're engaged in business transactions with U.S. entities, completing a w 8exp may be necessary to avoid unnecessary withholding tax on your earnings.

-

How does airSlate SignNow simplify the process of completing a w 8exp?

airSlate SignNow streamlines the process of filling out a w 8exp form through its user-friendly interface and robust eSignature capabilities. You can easily upload, complete, and sign the w 8exp digitally, ensuring a fast and compliant solution for your tax documentation.

-

Are there any costs associated with using airSlate SignNow for the w 8exp?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including features for processing the w 8exp effortlessly. You can choose from monthly or annual subscriptions, ensuring that you have a cost-effective solution for your document signing and management needs.

-

What features does airSlate SignNow offer for managing the w 8exp?

AirSlate SignNow provides features like customized templates, document collaboration, and secure storage, making it easy to manage your w 8exp forms. These capabilities help ensure that all stakeholders can complete and sign the form without hassle, enhancing productivity and compliance.

-

Can I integrate airSlate SignNow with other software for handling the w 8exp?

Yes, airSlate SignNow integrates seamlessly with various applications such as CRM tools and cloud storage services. This allows businesses to streamline their workflows involving the w 8exp and other documents, ultimately improving efficiency and reducing the time spent on administrative tasks.

-

What are the benefits of using airSlate SignNow for eSigning my w 8exp?

Using airSlate SignNow for eSigning your w 8exp offers several advantages, including increased security, ease of use, and faster turnaround times. You can sign and send documents from anywhere, helping you stay compliant while focusing on your core business operations.

-

Is airSlate SignNow secure for signing the w 8exp online?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to ensure that your w 8exp and other sensitive documents are protected. You can sign with confidence, knowing that your data is secure during the entire signing process.

Get more for Organization For United States Tax

- 2015 2021 form mn supervised driving log fill online

- New renewal and replacements permit class o car class form

- Get the free request for dmv forms to be mailed state of

- Motorboat hull identification number hin form

- Information request virginia

- For each offense provide form

- 2019 2021 form ny cdl 15 fill online printable fillable

- Fillable disclosure form compliance enforcement division

Find out other Organization For United States Tax

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template

- eSign Florida Sublease Agreement Template Free

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application