5695 2020

What is the 5695?

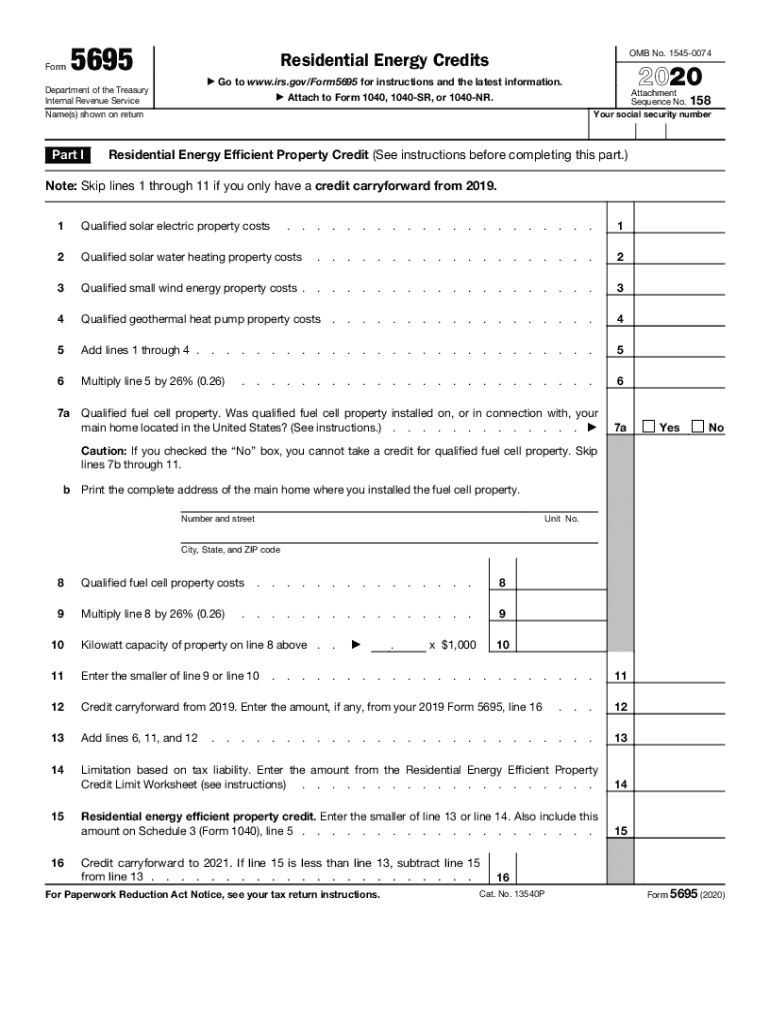

The 5695 form, officially known as the 2020 Residential Energy Credits form, is utilized by taxpayers to claim credits for energy-efficient improvements made to their homes. This form allows individuals to report qualifying expenditures for energy-saving installations, such as solar panels, energy-efficient windows, and insulation. By completing the 5695, taxpayers can reduce their overall tax liability, making it a valuable tool for promoting energy efficiency and sustainability.

How to use the 5695

Using the 5695 form involves several steps to ensure accurate completion. Taxpayers should first gather all necessary documentation related to their energy-efficient improvements. This may include receipts, invoices, and manufacturer certifications. Next, individuals will need to fill out the form by providing personal information, detailing the energy improvements made, and calculating the credits based on the expenditures. It is crucial to review the form for accuracy before submission to avoid delays or complications.

Steps to complete the 5695

Completing the 5695 form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant documentation for energy-efficient improvements.

- Fill in your personal information, including your name, address, and Social Security number.

- List all qualifying energy improvements made to your home, including dates and costs.

- Calculate the total credits based on the specific percentages outlined in IRS guidelines.

- Double-check all entries for accuracy and completeness.

- Submit the completed form with your tax return or file it separately if required.

Eligibility Criteria

To qualify for the credits available on the 5695 form, taxpayers must meet specific eligibility criteria. These criteria typically include:

- The improvements must be made to a primary residence located in the United States.

- Eligible improvements must meet certain energy efficiency standards set by the IRS.

- Taxpayers must retain documentation proving the expenditures and compliance with energy standards.

Required Documents

When completing the 5695 form, it is essential to have the following documents ready:

- Receipts or invoices for all qualifying energy-efficient improvements.

- Manufacturer certifications for products installed, confirming they meet IRS standards.

- Any additional documentation that may support your claims, such as energy audit reports.

IRS Guidelines

The IRS provides specific guidelines for completing the 5695 form, which include instructions on eligible improvements, credit amounts, and filing procedures. Taxpayers should refer to the latest IRS publications to ensure compliance with current regulations. Understanding these guidelines is crucial for maximizing available credits and ensuring a smooth filing process.

Quick guide on how to complete 2020 5695

Complete 5695 effortlessly on any gadget

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage 5695 on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

How to modify and eSign 5695 with ease

- Obtain 5695 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Alter and eSign 5695 and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 5695

Create this form in 5 minutes!

People also ask

-

What is a credits form in airSlate SignNow?

A credits form in airSlate SignNow allows users to purchase credits that can be used for sending and signing documents. This flexible system provides an easy way to manage document transactions without a subscription commitment, making it perfect for occasional users.

-

How does pricing work for the credits form?

Pricing for the credits form in airSlate SignNow is straightforward. Users can buy a set number of credits, which are then used to pay for document sending and signing. This pay-as-you-go model ensures that you only pay for what you need.

-

Can I track my credits usage with the credits form?

Yes, airSlate SignNow provides users with the ability to track their credits usage through their account dashboard. This feature allows you to monitor how many credits you've used and how many are remaining, ensuring you can manage your document signing efficiently.

-

What features are included with the credits form?

The credits form offers access to all essential features of airSlate SignNow, including secure eSigning, document templates, and automated workflows. This makes it a versatile choice for businesses looking to streamline their document processes without a long-term commitment.

-

What benefits does the credits form provide over traditional subscriptions?

The credits form provides signNow benefits compared to traditional subscriptions, primarily flexibility and cost control. Users can purchase credits as needed, avoiding ongoing monthly fees while still enjoying the full range of eSigning capabilities.

-

Is the credits form suitable for businesses of all sizes?

Absolutely! The credits form is designed to accommodate businesses of all sizes, from startups to large enterprises. Its pay-as-you-go structure is particularly beneficial for businesses with fluctuating document signing needs.

-

Does the credits form integrate with other applications?

Yes, the credits form easily integrates with various applications and platforms. airSlate SignNow supports popular tools like Google Drive, Salesforce, and others, ensuring that your document workflows can fit seamlessly into your existing systems.

Get more for 5695

Find out other 5695

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License