Escrow Agreement Document Form

What is the Escrow Agreement Document

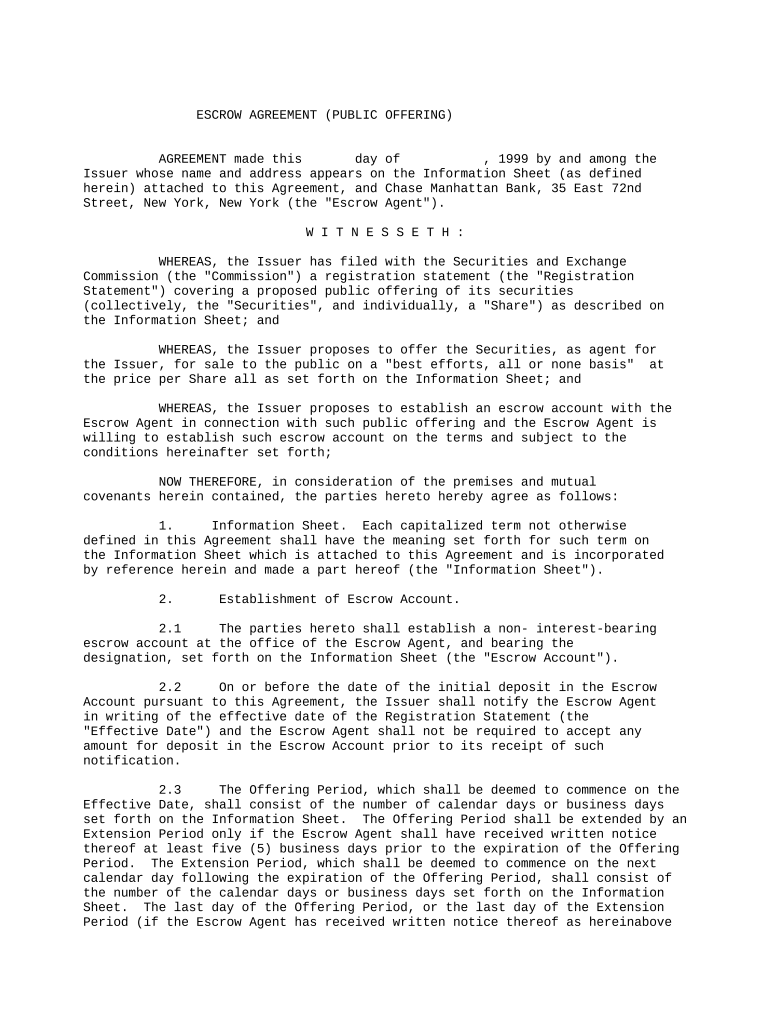

An escrow agreement document is a legally binding contract that outlines the terms and conditions under which a third party holds funds or assets on behalf of two other parties involved in a transaction. This document is essential in various contexts, including real estate transactions, business deals, and online sales, ensuring that all parties fulfill their obligations before the transfer of funds or property occurs. The escrow agent, often a financial institution or a specialized escrow company, is responsible for managing the escrow account and ensuring compliance with the agreement's terms.

Key Elements of the Escrow Agreement Document

Several critical components make up an escrow agreement document, ensuring clarity and legal validity. These elements typically include:

- Parties Involved: Identification of the buyer, seller, and escrow agent.

- Terms of the Agreement: Detailed description of the transaction, including the purchase price and any contingencies.

- Deposit Amount: The specific amount of money or assets being held in escrow.

- Conditions for Release: Clear stipulations outlining when and how the escrow agent will release the funds or assets.

- Dispute Resolution: Procedures for resolving any disputes that may arise during the transaction.

Steps to Complete the Escrow Agreement Document

Completing an escrow agreement document involves several key steps to ensure accuracy and compliance. Here’s a straightforward process to follow:

- Gather necessary information about all parties involved.

- Clearly define the terms of the transaction, including the purchase price and any conditions.

- Consult with legal professionals if needed, to ensure all legal requirements are met.

- Fill out the escrow agreement form, ensuring that all fields are completed accurately.

- Have all parties review and sign the document, either physically or digitally.

- Submit the completed form to the escrow agent to initiate the process.

Legal Use of the Escrow Agreement Document

To be legally binding, an escrow agreement document must comply with specific legal standards and regulations. This includes adherence to state laws governing escrow transactions, ensuring that the agreement is clear and unambiguous, and that all parties understand their rights and obligations. The use of electronic signatures is also permissible under the ESIGN Act and UETA, provided that the parties consent to use electronic documents and signatures.

How to Obtain the Escrow Agreement Document

Obtaining an escrow agreement document can be done through various means. Many online platforms provide templates that can be customized to fit specific needs. Additionally, legal professionals can draft a tailored agreement, ensuring that all necessary legal provisions are included. It is crucial to ensure that any template used complies with local laws and regulations to avoid potential legal issues.

Digital vs. Paper Version

Choosing between a digital and paper version of the escrow agreement document depends on the preferences of the parties involved. Digital versions offer convenience, allowing for easy sharing and signing through electronic means. They also provide enhanced security features, such as encryption and audit trails, which help protect sensitive information. Conversely, paper versions may be preferred in situations where physical signatures are required or when parties prefer traditional documentation methods.

Quick guide on how to complete escrow agreement document

Complete Escrow Agreement Document effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents rapidly without delays. Manage Escrow Agreement Document on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Escrow Agreement Document smoothly

- Identify Escrow Agreement Document and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or black out sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you would like to share your form, by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing out new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and eSign Escrow Agreement Document and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an escrow agreement form?

An escrow agreement form is a legal document that outlines the arrangement between two parties for holding funds or assets by a third party until certain conditions are met. This form ensures that all parties involved meet their obligations before the completion of a transaction, providing security and peace of mind.

-

How can I create an escrow agreement form using airSlate SignNow?

Creating an escrow agreement form with airSlate SignNow is simple. You can start by selecting a template or drafting your own form, adding necessary fields, and customizing it to your needs. After that, you can send it for eSignature directly from the platform.

-

What are the benefits of using airSlate SignNow for escrow agreement forms?

Using airSlate SignNow for your escrow agreement forms offers many benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick eSigning and tracking of documents, ensuring your agreements are finalized seamlessly.

-

Is there a cost associated with using the escrow agreement form feature?

Yes, there is a cost associated with using the escrow agreement form feature on airSlate SignNow, but we offer competitive pricing plans to suit various business needs. Additionally, our cost-effective solution may save you money in the long run by streamlining your document management process.

-

Can I integrate airSlate SignNow with other applications for my escrow agreement forms?

Absolutely! airSlate SignNow supports various integrations with popular applications like Google Drive, Salesforce, and Dropbox. This means you can easily import and export your escrow agreement forms, enhancing your overall workflow and efficiency.

-

How secure is my information when using an escrow agreement form on airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption methods and comply with industry standards to protect your data when creating and managing your escrow agreement forms. You can trust that your information is safe and secure.

-

Can multiple parties sign an escrow agreement form on airSlate SignNow?

Yes, airSlate SignNow allows multiple parties to sign an escrow agreement form, which can be sent to all necessary signers simultaneously. This feature streamlines the signing process and ensures that all parties can complete their agreements quickly and efficiently.

Get more for Escrow Agreement Document

Find out other Escrow Agreement Document

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document