Processors Llc Form

What is the Processors LLC?

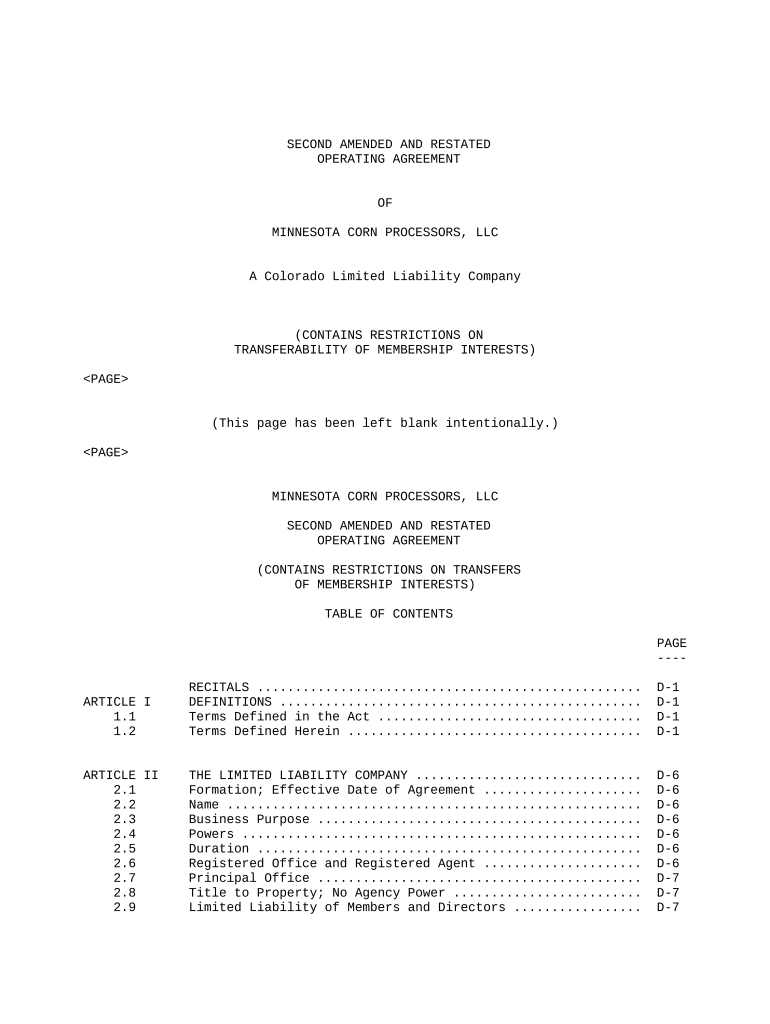

The Processors LLC is a specific form utilized by businesses in the United States to establish a limited liability company (LLC) that focuses on processing services. This document is essential for entrepreneurs looking to formalize their business structure while limiting personal liability. By filing the Processors LLC form, individuals can enjoy the benefits of an LLC, including flexibility in management and potential tax advantages. The form typically requires basic information about the business, such as its name, address, and the names of its members.

Steps to complete the Processors LLC

Completing the Processors LLC form involves several key steps to ensure proper submission and compliance with state regulations. First, choose a unique name for your LLC that complies with state naming requirements. Next, gather necessary information, including the addresses and names of all members. After that, fill out the form accurately, paying attention to details such as the business purpose and registered agent information. Once completed, review the document for accuracy before submitting it to the appropriate state office, either online or by mail.

Legal use of the Processors LLC

The legal use of the Processors LLC form is crucial for ensuring that the business operates within the framework of state laws. This form must be filed in compliance with the specific regulations governing LLCs in the state where the business is established. An accurately completed and submitted Processors LLC form provides legal recognition to the business entity, allowing it to engage in processing services while protecting the personal assets of its members. Compliance with state laws also ensures that the LLC can benefit from legal protections and tax advantages.

Required Documents

When preparing to file the Processors LLC form, certain documents are typically required. These may include:

- Proof of identity for all members, such as a driver's license or passport.

- A completed Operating Agreement outlining the management structure and operational procedures of the LLC.

- Any necessary licenses or permits specific to the processing services offered.

- Payment for the filing fee, which varies by state.

Gathering these documents in advance can streamline the filing process and help ensure that the form is submitted correctly.

Form Submission Methods

The Processors LLC form can typically be submitted through various methods, depending on the state regulations. Common submission methods include:

- Online submission via the state’s business registration portal, which often provides immediate confirmation.

- Mailing a physical copy of the form to the designated state office, which may take longer for processing.

- In-person submission at the state office, allowing for direct interaction with officials who can answer questions.

Choosing the appropriate submission method can help expedite the formation process and ensure compliance with state requirements.

Eligibility Criteria

To successfully file the Processors LLC form, certain eligibility criteria must be met. Generally, the following conditions apply:

- All members must be at least eighteen years old.

- Members must be legally capable of entering into contracts.

- The business name must not be similar to existing registered entities in the state.

- Members must provide accurate and truthful information on the form.

Meeting these criteria is essential for the legal formation of the LLC and to avoid potential issues during the registration process.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the taxation of LLCs, including those formed using the Processors LLC form. LLCs are typically treated as pass-through entities, meaning that profits and losses are reported on the members' individual tax returns. It is important for members to understand their tax obligations and choose the appropriate tax classification for their LLC, whether as a sole proprietorship, partnership, or corporation. Consulting with a tax professional can provide valuable insights into compliance with IRS regulations.

Quick guide on how to complete processors llc

Complete Processors Llc effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents quickly without delays. Manage Processors Llc on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

The easiest way to modify and eSign Processors Llc seamlessly

- Obtain Processors Llc and select Get Form to begin.

- Utilize the tools we offer to finish your document.

- Select important sections of your documents or obscure sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Decide how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Processors Llc and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to processors llc?

airSlate SignNow is an electronic signature solution that enables businesses to send and eSign documents easily. For processors llc, this means you can streamline operations, enhance compliance, and improve document workflow efficiency with our user-friendly platform.

-

How can processors llc benefit from using airSlate SignNow?

Processors llc can benefit from airSlate SignNow by reducing the time spent on document management. The platform allows for quick eSigning and approvals, which accelerates business processes, ultimately saving time and resources.

-

What pricing plans are available for processors llc using airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to businesses, including processors llc. Each plan is designed to provide maximum value, with flexible options that suit varying needs, ensuring you only pay for what you use.

-

Is airSlate SignNow secure enough for processors llc?

Absolutely! airSlate SignNow is built with high-security standards to guarantee the safety of your documents. For processors llc, this means you can confidently manage sensitive information without compromising on security.

-

What features does airSlate SignNow offer for processors llc?

airSlate SignNow provides a range of features tailored for processors llc, including customizable workflows, advanced document analytics, and integrations with other business applications. These features empower you to enhance efficiency and optimize your document management processes.

-

Can airSlate SignNow integrate with other software used by processors llc?

Yes, airSlate SignNow seamlessly integrates with various software platforms popular among processors llc. This integration enables you to sync your workflow and improve collaboration across different tools, enhancing overall productivity.

-

How easy is it to get started with airSlate SignNow for processors llc?

Getting started with airSlate SignNow is quick and user-friendly for processors llc. You can sign up for a free trial, access tutorials, and start sending documents for eSignature within minutes, making the transition to digital signatures a breeze.

Get more for Processors Llc

- Towing invoice statutory declaration companies towing invoicestatutory declaration companies catalogue no 45065678 form no 5556

- Nat 8676 form

- Pin on high heels pinterestcom form

- Tea program change form

- Fire extinguisher checklist form

- Tc 20s forms utah s corporation tax forms ampamp publications

- 2011 form tc 20s

- Fillable online rn ca online rn request for repeatreapply form

Find out other Processors Llc

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word