TC 20S Forms, Utah S Corporation Tax Forms & Publications 2020

What is the TC 20S Form?

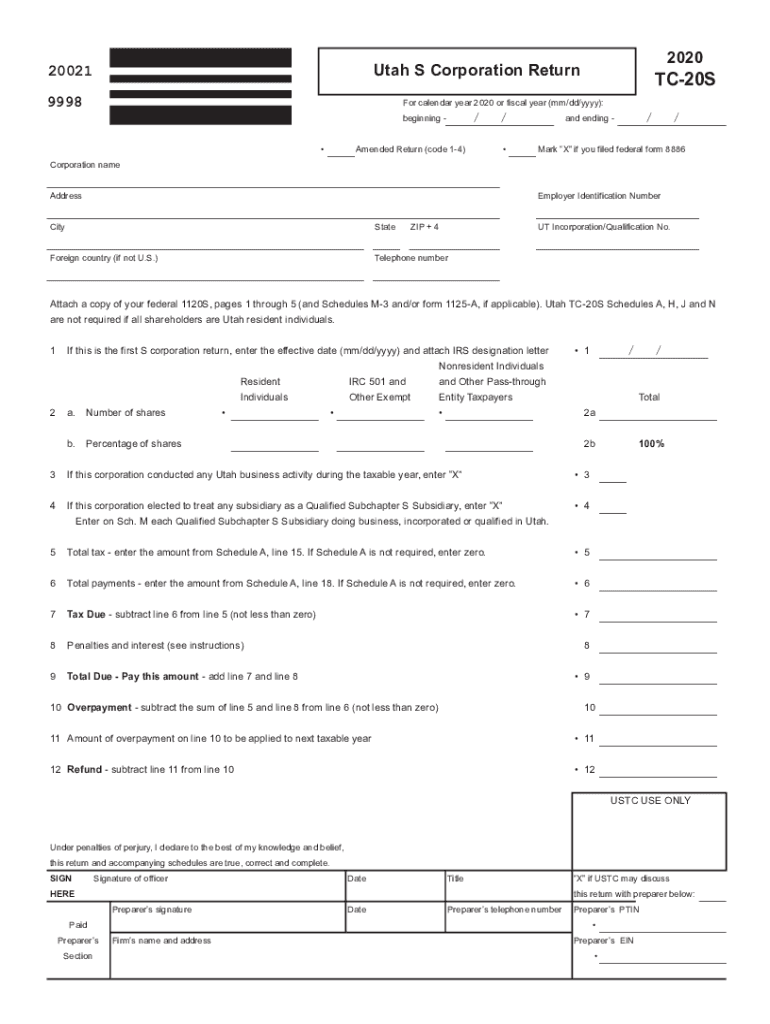

The TC 20S form is a crucial document used by S corporations in Utah for tax purposes. It serves as the state-level tax return for S corporations, allowing them to report income, deductions, and credits to the Utah State Tax Commission. This form is essential for compliance with state tax regulations and ensures that S corporations fulfill their tax obligations accurately. The TC 20S form is specifically designed for entities that have elected S corporation status under both federal and state law.

How to Use the TC 20S Form

Using the TC 20S form involves several steps that ensure accurate reporting of your corporation's financial activities. First, gather all necessary financial records, including income statements, balance sheets, and any relevant deductions. Next, complete the form by entering the required information, which includes total income, deductions, and credits. It is important to follow the instructions provided with the form to ensure proper completion. Once filled out, the form can be submitted to the Utah State Tax Commission either electronically or by mail, depending on your preference and the submission methods available.

Steps to Complete the TC 20S Form

Completing the TC 20S form requires careful attention to detail. Begin by downloading the form from the Utah State Tax Commission website or obtaining a physical copy. Follow these steps:

- Enter your corporation's name, address, and federal employer identification number (EIN).

- Report total income from all sources, including sales and services.

- List all allowable deductions, ensuring you have documentation to support each entry.

- Calculate any credits your corporation may qualify for, such as tax credits for specific business activities.

- Double-check all entries for accuracy before signing and dating the form.

Legal Use of the TC 20S Form

The TC 20S form is legally binding when completed and submitted according to Utah tax laws. It is essential for S corporations to understand that electronic signatures are valid under the ESIGN Act and UETA, provided that the signing process meets specific legal requirements. Using a reliable eSignature platform can help ensure that your form is executed correctly and securely, maintaining compliance with legal standards.

Filing Deadlines for the TC 20S Form

Timely filing of the TC 20S form is critical to avoid penalties. The deadline for submitting the TC 20S form typically aligns with the federal tax return due date, which is usually the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. It is advisable to check the Utah State Tax Commission website for any updates or changes to filing deadlines.

Form Submission Methods

The TC 20S form can be submitted through various methods to accommodate different preferences. Corporations may choose to file electronically using the Utah State Tax Commission's online portal, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate address provided in the instructions. In-person submissions may also be available at designated tax offices, allowing for direct interaction with tax officials if needed.

Quick guide on how to complete tc 20s forms utah s corporation tax forms ampamp publications

Effortlessly Prepare TC 20S Forms, Utah S Corporation Tax Forms & Publications on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and without any delays. Manage TC 20S Forms, Utah S Corporation Tax Forms & Publications on any device using the airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

How to Edit and eSign TC 20S Forms, Utah S Corporation Tax Forms & Publications with Ease

- Locate TC 20S Forms, Utah S Corporation Tax Forms & Publications and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information thoroughly and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign TC 20S Forms, Utah S Corporation Tax Forms & Publications and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tc 20s forms utah s corporation tax forms ampamp publications

Create this form in 5 minutes!

How to create an eSignature for the tc 20s forms utah s corporation tax forms ampamp publications

The best way to create an eSignature for your PDF document in the online mode

The best way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The way to make an eSignature for a PDF file on Android devices

People also ask

-

What are Utah TC 20s and how do they benefit my business?

Utah TC 20s are specialized document templates designed for optimal compliance and efficiency in transaction processing. Using airSlate SignNow for Utah TC 20s allows businesses to streamline their signing processes, reduce errors, and enhance overall document management.

-

How much does it cost to use airSlate SignNow for Utah TC 20s?

The pricing for using airSlate SignNow with Utah TC 20s is competitive and varies based on your subscription plan. We offer flexible pricing options that cater to businesses of all sizes, ensuring you can manage your eSigning needs without breaking the bank.

-

Are there any integrations available for airSlate SignNow and Utah TC 20s?

Yes, airSlate SignNow offers a wide range of integrations that enhance the usability of Utah TC 20s. You can connect it with various CRM systems, cloud storage solutions, and productivity tools, making it easier to manage your documents seamlessly.

-

What features should I look for when using Utah TC 20s?

When using Utah TC 20s, focus on features like document templates, customizable workflows, and real-time tracking. airSlate SignNow provides these features to ensure you can efficiently manage eSigning processes while maintaining compliance with Utah regulations.

-

Can I customize Utah TC 20s templates in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize Utah TC 20s templates according to your business needs. You can easily add branding, information fields, and various options to create a document that fits your specific requirements.

-

How secure is using airSlate SignNow for Utah TC 20s?

Security is a top priority at airSlate SignNow. When you use Utah TC 20s, your documents are protected with advanced encryption, secure access controls, and comprehensive audit trails, ensuring your sensitive data remains confidential.

-

What are the advantages of using airSlate SignNow for Utah TC 20s over traditional methods?

Using airSlate SignNow for Utah TC 20s provides signNow advantages over traditional methods, such as faster processing times, reduced paperwork, and enhanced accuracy. This digital approach not only saves time but also minimizes the risk of errors associated with manual signing.

Get more for TC 20S Forms, Utah S Corporation Tax Forms & Publications

Find out other TC 20S Forms, Utah S Corporation Tax Forms & Publications

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe