Indemnity Shares Form

What is the indemnity escrow agreement?

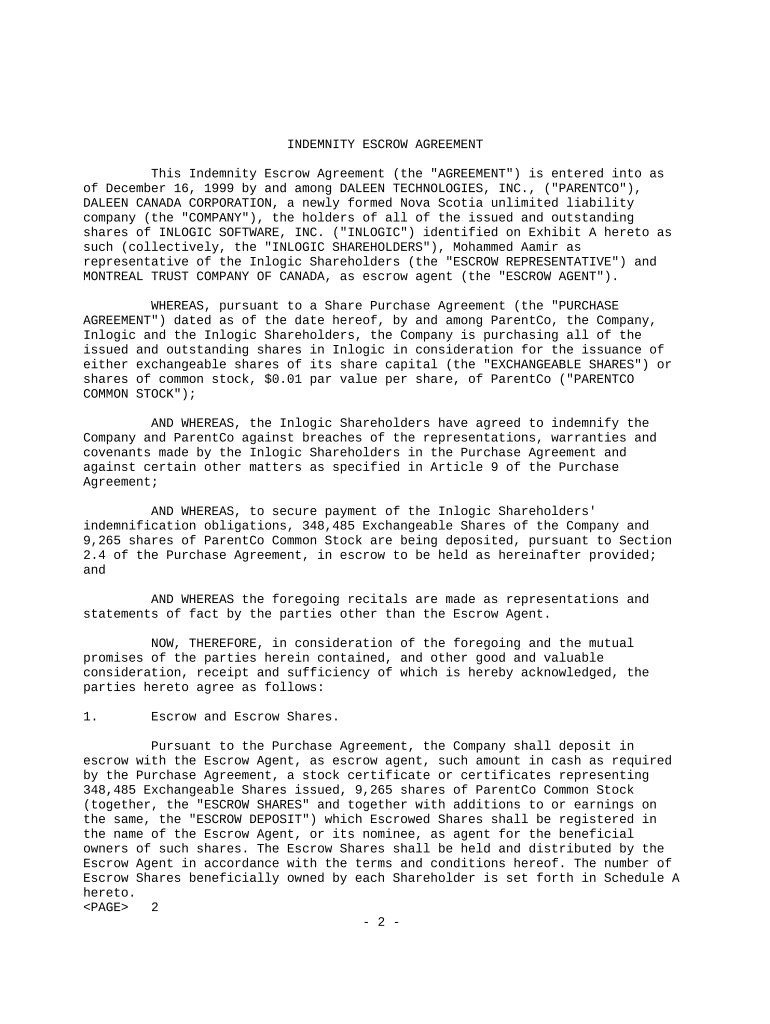

An indemnity escrow agreement is a legal document that outlines the terms under which funds or assets are held in escrow to protect parties involved in a transaction. This agreement serves as a safeguard against potential losses or liabilities that may arise during the execution of a contract. Typically, it involves a third-party escrow agent who manages the funds or assets until certain conditions are met, ensuring that all parties fulfill their obligations. The indemnity aspect provides assurance that the escrow agent will cover any losses incurred due to breaches of the agreement.

Key elements of the indemnity escrow agreement

Understanding the key elements of an indemnity escrow agreement is crucial for effective execution. These elements typically include:

- Parties involved: Identification of all parties entering into the agreement, including the buyer, seller, and escrow agent.

- Escrow amount: The specific amount of money or assets to be held in escrow.

- Conditions for release: Clear stipulations detailing the conditions under which the escrow agent will release the funds or assets.

- Indemnification clause: Provisions that outline the responsibilities of each party regarding potential losses or liabilities.

- Duration: The time frame during which the escrow agreement is valid.

Steps to complete the indemnity escrow agreement

Completing an indemnity escrow agreement involves several important steps:

- Draft the agreement: Begin by drafting the agreement, ensuring all key elements are included.

- Review with legal counsel: Have the document reviewed by legal professionals to ensure compliance with applicable laws.

- Sign the agreement: All parties involved must sign the document, often in the presence of witnesses or a notary.

- Fund the escrow account: Deposit the agreed-upon funds or assets into the escrow account managed by the escrow agent.

- Monitor compliance: Ensure that all parties meet the conditions outlined in the agreement.

Legal use of the indemnity escrow agreement

The legal use of an indemnity escrow agreement is essential for protecting the interests of all parties in a transaction. It is commonly used in various scenarios, including real estate transactions, mergers and acquisitions, and other business dealings where risk is involved. The agreement must comply with relevant state and federal laws to be enforceable. It is advisable to consult with legal experts to ensure that the agreement is structured correctly and adheres to legal standards.

Examples of using the indemnity escrow agreement

Indemnity escrow agreements can be applied in various contexts. Some examples include:

- Real estate transactions: Holding earnest money in escrow until the sale is finalized.

- Business acquisitions: Protecting the buyer against potential liabilities that may arise post-transaction.

- Construction contracts: Ensuring that funds are available for project completion and addressing any claims that may arise.

Who issues the indemnity escrow agreement?

The indemnity escrow agreement is typically issued by the parties involved in the transaction, often with the assistance of legal counsel. The escrow agent, a neutral third party, plays a crucial role in facilitating the agreement. This agent is responsible for managing the escrow account and ensuring that the terms of the agreement are adhered to. It is important to select a reputable escrow agent to ensure the integrity of the transaction.

Quick guide on how to complete indemnity shares

Effortlessly prepare Indemnity Shares on any device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly and without delays. Manage Indemnity Shares on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest method to modify and eSign Indemnity Shares with ease

- Find Indemnity Shares and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or censor sensitive information using tools that airSlate SignNow provides for this purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, the hassle of searching for forms, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Indemnity Shares to ensure excellent communication throughout every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an indemnity escrow agreement?

An indemnity escrow agreement is a legal document that outlines the terms under which one party holds funds or assets in escrow to protect against potential losses or claims. This type of agreement is commonly used in real estate transactions and other business deals to ensure that all parties are protected. Understanding the components of an indemnity escrow agreement can help you navigate complex transactions with ease.

-

How does airSlate SignNow facilitate an indemnity escrow agreement?

airSlate SignNow streamlines the process of drafting and signing indemnity escrow agreements by providing a user-friendly platform for eSigning documents. With our solution, you can create, send, and manage your indemnity escrow agreements effortlessly, saving time and reducing paperwork. Our secure platform ensures that all transactions are compliant and documented appropriately.

-

What are the benefits of using airSlate SignNow for my indemnity escrow agreements?

Using airSlate SignNow for your indemnity escrow agreements offers multiple benefits, including enhanced security, faster turnaround times, and simplified document management. Our platform allows for real-time tracking of document status, ensuring that all parties are aware of where the agreement stands in the process. Additionally, our cost-effective pricing model makes it suitable for businesses of all sizes.

-

Can I integrate airSlate SignNow with other tools for my indemnity escrow agreements?

Yes, airSlate SignNow supports seamless integrations with various applications and tools to enhance your workflow for indemnity escrow agreements. You can easily connect with CRM, project management, and accounting software, making it simpler to manage all aspects of your escrow process. These integrations help centralize your operations and improve efficiency.

-

What features does airSlate SignNow offer for creating indemnity escrow agreements?

airSlate SignNow provides several features to help you create and manage indemnity escrow agreements effectively. These include customizable templates, automated workflows, and the ability to add multiple signers. Additionally, our platform incorporates advanced security measures to ensure that your agreements are protected at all times.

-

Is there a mobile app to manage my indemnity escrow agreements?

Yes, airSlate SignNow offers a mobile app that enables you to manage your indemnity escrow agreements on the go. With the mobile app, you can easily create, review, and sign documents from your smartphone or tablet, ensuring that you can stay productive no matter where you are. This feature is especially useful for busy professionals handling multiple contracts.

-

What is the pricing structure for using airSlate SignNow for indemnity escrow agreements?

airSlate SignNow offers competitive pricing plans tailored to meet different business needs for managing indemnity escrow agreements. Our pricing is transparent and includes various features, allowing you to choose a plan that fits your budget and requirements. You can also take advantage of a free trial to explore our platform's capabilities before committing.

Get more for Indemnity Shares

Find out other Indemnity Shares

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe