Guaranty of Payment of Open Account Form

What is the Guaranty Of Payment Of Open Account

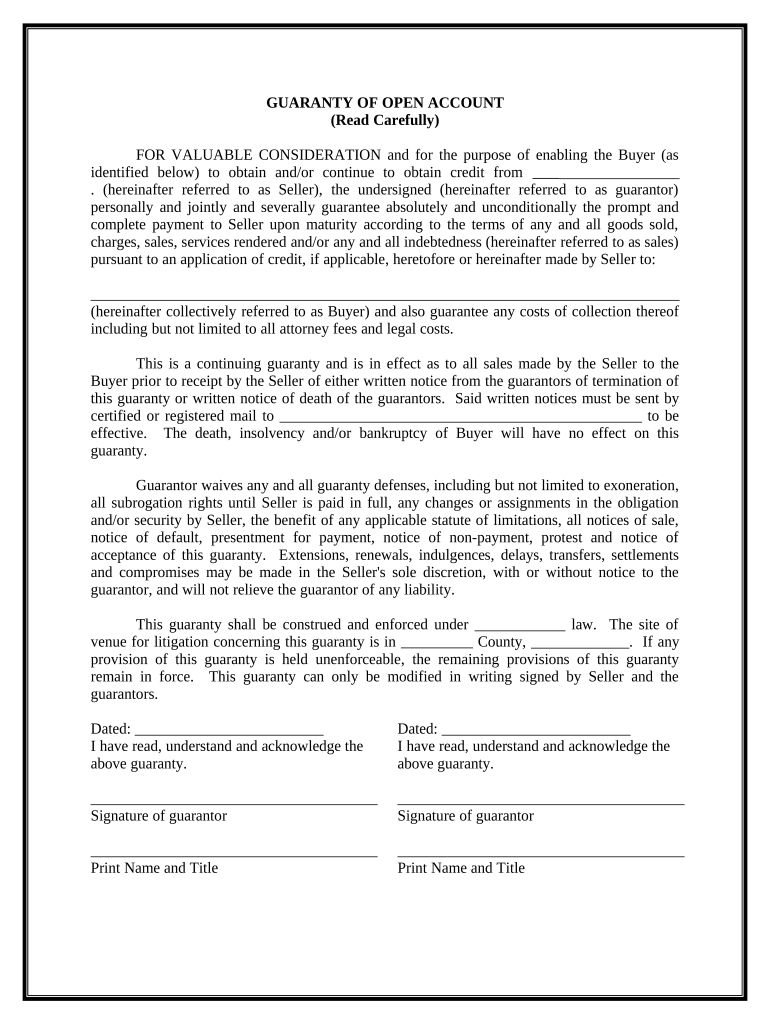

The Guaranty Of Payment Of Open Account is a legal document that serves as a commitment from one party to pay the debts or obligations of another party in a business transaction. This form is particularly relevant in situations where goods or services are provided on credit. By signing this document, the guarantor agrees to assume responsibility for the payment if the primary debtor defaults. This type of guaranty is often used in commercial settings to ensure that suppliers and service providers are protected against non-payment.

How to use the Guaranty Of Payment Of Open Account

To effectively use the Guaranty Of Payment Of Open Account, both the creditor and the guarantor must complete the form accurately. The creditor should provide details about the transaction, including the amount owed and the terms of the agreement. The guarantor must then review these terms and sign the document, indicating their acceptance of the responsibility for payment. It is essential for all parties involved to retain copies of the signed document for their records, as it serves as proof of the agreement.

Steps to complete the Guaranty Of Payment Of Open Account

Completing the Guaranty Of Payment Of Open Account involves several key steps:

- Gather necessary information about the transaction, including the debtor's details and the amount owed.

- Fill out the form with accurate information, ensuring that all required fields are completed.

- Review the terms and conditions outlined in the document to ensure clarity and understanding.

- Have the guarantor sign the form, either electronically or in print, to validate the agreement.

- Distribute copies of the signed document to all parties involved for their records.

Legal use of the Guaranty Of Payment Of Open Account

For the Guaranty Of Payment Of Open Account to be legally binding, it must meet specific criteria. The document should clearly outline the obligations of the guarantor and the terms of payment. Additionally, it must be signed by the guarantor, demonstrating their consent to the terms. Compliance with relevant laws, such as the Uniform Commercial Code (UCC), is also crucial to ensure enforceability in a court of law. Electronic signatures are generally accepted, provided they adhere to the standards set by the ESIGN Act and UETA.

Key elements of the Guaranty Of Payment Of Open Account

Several key elements are essential for the effectiveness of the Guaranty Of Payment Of Open Account:

- Identification of Parties: Clearly state the names and addresses of the creditor, debtor, and guarantor.

- Details of the Obligation: Specify the amount owed and the nature of the debt.

- Terms of Payment: Outline the conditions under which payment is to be made, including due dates.

- Signature of the Guarantor: The guarantor must sign the document to acknowledge their commitment.

- Governing Law: Indicate the state laws that will govern the agreement.

Examples of using the Guaranty Of Payment Of Open Account

Common scenarios for utilizing the Guaranty Of Payment Of Open Account include:

- A supplier providing materials to a contractor who requires credit terms.

- A service provider offering services to a business that may not have immediate cash flow.

- A landlord requiring a guarantor for a tenant who has limited credit history.

In each case, the guaranty helps secure the transaction by ensuring that payment will be made, even if the primary party fails to fulfill their financial obligations.

Quick guide on how to complete guaranty of payment of open account

Complete Guaranty Of Payment Of Open Account effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without any hold-ups. Manage Guaranty Of Payment Of Open Account on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

The easiest method to modify and eSign Guaranty Of Payment Of Open Account with ease

- Locate Guaranty Of Payment Of Open Account and click on Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or disorganized documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Guaranty Of Payment Of Open Account and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Guaranty Of Payment Of Open Account?

A Guaranty Of Payment Of Open Account is a legal agreement ensuring that payment for goods or services will be made. This document acts as a financial safety net for suppliers, minimizing the risk of non-payment. By using airSlate SignNow, businesses can efficiently create and sign these agreements electronically.

-

How does airSlate SignNow facilitate the Guaranty Of Payment Of Open Account process?

airSlate SignNow allows users to easily draft, send, and eSign a Guaranty Of Payment Of Open Account. The platform's intuitive interface simplifies document management and enhances workflow efficiency. This streamlined process saves businesses time and ensures that agreements are legally binding.

-

What are the benefits of using airSlate SignNow for a Guaranty Of Payment Of Open Account?

Using airSlate SignNow for a Guaranty Of Payment Of Open Account provides several advantages, including reduced paperwork and faster transaction times. The electronic signing feature increases compliance while maintaining a clear record of agreements. Additionally, businesses can save costs traditionally associated with printing and mailing documents.

-

Can I customize the Guaranty Of Payment Of Open Account templates in airSlate SignNow?

Yes, airSlate SignNow offers customizable templates for the Guaranty Of Payment Of Open Account. Users can tailor these templates to match their specific business needs and branding. This flexibility helps ensure that all necessary terms are included in the agreement.

-

Is airSlate SignNow secure for managing Guaranty Of Payment Of Open Account documents?

Absolutely, airSlate SignNow employs advanced encryption and security measures to protect all documents, including the Guaranty Of Payment Of Open Account. All signed documents are stored securely, ensuring that sensitive financial information is safeguarded. Compliance with legal regulations further enhances trust in the platform.

-

What is the pricing structure for airSlate SignNow when creating a Guaranty Of Payment Of Open Account?

airSlate SignNow offers flexible pricing plans suitable for all business sizes, allowing users to effectively manage their Guaranty Of Payment Of Open Account. Each plan includes various features tailored to different needs. Users can choose from monthly or annual subscriptions, ensuring maximum value.

-

Does airSlate SignNow integrate with other applications for managing accounts?

Yes, airSlate SignNow easily integrates with various business applications that help manage accounts, facilitating the creation and storage of a Guaranty Of Payment Of Open Account. This interoperability ensures that users can work seamlessly within their current workflows. Popular integrations include CRM, accounting software, and project management tools.

Get more for Guaranty Of Payment Of Open Account

- Haunted house waiver form

- Sample proposal to supply food to a company pdf form

- Dole tupad application form

- Fiche de renseignement form

- Klb book 3 form

- Ea 250 proof of service of response by mail elder or dependent adult abuse prevention form

- Jv 433 six month permanency attachment reunification services terminated welf inst code 366 21e form

- Rein property analyzer real estate investment network form

Find out other Guaranty Of Payment Of Open Account

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile