Agreement Self Employed Form

What is the Agreement Self Employed

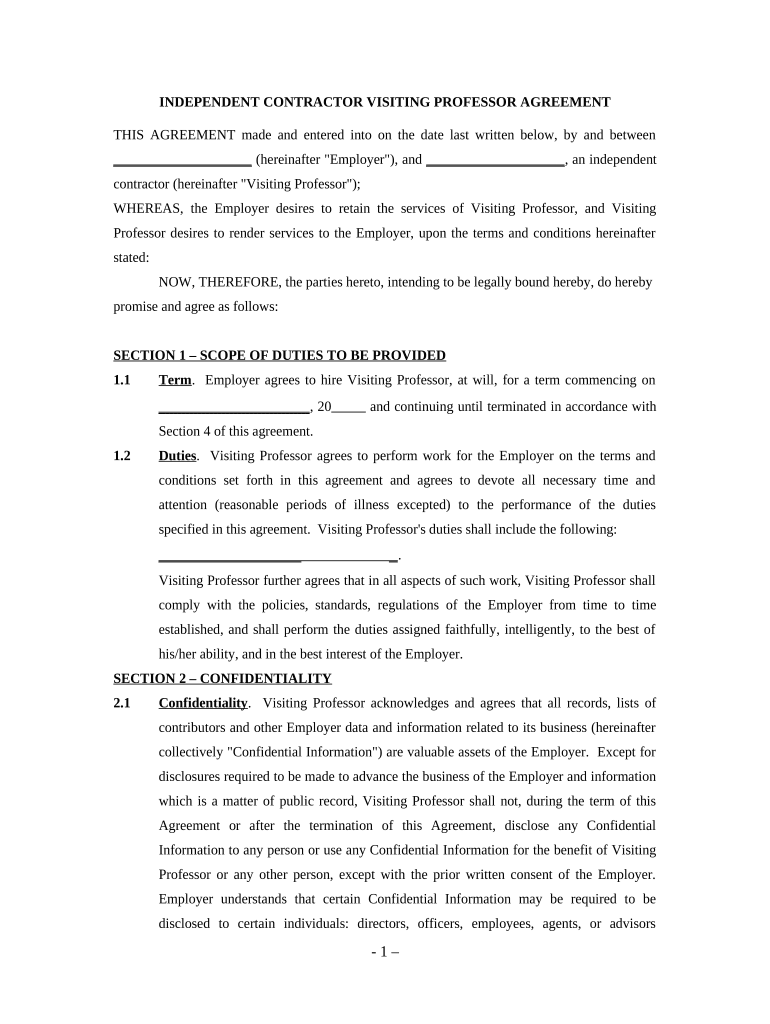

The agreement self employed is a formal document that outlines the terms and conditions between a self-employed individual and a client or business. This agreement typically details the scope of work, payment terms, deadlines, and other essential elements that govern the working relationship. It serves to protect both parties by ensuring clarity and mutual understanding of expectations. Having a well-structured agreement is crucial for self-employed individuals to establish professionalism and legal standing in their business dealings.

How to use the Agreement Self Employed

Using the agreement self employed involves several steps to ensure it meets legal requirements and serves its purpose effectively. First, it is important to clearly define the roles and responsibilities of each party involved. Next, outline the compensation structure, including payment methods and timelines. Be sure to include clauses related to confidentiality, termination, and dispute resolution. Once the document is drafted, both parties should review it thoroughly before signing. Utilizing digital tools for e-signatures can streamline this process, ensuring that the agreement is executed efficiently and securely.

Steps to complete the Agreement Self Employed

Completing the agreement self employed involves a systematic approach to ensure all necessary information is included. Begin by gathering relevant details such as names, addresses, and contact information of both parties. Next, draft the agreement by including the following key components:

- Scope of work: Clearly describe the tasks to be performed.

- Payment terms: Specify how and when payments will be made.

- Duration: Indicate the start and end dates of the agreement.

- Confidentiality clauses: Protect sensitive information shared during the engagement.

- Termination conditions: Outline how either party can end the agreement.

After drafting, review the document for accuracy and completeness. Finally, both parties should sign the agreement to make it legally binding.

Legal use of the Agreement Self Employed

The legal use of the agreement self employed is governed by various laws and regulations that vary by state. To ensure its enforceability, the agreement must meet certain criteria, such as mutual consent, a lawful purpose, and consideration. Additionally, it is essential to comply with eSignature laws, such as the ESIGN Act and UETA, which recognize electronic signatures as valid. By adhering to these legal frameworks, self-employed individuals can protect their rights and interests while fostering trust with clients.

Key elements of the Agreement Self Employed

Key elements of the agreement self employed include several critical components that contribute to its effectiveness and legality. These elements typically encompass:

- Parties involved: Names and contact information of the self-employed individual and the client.

- Scope of work: Detailed description of the services to be provided.

- Payment terms: Clear outline of fees, payment schedule, and methods.

- Duration: Start and end dates of the agreement.

- Termination clause: Conditions under which the agreement may be terminated.

Including these elements helps ensure that both parties have a clear understanding of their obligations and rights, reducing the potential for disputes.

Examples of using the Agreement Self Employed

Examples of using the agreement self employed can be found across various industries. For instance, a freelance graphic designer may use this agreement to outline the specific design services to be provided, payment terms, and deadlines for project completion. Similarly, a consultant may draft an agreement to define the scope of their advisory services and the fees associated with their expertise. These examples illustrate the versatility of the agreement self employed in different professional contexts, highlighting its importance in establishing clear working relationships.

Quick guide on how to complete agreement self employed

Effortlessly Prepare Agreement Self Employed on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an excellent eco-conscious substitute for conventional printed and signed documents, allowing you to easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and electronically sign your documents without delays. Manage Agreement Self Employed on any device using the airSlate SignNow apps for Android or iOS, and simplify your document-related tasks today.

The Easiest Method to Modify and Electronically Sign Agreement Self Employed Stress-Free

- Locate Agreement Self Employed and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all information and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to missing or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from your chosen device. Modify and electronically sign Agreement Self Employed and ensure exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an 'agreement self employed' and how can airSlate SignNow help?

An 'agreement self employed' refers to contracts specifically designed for independent contractors or freelance workers. airSlate SignNow streamlines the process of creating, sending, and signing these agreements, ensuring that you can manage your contracts efficiently and legally.

-

How much does it cost to use airSlate SignNow for agreement self employed?

Pricing for airSlate SignNow is competitive and varies based on the features you need. We offer multiple plans, including a free trial, allowing self employed individuals to explore our platform and determine the best fit for their agreement needs.

-

What features does airSlate SignNow offer for managing agreement self employed?

airSlate SignNow provides a plethora of features designed for handling agreement self employed, including customizable templates, real-time tracking of document status, and secure storage options. These features ensure that your agreements are both easy to create and maintain.

-

Can I integrate airSlate SignNow with other tools I use for my agreement self employed?

Yes, airSlate SignNow integrates seamlessly with various tools like Google Workspace, Dropbox, and CRM systems. This allows self employed professionals to streamline their workflow and manage agreements more effectively in their preferred ecosystem.

-

How does airSlate SignNow enhance the security of my agreement self employed?

Security is a top priority at airSlate SignNow. We employ advanced encryption, multi-factor authentication, and compliance with industry standards to protect your agreement self employed documents, ensuring safe transactions and peace of mind.

-

Is airSlate SignNow suitable for all types of agreement self employed?

Absolutely! airSlate SignNow is versatile and can accommodate various types of agreement self employed, whether you're drafting service contracts, client agreements, or freelance invoices. Our platform provides the flexibility needed for any self employed professional.

-

How easy is it to get started with airSlate SignNow for agreement self employed?

Getting started with airSlate SignNow is a breeze. Simply sign up for a free account, and you can begin creating and managing your agreement self employed within minutes, thanks to our user-friendly interface and helpful resources.

Get more for Agreement Self Employed

- Occupancy certificate format

- Office management book pdf download form

- Funza lushaka application form 2022 pdf

- New american streamline workbook answers form

- Sr nancy nursing book pdf download form

- Wealth declaration tsc form

- Chemistry form 2 questions and answers pdf

- By the sea abdulrazak gurnah pdf form

Find out other Agreement Self Employed

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA