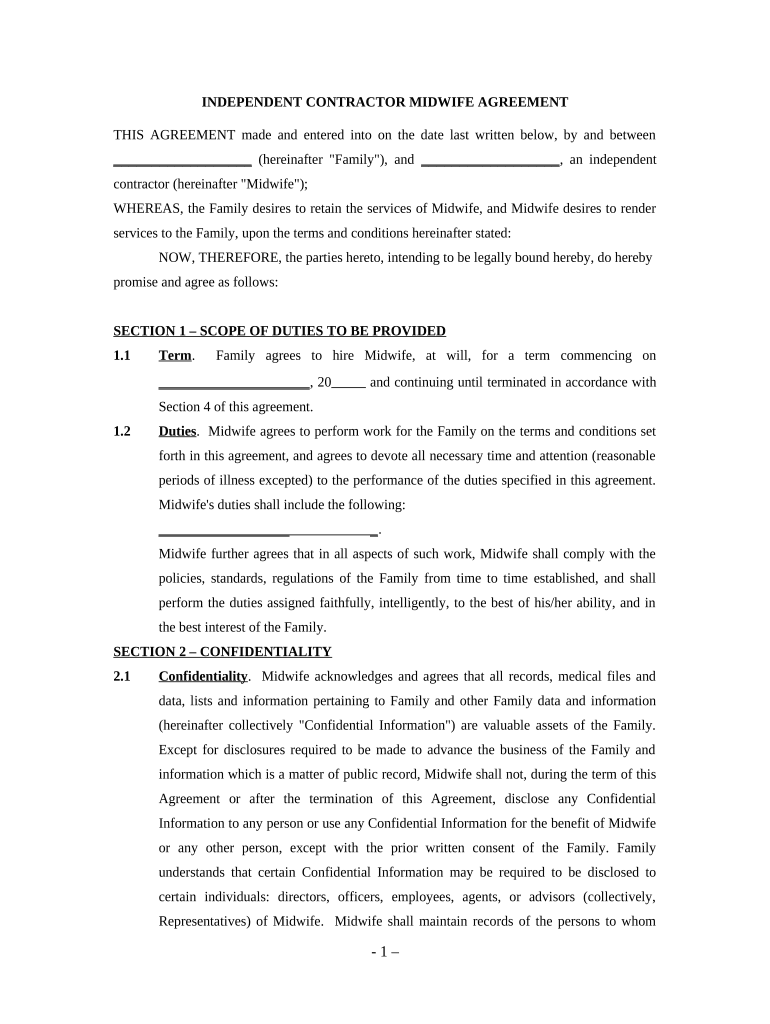

Self Employed Independent Contractor Agreement Form

What is the Self Employed Independent Contractor Agreement

The self employed independent contractor agreement is a legal document that outlines the terms and conditions between a business and an independent contractor. This agreement specifies the scope of work, payment terms, and responsibilities of both parties. It serves to protect the interests of both the contractor and the business, ensuring clarity and reducing the potential for disputes. By defining the relationship, this agreement helps to establish that the contractor operates independently, without the same obligations as an employee.

Key Elements of the Self Employed Independent Contractor Agreement

Several critical components make up a comprehensive self employed independent contractor agreement. These elements include:

- Scope of Work: A detailed description of the tasks and services to be performed by the contractor.

- Payment Terms: Clear stipulations regarding compensation, including rates, payment schedules, and any reimbursement for expenses.

- Duration: The length of time the agreement will be in effect, including start and end dates.

- Confidentiality: Provisions that protect sensitive information shared during the course of the contract.

- Termination Clause: Conditions under which either party may terminate the agreement, including notice periods.

How to Use the Self Employed Independent Contractor Agreement

To effectively use the self employed independent contractor agreement, follow these steps:

- Draft the Agreement: Begin by customizing a template to fit the specific needs of the project and the parties involved.

- Review Terms: Both parties should carefully review the terms to ensure mutual understanding and agreement.

- Sign the Document: Utilize a reliable electronic signature platform to sign the agreement, ensuring it meets legal requirements.

- Distribute Copies: Provide copies of the signed agreement to all parties for their records.

Steps to Complete the Self Employed Independent Contractor Agreement

Completing the self employed independent contractor agreement involves several straightforward steps:

- Gather Information: Collect all necessary details about the contractor and the work to be performed.

- Fill Out the Agreement: Input the relevant information into the agreement template, ensuring accuracy.

- Review and Edit: Both parties should review the document for any errors or omissions before signing.

- Sign and Date: Each party should sign and date the agreement to formalize it.

Legal Use of the Self Employed Independent Contractor Agreement

For the self employed independent contractor agreement to be legally binding, it must adhere to certain requirements. This includes compliance with federal and state laws regarding independent contractors. The agreement should clearly define the nature of the relationship, ensuring that the contractor is not classified as an employee. Additionally, it is essential to follow eSignature regulations, such as the ESIGN Act and UETA, to ensure that electronic signatures are valid and enforceable.

State-Specific Rules for the Self Employed Independent Contractor Agreement

Each state may have unique regulations that affect the self employed independent contractor agreement. It is important to be aware of these rules, as they can influence various aspects of the agreement, such as:

- Tax Obligations: Different states have varying requirements for tax reporting and withholding.

- Licensing Requirements: Certain professions may require specific licenses to operate legally as an independent contractor.

- Labor Laws: States may have laws that impact the classification of workers and the rights of independent contractors.

Quick guide on how to complete self employed independent contractor agreement 497337088

Prepare Self Employed Independent Contractor Agreement effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Self Employed Independent Contractor Agreement on any device with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The simplest method to edit and electronically sign Self Employed Independent Contractor Agreement without any hassle

- Find Self Employed Independent Contractor Agreement and click Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Carefully review all the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or inaccuracies that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Self Employed Independent Contractor Agreement and ensure clear communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a self employed independent contractor agreement?

A self employed independent contractor agreement is a legal document that outlines the terms of engagement between a self-employed individual and a business. This agreement specifies the scope of work, payment terms, and responsibilities of both parties. Using airSlate SignNow, you can easily create, send, and electronically sign these agreements for smooth operations.

-

How much does airSlate SignNow cost for creating self employed independent contractor agreements?

airSlate SignNow offers competitive pricing plans that vary based on features and user needs. You can choose a plan that fits your requirements, whether you're an individual contractor or a larger organization. For creating self employed independent contractor agreements, monthly subscriptions often provide the best value, especially for frequent use.

-

What are the features of airSlate SignNow for self employed independent contractor agreements?

airSlate SignNow includes features like customizable templates for self employed independent contractor agreements, document tracking, and secure eSigning. These tools simplify the process of creating and managing agreements, ensuring you can focus on your work without worrying about paperwork. Additionally, you can integrate with other applications for a seamless workflow.

-

What are the benefits of using airSlate SignNow for a self employed independent contractor agreement?

The primary benefit of using airSlate SignNow for a self employed independent contractor agreement is the efficiency it brings to contract management. You can quickly create and send agreements, and receive signed documents in real-time. This reduces turnaround time and streamlines your contracting process, allowing you to focus on delivering your services.

-

Can I use airSlate SignNow to manage multiple self employed independent contractor agreements?

Yes, airSlate SignNow allows you to manage multiple self employed independent contractor agreements conveniently. With features like bulk sending and template creation, you can streamline the process for different contracts. This makes it easier to stay organized and maintain consistency across all agreements you handle.

-

Is eSigning a self employed independent contractor agreement legally binding?

Absolutely, eSigning a self employed independent contractor agreement through airSlate SignNow creates a legally binding contract. The platform adheres to the electronic signature laws and regulations, ensuring that signed documents hold the same legal weight as traditional paper contracts. This offers you peace of mind when entering into agreements with clients.

-

What integrations does airSlate SignNow offer for self employed independent contractor agreements?

airSlate SignNow integrates with a variety of business applications like Google Drive, Salesforce, and Microsoft Office. These integrations enhance your ability to manage self employed independent contractor agreements by simplifying document sharing and collaboration. With seamless integration, you can streamline processes and improve overall efficiency.

Get more for Self Employed Independent Contractor Agreement

Find out other Self Employed Independent Contractor Agreement

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors