Agreement Self Employed Form

What is the Agreement Self Employed

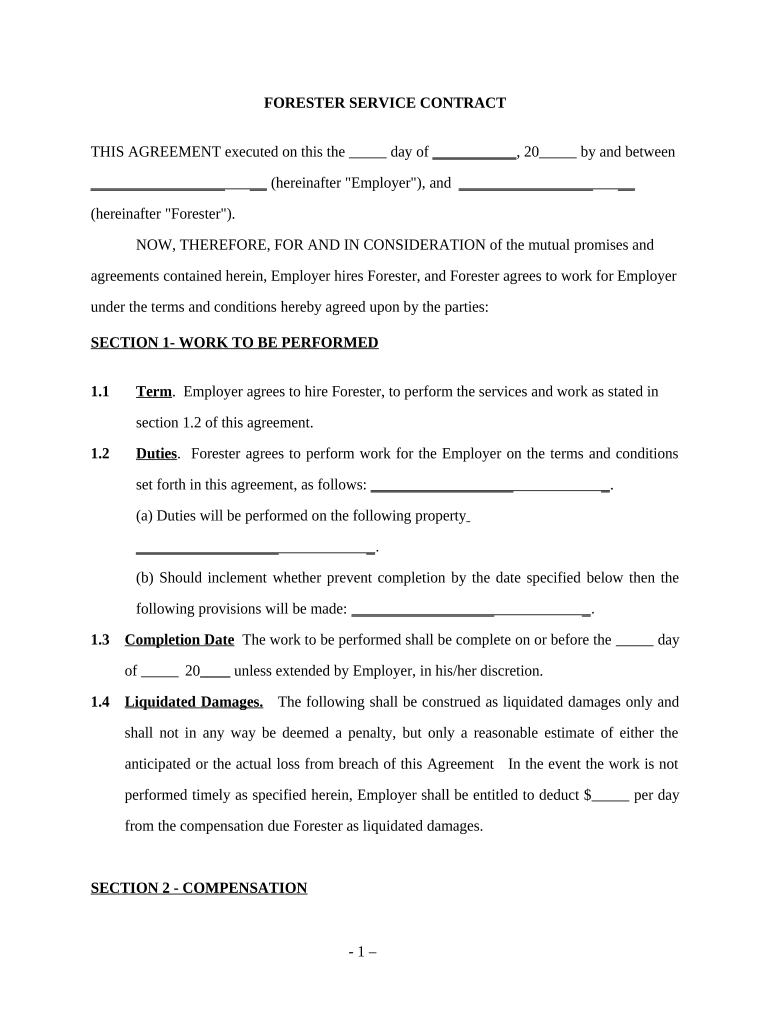

The agreement self employed is a legal document that outlines the terms and conditions between a self-employed individual and their clients or business partners. This form serves to clarify the expectations, responsibilities, and rights of both parties involved in a business relationship. It is essential for establishing a clear understanding of the services to be provided, payment terms, deadlines, and other critical aspects of the working arrangement.

How to use the Agreement Self Employed

Using the agreement self employed involves several key steps. First, identify the specific terms that need to be included, such as the scope of work, payment structure, and duration of the agreement. Next, fill out the form accurately, ensuring that all parties involved are clearly identified. Once the document is completed, it should be reviewed by all parties to confirm agreement on the terms. Finally, all parties should sign the document, either physically or electronically, to make it legally binding.

Steps to complete the Agreement Self Employed

Completing the agreement self employed requires careful attention to detail. Follow these steps:

- Gather necessary information about all parties involved.

- Draft the agreement, including specific terms such as services rendered and payment details.

- Review the document for clarity and completeness.

- Ensure all parties understand the terms and conditions.

- Sign the agreement, using an electronic signature platform for convenience and security.

Legal use of the Agreement Self Employed

The legal use of the agreement self employed is governed by various laws and regulations that ensure its enforceability. To be considered valid, the agreement must include essential elements such as mutual consent, a lawful purpose, and consideration (something of value exchanged). Additionally, compliance with electronic signature laws, such as the ESIGN Act and UETA, is crucial when signing the document online. This ensures that the agreement holds up in a court of law if disputes arise.

Key elements of the Agreement Self Employed

Several key elements must be included in the agreement self employed to ensure its effectiveness:

- Parties involved: Clearly identify all individuals or entities entering the agreement.

- Scope of work: Detail the specific services to be provided.

- Payment terms: Outline how and when payments will be made.

- Duration: Specify the length of the agreement and any renewal conditions.

- Termination clauses: Include conditions under which the agreement can be terminated.

Examples of using the Agreement Self Employed

Examples of situations where the agreement self employed is beneficial include:

- A freelance graphic designer outlining project details and payment terms with a client.

- A consultant establishing a working relationship with a business, detailing services and fees.

- A self-employed contractor defining the scope of work and payment structure for a construction project.

Quick guide on how to complete agreement self employed 497337090

Effortlessly Prepare Agreement Self Employed on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right forms and store them securely online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Agreement Self Employed on any platform using airSlate SignNow’s Android or iOS applications, streamlining any document-related process today.

Simple Steps to Modify and eSign Agreement Self Employed with Ease

- Obtain Agreement Self Employed and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for this by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you would like to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Agreement Self Employed and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an agreement self employed?

An agreement self employed is a legal document that outlines the terms and conditions agreed upon by a self-employed individual and their clients or partners. With airSlate SignNow, you can easily create, manage, and eSign these agreements to ensure clarity and legal compliance.

-

How does airSlate SignNow help with agreement self employed?

airSlate SignNow simplifies the process of creating and signing agreement self employed by providing customizable templates and a user-friendly interface. This ensures that self-employed individuals can produce professional contracts quickly and efficiently.

-

What features does airSlate SignNow offer for agreement self employed?

airSlate SignNow offers features tailored for agreement self employed, such as eSignature capabilities, real-time collaboration, and automatic reminders. These tools help streamline the signing process and keep all parties informed throughout the agreement's lifecycle.

-

Is airSlate SignNow cost-effective for self-employed individuals?

Yes, airSlate SignNow is designed to be a cost-effective solution for self-employed individuals looking to manage their agreements. With various pricing plans available, users can find an option that fits their budget while benefiting from robust eSigning features.

-

Can I integrate airSlate SignNow with other tools for my agreements self employed?

Absolutely! airSlate SignNow offers seamless integrations with popular platforms, making it easy to include your agreement self employed within your existing workflow. This flexibility allows you to enhance productivity and maintain consistency across your operations.

-

What benefits can I expect from using airSlate SignNow for my agreement self employed?

Using airSlate SignNow for your agreement self employed provides numerous benefits, including faster turnarounds on contracts, enhanced document security, and reduced paper usage. These advantages help you focus more on your business rather than administrative tasks.

-

Is it easy to customize an agreement self employed using airSlate SignNow?

Yes, airSlate SignNow allows you to easily customize your agreement self employed with its intuitive drag-and-drop interface. You can add your branding, adjust the content, and include necessary clauses to ensure the agreement meets your specific needs.

Get more for Agreement Self Employed

- Montana short sale addendum to purchase agreement form

- Free kentucky lease agreement with option to purchase form

- Oklahoma uniform contract of sale of real estate residential sale

- Oklahoma standard residential lease agreement eforms

- Oklahoma property condition disclaimer statement form

- Nevada short sale addendum to purchase agreement form

- 524 comp consent to act form

- 40 free roommate agreement templates ampamp forms word pdf

Find out other Agreement Self Employed

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement