Form No 15g Filled Sample Part 2

What is the Form No 15g Filled Sample Part 2

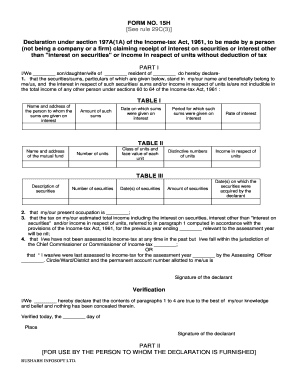

The Form No 15G is a declaration that individuals can submit to ensure that no tax is deducted at source on their income. This form is primarily used by individuals whose total income is below the taxable limit. The filled sample of Form 15G Part 2 provides a clear example of how to declare income from various sources, such as interest from bank deposits or fixed deposits. It is essential for taxpayers to understand the components of this form to ensure accurate completion and compliance with tax regulations.

How to use the Form No 15g Filled Sample Part 2

Using the Form No 15G filled sample Part 2 involves understanding the specific sections of the form that need to be completed. Taxpayers should fill in their personal details, including name, address, and PAN (Permanent Account Number). Additionally, they must declare the income for which they are requesting non-deduction of tax. The filled sample serves as a guide to correctly inputting this information, ensuring that all required fields are completed accurately to avoid any issues during processing.

Steps to complete the Form No 15g Filled Sample Part 2

Completing the Form No 15G filled sample Part 2 involves several key steps:

- Begin by entering your personal information, including your name and contact details.

- Provide your PAN, which is crucial for identification purposes.

- Declare the total income you expect to earn during the financial year.

- Sign and date the form to validate your declaration.

- Submit the form to the financial institution or entity from which you are receiving income.

Following these steps ensures that your form is filled out correctly, increasing the likelihood of acceptance without tax deductions.

Legal use of the Form No 15g Filled Sample Part 2

The legal use of the Form No 15G filled sample Part 2 is grounded in its compliance with tax regulations in the United States. By submitting this form, individuals declare that their total income is below the taxable threshold, allowing them to avoid unnecessary tax deductions. It is essential to ensure that all information provided is accurate and truthful, as submitting false information can lead to penalties or legal consequences. Understanding the legal framework surrounding this form helps taxpayers navigate their obligations effectively.

Key elements of the Form No 15g Filled Sample Part 2

The key elements of the Form No 15G filled sample Part 2 include:

- Personal Information: This includes the taxpayer's name, address, and PAN.

- Income Declaration: A section to declare the total income expected for the financial year.

- Signature: The taxpayer's signature is required to validate the form.

- Date: The date of signing is also crucial for record-keeping.

These elements are vital for ensuring that the form is processed correctly and meets legal requirements.

Examples of using the Form No 15g Filled Sample Part 2

Examples of using the Form No 15G filled sample Part 2 include scenarios where individuals receive interest income from savings accounts or fixed deposits. For instance, if a retiree has a total income that does not exceed the taxable limit, they can submit this form to their bank to avoid TDS (Tax Deducted at Source) on their interest income. Another example is a student who earns interest from a fixed deposit created from their savings. By using the filled sample as a reference, they can ensure their form is completed accurately and submitted correctly.

Quick guide on how to complete form no 15g filled sample part 2

Complete Form No 15g Filled Sample Part 2 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools needed to create, alter, and eSign your documents swiftly without interruptions. Manage Form No 15g Filled Sample Part 2 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Form No 15g Filled Sample Part 2 with ease

- Obtain Form No 15g Filled Sample Part 2 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, painstaking form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form No 15g Filled Sample Part 2 to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 15g filled sample part 2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 15G Part 2 filled sample?

A form 15G Part 2 filled sample is a template used to ensure that no tax is deducted from your income when your total taxable income is below the taxable limit. This sample helps individuals confidently submit their tax exemption requests. By utilizing airSlate SignNow, users can easily fill out and eSign their form 15G Part 2 efficiently.

-

How can I create a form 15G Part 2 filled sample using airSlate SignNow?

Creating a form 15G Part 2 filled sample on airSlate SignNow is straightforward. Simply select the document template, fill in the required fields, and use our user-friendly interface to personalize it. Once completed, you can eSign the document instantly, facilitating a quick submission.

-

Are there any costs associated with creating a form 15G Part 2 filled sample?

airSlate SignNow offers flexible pricing plans tailored to various needs, whether you're an individual or a business. The cost of creating a form 15G Part 2 filled sample is included in these plans, ensuring a cost-effective solution for document management and eSigning. You can start with a free trial to explore our features without any upfront costs.

-

What features does airSlate SignNow offer for handling form 15G Part 2 filled samples?

airSlate SignNow provides an array of features for efficiently managing your form 15G Part 2 filled samples. Users can enjoy auto-fill capabilities, advanced eSignature options, secure storage, and easy sharing with stakeholders. These features streamline the process, making tax documentation a breeze.

-

Is it safe to eSign a form 15G Part 2 filled sample online?

Yes, it is safe to eSign your form 15G Part 2 filled sample online using airSlate SignNow. We utilize industry-standard encryption and compliance with global security regulations to protect your sensitive information. You can sign with peace of mind, knowing your data is secure.

-

Can I integrate airSlate SignNow with other applications for managing form 15G Part 2 filled samples?

Absolutely! airSlate SignNow offers seamless integrations with various applications, enhancing your document workflow for form 15G Part 2 filled samples. You can easily connect with tools like Google Drive, Dropbox, and CRM solutions to manage your documents effectively.

-

What are the benefits of using airSlate SignNow for form 15G Part 2 filled samples?

Using airSlate SignNow for form 15G Part 2 filled samples brings numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. The platform provides an intuitive user experience, ensuring that your forms are correctly filled and securely signed. Enjoy the convenience of managing your tax documents all in one place.

Get more for Form No 15g Filled Sample Part 2

- 2014 form 8804 schedule a penalty for underpayment of estimated section 1446 tax by partnerships

- 2015 8804 form

- 32115 foreign partnership withholdinginternal revenue irsgov form

- 2016 form 8804 schedule a penalty for underpayment of estimated section 1446 tax by partnerships

- Irs 8804 2017 form

- 2000 form 709

- 2009 709 form

- 2004 709 form

Find out other Form No 15g Filled Sample Part 2

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template