Worker Independent Contractor Form

What is the campaign agreement?

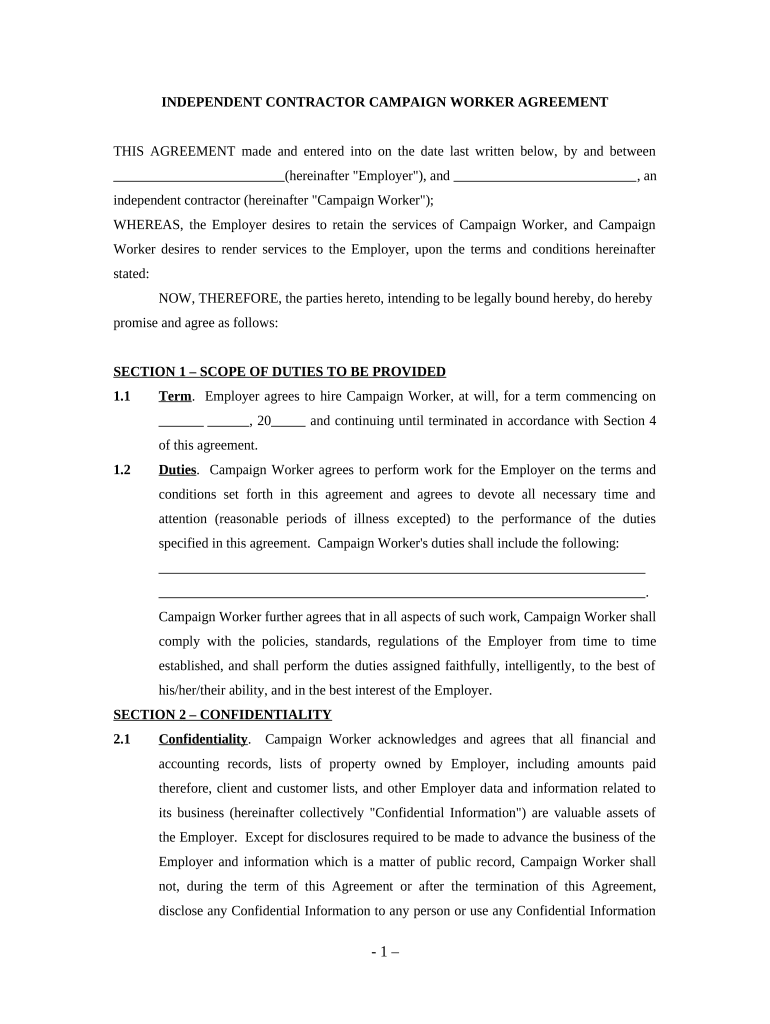

A campaign agreement is a legal document that outlines the terms and conditions between parties involved in a specific campaign. This can include marketing campaigns, political campaigns, or promotional events. The agreement typically details the responsibilities of each party, the timeline for the campaign, and any financial arrangements. It serves to protect the interests of all involved and ensures that everyone is on the same page regarding expectations and deliverables.

Key elements of the campaign agreement

When drafting a campaign agreement, several key elements should be included to ensure clarity and legal validity. These elements typically encompass:

- Parties involved: Clearly identify all parties entering the agreement.

- Scope of work: Define the specific tasks and responsibilities of each party.

- Timeline: Establish deadlines for the campaign and milestones for deliverables.

- Compensation: Outline the payment terms, including amounts, schedules, and methods.

- Confidentiality: Include clauses to protect sensitive information shared during the campaign.

- Termination conditions: Specify the circumstances under which the agreement may be terminated by either party.

Steps to complete the campaign agreement

Completing a campaign agreement involves several important steps to ensure that all parties are aligned and legally protected:

- Draft the agreement: Begin by outlining the key elements discussed above.

- Review with all parties: Share the draft with all involved parties for feedback and adjustments.

- Finalize the document: Incorporate any necessary changes and prepare the final version of the agreement.

- Sign the agreement: Use a reliable electronic signature platform to ensure that all parties can sign the document securely and legally.

- Store the agreement: Keep a copy of the signed agreement in a secure location for future reference.

Legal use of the campaign agreement

For a campaign agreement to be legally binding, it must adhere to certain legal standards. This includes ensuring that all parties have the legal capacity to enter into the agreement and that the terms are clear and enforceable. Additionally, the agreement should comply with relevant laws and regulations, such as those pertaining to advertising, marketing practices, and privacy. Utilizing a trusted electronic signature platform can further enhance the legal validity of the agreement by providing a digital certificate that verifies the signers’ identities.

Examples of using the campaign agreement

Campaign agreements can be utilized in various scenarios, including:

- Political campaigns: Agreements between campaign managers and volunteers outlining roles and responsibilities.

- Marketing collaborations: Partnerships between businesses for joint promotional efforts, detailing shared resources and financial contributions.

- Event sponsorships: Contracts between event organizers and sponsors that specify the terms of sponsorship and promotional activities.

Digital vs. paper version of the campaign agreement

Choosing between a digital and paper version of a campaign agreement depends on various factors, including convenience and legal requirements. Digital agreements offer advantages such as ease of access, quicker turnaround times, and enhanced security features like encryption and audit trails. Conversely, paper agreements may be preferred in situations where physical signatures are required or where parties are more comfortable with traditional documentation. Regardless of the format, ensuring that the agreement is properly executed and stored is essential for legal protection.

Quick guide on how to complete worker independent contractor

Complete Worker Independent Contractor effortlessly on any gadget

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, alter, and eSign your documents rapidly without delays. Manage Worker Independent Contractor on any device with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest method to alter and eSign Worker Independent Contractor with ease

- Obtain Worker Independent Contractor and then click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent portions of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Recheck all the information and then click on the Done button to preserve your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Adjust and eSign Worker Independent Contractor and guarantee outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a campaign agreement?

A campaign agreement is a formal contract outlining the terms and conditions between parties involved in a marketing or promotional campaign. Using airSlate SignNow, you can easily create, send, and eSign campaign agreements to ensure all parties are aligned and legally protected.

-

How does airSlate SignNow facilitate campaign agreement signing?

airSlate SignNow provides an intuitive platform that allows you to seamlessly send and eSign campaign agreements. With features such as real-time tracking and automated reminders, you can ensure that your campaign agreements are completed promptly without unnecessary delays.

-

What are the benefits of using airSlate SignNow for campaign agreements?

Using airSlate SignNow for your campaign agreements enhances efficiency and security. You can reduce paperwork and streamline your workflow while maintaining compliance with legally binding electronic signatures, ensuring that your campaigns run smoothly.

-

Can I customize my campaign agreement templates in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your campaign agreement templates to fit your specific needs. Tailor clauses, add branding, and create reusable templates that can be quickly filled out and sent for signature, saving you valuable time.

-

Is airSlate SignNow compliant with legal standards for campaign agreements?

Absolutely! airSlate SignNow complies with all legal standards and regulations regarding electronic signatures. This ensures that your campaign agreements are valid and enforceable, providing peace of mind as you execute your marketing strategies.

-

What integrations does airSlate SignNow offer for campaign agreement management?

airSlate SignNow can integrate with various business tools such as CRMs and document management systems to help streamline the management of campaign agreements. These integrations enhance productivity by allowing you to work within your preferred applications without interruption.

-

How will the pricing for airSlate SignNow service affect my campaign agreements?

airSlate SignNow offers competitive pricing plans that can help you manage your campaign agreements without breaking the bank. By utilizing an affordable solution, you gain access to all the necessary features to create, send, and manage your agreements efficiently.

Get more for Worker Independent Contractor

- Va form 26 6681 application for fee or roster

- Fillable online 02 3virginia tax fax email print pdffiller form

- 2021 form 763 virginia nonresident income tax return 2021 virginia nonresident income tax return

- Agency information collection activity under omb review

- Va form 10 10hs request for hardship determination

- To the regional loan center form

- 2021 form 763s virginia special nonresident claim for individual income tax withheld

- Wwwtaxformfinderorgvirginiaform 760pyvirginia form 760py part year resident individual income tax

Find out other Worker Independent Contractor

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word