Personal Independent Contractor Form

What is the Personal Independent Contractor

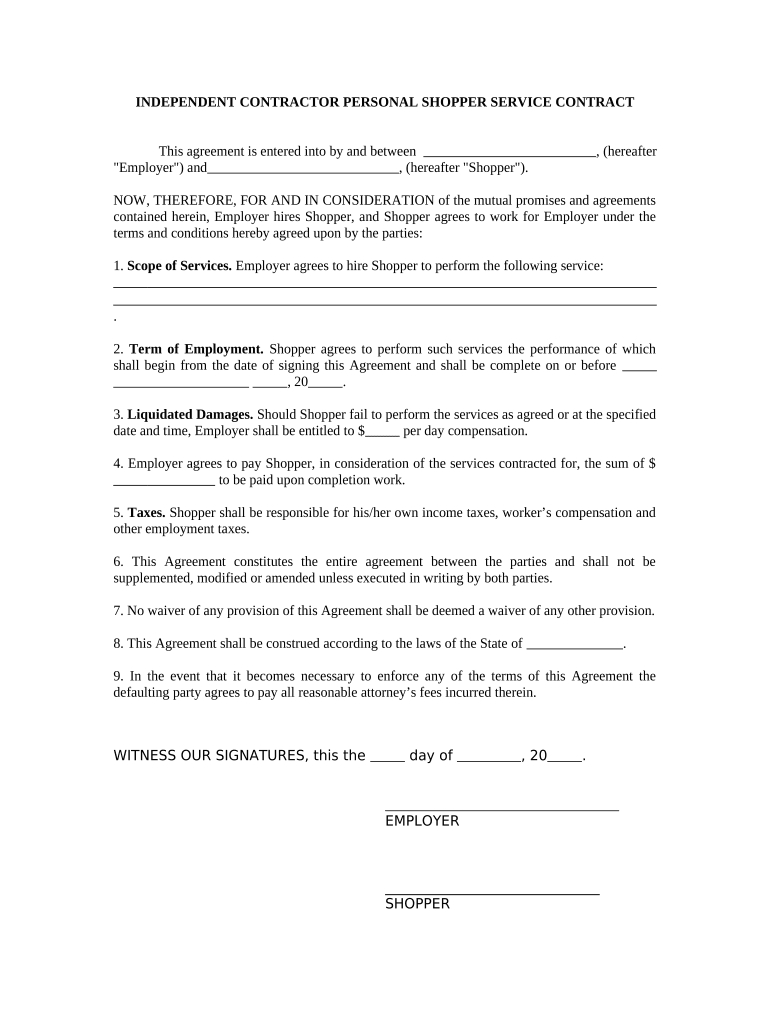

The personal independent contractor form is a crucial document used by individuals who work independently, providing services to clients without being classified as employees. This form outlines the nature of the work, payment terms, and other relevant details that clarify the relationship between the contractor and the client. It is essential for tax purposes, as independent contractors are responsible for reporting their income and paying self-employment taxes. Understanding this form is vital for anyone engaging in freelance work or contract-based services.

How to use the Personal Independent Contractor

Using the personal independent contractor form involves several steps. First, the contractor must gather all necessary information, including their business details, tax identification number, and the scope of work they will perform. Next, they should complete the form accurately, ensuring all sections are filled out to avoid delays. Once completed, the form should be shared with the client for their review and signature. Utilizing a digital platform like signNow can streamline this process, allowing for secure eSigning and easy document management.

Steps to complete the Personal Independent Contractor

Completing the personal independent contractor form requires careful attention to detail. Follow these steps:

- Gather necessary information, including your name, address, and tax identification number.

- Clearly define the services you will provide and the payment terms.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Share the form with your client for their signature, utilizing a secure eSigning platform for efficiency.

Legal use of the Personal Independent Contractor

The legal use of the personal independent contractor form is governed by various regulations that ensure the document is binding and enforceable. For the form to be legally valid, it must meet specific criteria, including proper signatures and compliance with eSignature laws such as ESIGN and UETA. It is essential for both parties to understand their rights and obligations outlined in the form, as this can prevent disputes and ensure smooth business operations.

Key elements of the Personal Independent Contractor

Several key elements make up the personal independent contractor form. These include:

- Contractor Information: Name, address, and tax identification number.

- Client Information: Name and contact details of the client or business hiring the contractor.

- Scope of Work: A detailed description of the services to be provided.

- Payment Terms: Compensation structure, including rates and payment schedule.

- Signatures: Signatures of both the contractor and client to validate the agreement.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines for independent contractors, emphasizing the importance of proper classification and tax reporting. Independent contractors must report their income using Schedule C and pay self-employment taxes. Understanding IRS guidelines helps contractors comply with tax obligations and avoid penalties. It is advisable for contractors to keep detailed records of their income and expenses to facilitate accurate reporting during tax season.

Quick guide on how to complete personal independent contractor

Complete Personal Independent Contractor effortlessly on any device

Digital document management has become favored among organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents swiftly without delays. Manage Personal Independent Contractor on any device with airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The simplest way to edit and electronically sign Personal Independent Contractor without hassle

- Locate Personal Independent Contractor and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether through email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form finding, or errors that require printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Personal Independent Contractor and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it assist a personal independent contractor?

airSlate SignNow is an intuitive eSigning solution that empowers personal independent contractors to easily send and sign documents online. This platform offers a cost-effective way to manage contracts, proposals, and agreements, streamlining your workflow and reducing turnaround time. By using airSlate SignNow, personal independent contractors can focus more on their work rather than paperwork.

-

Is airSlate SignNow affordable for personal independent contractors?

Yes, airSlate SignNow is designed to be budget-friendly, making it an ideal choice for personal independent contractors. With various pricing plans tailored to meet different needs, you can choose a solution that fits your budget. This ensures that cost does not become a barrier for independent contractors seeking efficient document management.

-

What features does airSlate SignNow provide for personal independent contractors?

AirSlate SignNow offers a suite of features tailored to personal independent contractors, including customizable templates, in-app chat functionality, and the ability to collect payments with ease. This comprehensive feature set helps streamline document handling and enhances productivity, allowing independent contractors to manage their work efficiently. Simplified tracking and notifications also ensure you never miss a deadline.

-

Can personal independent contractors integrate airSlate SignNow with other tools?

Absolutely! airSlate SignNow offers robust integrations with a variety of applications commonly used by personal independent contractors, including Google Drive, Dropbox, and Salesforce. This allows you to work seamlessly across platforms while maintaining organization and efficiency. Integration capabilities help to further enhance the utility of airSlate SignNow in your daily operations.

-

How secure is airSlate SignNow for personal independent contractors?

Security is a top priority for airSlate SignNow, particularly for personal independent contractors handling sensitive documents. The platform employs advanced encryption and compliance with industry standards, ensuring that your data and documents remain protected at all times. You can eSign and manage contracts confidently, knowing that your information is secure.

-

What benefits do personal independent contractors gain from using airSlate SignNow?

By using airSlate SignNow, personal independent contractors benefit from increased productivity, enhanced professionalism, and a streamlined document workflow. The ease of sending and signing documents helps save time, which can be redirected towards building your business. Additionally, clients appreciate the swift response times and organized approach that comes with using SignNow.

-

How can personal independent contractors get started with airSlate SignNow?

Getting started with airSlate SignNow is simple for personal independent contractors. You can sign up for a free trial to explore the features and usability of the platform before committing to a paid plan. Once you create your account, you’ll have immediate access to all tools and resources to help you manage your documents efficiently.

Get more for Personal Independent Contractor

- Background request only covers north dakota criminal history records form

- Confidential information form north dakota

- Pdf state of north dakota in the matter of the petition form

- Sfn 60688 form

- North dakota self proving affidavit form

- Get the criminal history record check request form

- In district court county state of north dakota petition for form

- Goode et al v camden city school lawjustiacom form

Find out other Personal Independent Contractor

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure