Payroll Independent Contractor Form

What is the Payroll Independent Contractor

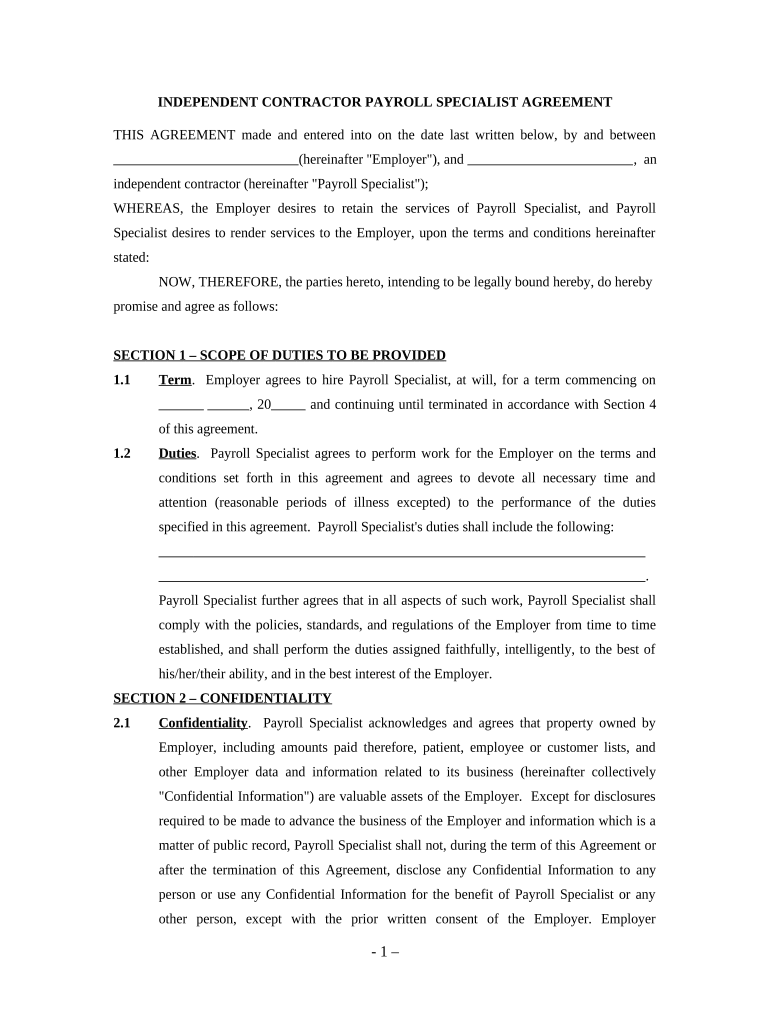

The payroll independent contractor form is a crucial document used to establish the relationship between a business and an independent contractor. This form outlines the terms of payment, responsibilities, and expectations for both parties. Unlike traditional employees, independent contractors operate with more autonomy, and this form clarifies their status for tax purposes and compliance with labor laws. It is essential for businesses to accurately complete this form to ensure proper tax reporting and to avoid potential legal issues.

How to Use the Payroll Independent Contractor

Using the payroll independent contractor form involves several steps. First, the business must gather necessary information about the contractor, including their legal name, address, and tax identification number. Next, the form should be filled out with specific details regarding the nature of the work, payment terms, and any applicable deadlines. Once completed, both parties should review the form to ensure accuracy before signing. Utilizing electronic signature solutions, like signNow, can streamline this process, making it easier to execute the form securely and efficiently.

Steps to Complete the Payroll Independent Contractor

Completing the payroll independent contractor form requires attention to detail. Follow these steps for effective completion:

- Gather contractor information, including their name, address, and tax identification number.

- Clearly define the scope of work and payment terms.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form with the contractor to confirm all details are correct.

- Obtain signatures from both parties, preferably using a secure electronic signature platform.

Legal Use of the Payroll Independent Contractor

The payroll independent contractor form must comply with various legal requirements to be considered valid. It is important to adhere to the guidelines set forth by the IRS and state regulations. The form should accurately reflect the nature of the work and payment terms to avoid misclassification of the contractor. Proper use of this form protects both the business and the contractor from potential legal disputes and ensures compliance with tax obligations.

IRS Guidelines

The IRS provides specific guidelines regarding independent contractors and the use of the payroll independent contractor form. According to IRS regulations, businesses must determine whether a worker is an independent contractor or an employee based on the level of control and independence in the working relationship. Misclassification can lead to penalties, so it is essential to follow IRS guidelines closely when completing this form. Additionally, independent contractors are responsible for their own tax obligations, including self-employment taxes.

Required Documents

To complete the payroll independent contractor form, several documents may be required. These typically include:

- A completed W-9 form, which provides the contractor's tax identification information.

- A copy of any relevant contracts or agreements outlining the scope of work.

- Proof of insurance or licenses, if applicable to the contractor's work.

Having these documents ready will facilitate a smooth completion process and ensure compliance with legal requirements.

Penalties for Non-Compliance

Failing to properly complete and submit the payroll independent contractor form can result in significant penalties for businesses. Non-compliance may lead to back taxes, fines, and interest charges imposed by the IRS. Additionally, misclassification of workers can result in legal disputes and potential lawsuits. It is crucial for businesses to understand the importance of this form and to ensure that it is completed accurately to avoid these risks.

Quick guide on how to complete payroll independent contractor

Effortlessly Prepare Payroll Independent Contractor on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without any delays. Manage Payroll Independent Contractor on any device using the airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The simplest way to adjust and eSign Payroll Independent Contractor with ease

- Find Payroll Independent Contractor and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which only takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Payroll Independent Contractor and guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's approach to managing payroll for independent contractors?

airSlate SignNow simplifies the payroll process for independent contractors by allowing businesses to automate document workflows. This ensures that contracts and payment forms are completed efficiently, enhancing compliance and reducing errors in contractor payments.

-

How does airSlate SignNow help with tax documentation for payroll independent contractors?

With airSlate SignNow, businesses can easily send and manage W-9 and 1099 forms for payroll independent contractors. The platform's electronic signature feature ensures that all documents are signed and submitted on time, streamlining tax reporting and minimizing potential penalties.

-

What are the pricing options for using airSlate SignNow for payroll independent contractor management?

airSlate SignNow provides flexible pricing plans to accommodate businesses of all sizes. These plans are designed with the needs of companies managing payroll independent contractors in mind, offering cost-effective solutions that scale as your team grows.

-

Can airSlate SignNow integrate with my existing payroll software for independent contractors?

Yes, airSlate SignNow offers integrations with popular payroll software that facilitates efficient management of payments to independent contractors. This compatibility allows you to streamline operations and ensure that your payroll system is updating in real-time.

-

What features does airSlate SignNow provide to support payroll independent contractors?

The platform includes features such as document templates, bulk sending, and automated reminders, which are essential for managing payroll independent contractors. These tools help businesses maintain organized records and ensure timely payments for completed work.

-

How secure is airSlate SignNow when handling documents for payroll independent contractors?

airSlate SignNow prioritizes security by utilizing advanced encryption protocols to protect sensitive documents related to payroll independent contractors. This ensures that all your data remains confidential and secure throughout the transaction process.

-

Is there customer support available for questions related to payroll independent contractors?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any questions concerning payroll independent contractors. Our team is available via chat, email, and phone, ensuring you receive timely help whenever needed.

Get more for Payroll Independent Contractor

- Get the free dmna form 86 request for nyarng military

- Sex offender in the state of iowa form

- Disaster summary outline form

- Fillable online form 30 d ohio secretary of state fax

- Quick reference michigan fill out and sign printable pdf form

- Live scan fingerprint background check request state of form

- State police investigator trainee career opportunities form

- Protective services unit illinois state police home page form

Find out other Payroll Independent Contractor

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document