Self Employed Independent Contractor Form

Understanding the Self Employed Independent Contractor

A self employed independent contractor is an individual who offers services to clients under terms specified in a contract. Unlike traditional employees, independent contractors operate their own businesses, setting their own hours and determining how to complete their work. This arrangement allows for greater flexibility, but it also requires a clear understanding of the responsibilities and legal implications involved.

Independent contractors are typically responsible for their own taxes, insurance, and benefits. They must also manage their own business expenses and maintain accurate records for tax purposes. Understanding the distinctions between independent contractors and employees is crucial for both the contractor and the hiring entity.

Steps to Complete the Independent Contractor Form

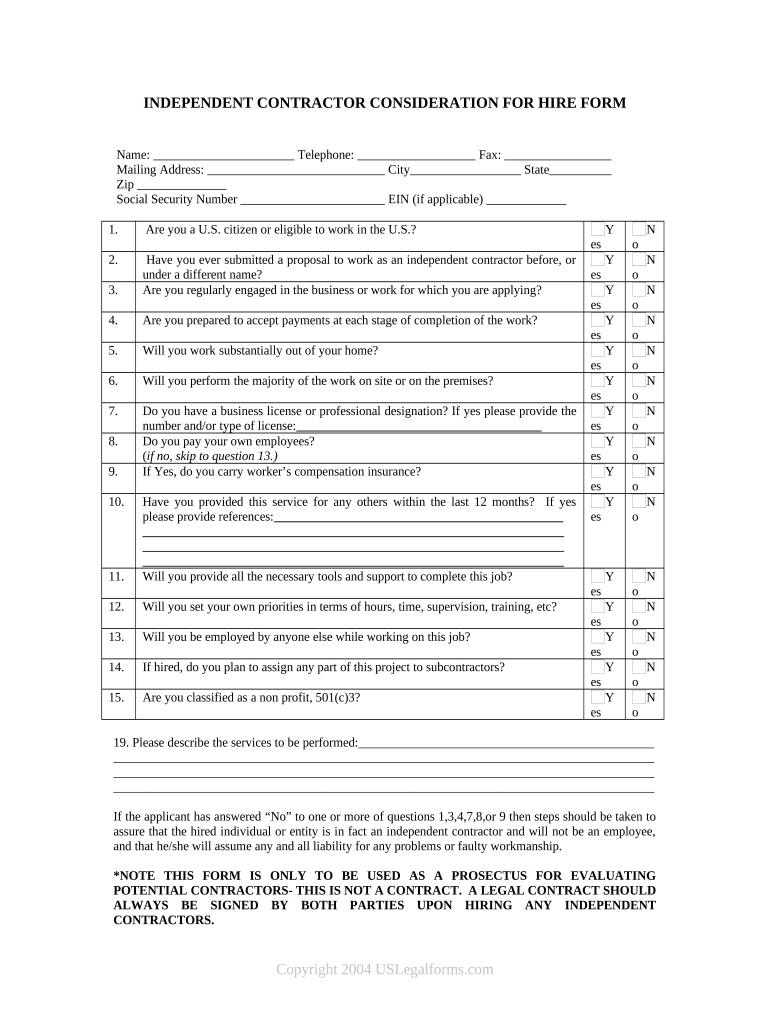

Filling out the independent contractor form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your personal identification details and business information. Next, clearly outline the services you will provide, including the scope of work, payment terms, and duration of the contract.

It is essential to review the form for completeness and accuracy before submission. Ensure that all parties involved in the contract sign and date the document. Utilizing a digital signature solution can streamline this process, ensuring that signatures are legally binding and compliant with eSignature regulations.

Legal Use of the Independent Contractor Form

The legal validity of the independent contractor form hinges on several factors, including the clarity of the contract terms and compliance with relevant laws. It is important to ensure that the form includes all necessary details about the services provided, payment arrangements, and the responsibilities of each party.

Compliance with federal and state regulations is crucial to avoid potential legal issues. The form should adhere to guidelines set forth by the IRS and other regulatory bodies. Utilizing a reliable eSignature platform can help maintain compliance and provide a secure method for signing and storing the document.

IRS Guidelines for Independent Contractors

The IRS has specific guidelines that govern the classification and taxation of independent contractors. It is essential for self employed individuals to understand these guidelines to ensure proper tax reporting and compliance. Independent contractors must report their income on Schedule C of their tax return and may be required to pay self-employment taxes.

Additionally, the IRS provides criteria to determine whether a worker is an independent contractor or an employee. Factors include the degree of control the employer has over the worker and the nature of the relationship. Misclassification can lead to penalties, making it vital for both parties to understand their obligations.

Required Documents for Independent Contractors

When completing the independent contractor form, several documents may be required to support your application. These documents typically include a valid identification, proof of business registration, and any relevant licenses or certifications related to your field of work.

Additionally, having a well-prepared portfolio or examples of previous work can help establish credibility. Maintaining organized records of all transactions and communications with clients is also beneficial for tax purposes and future reference.

Penalties for Non-Compliance

Failure to comply with IRS regulations and other legal requirements can result in significant penalties for independent contractors. These penalties may include fines, interest on unpaid taxes, and potential legal action. Misclassification of employees can also lead to back taxes owed and additional fines.

To avoid these penalties, it is important to keep accurate records, file taxes on time, and ensure compliance with all relevant laws. Seeking advice from a tax professional can provide guidance on maintaining compliance and understanding the implications of your independent contractor status.

Quick guide on how to complete self employed independent contractor 497337208

Complete Self Employed Independent Contractor effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the suitable form and safely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your files quickly without interruptions. Manage Self Employed Independent Contractor on any device with airSlate SignNow’s Android or iOS applications and enhance any document-driven procedure today.

The simplest way to modify and electronically sign Self Employed Independent Contractor with ease

- Find Self Employed Independent Contractor and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for such tasks.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Self Employed Independent Contractor and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the best eSignature solution for a self employed independent contractor?

For a self employed independent contractor, airSlate SignNow offers an ideal eSignature solution that is intuitive and easy to use. Its features cater specifically to the needs of independent contractors, ensuring smooth document management and signature processes. With flexible pricing options, it allows you to sign as many documents as you need without breaking the bank.

-

How much does airSlate SignNow cost for self employed independent contractors?

Pricing for self employed independent contractors using airSlate SignNow is structured to suit individual needs. Plans start on a monthly basis, ensuring affordability for even the smallest budgets. This cost-effective solution offers a variety of features tailored to enhance productivity without overwhelming costs.

-

What features does airSlate SignNow offer for independent contractors?

AirSlate SignNow includes a range of features designed specifically for self employed independent contractors, such as document templates, customizable workflows, and secure cloud storage. The platform also enables team collaboration, allowing multiple parties to work on documents seamlessly. These features streamline the document signing process, making it easier for contractors to manage their tasks.

-

Can self employed independent contractors integrate airSlate SignNow with their existing tools?

Yes, self employed independent contractors can easily integrate airSlate SignNow with various tools and applications such as Google Drive, Dropbox, and CRM systems. This integration simplifies document management and enhances workflow efficiency. By connecting airSlate SignNow with other tools, contractors can automate their processes and save valuable time.

-

How does airSlate SignNow benefit self employed independent contractors?

Self employed independent contractors benefit from airSlate SignNow through enhanced efficiency and improved document turnaround times. This user-friendly platform minimizes paperwork, allows for quick eSigning, and ensures that contracts are legally binding. With its mobile capabilities, you can manage your documents anytime, anywhere, which is crucial for a busy independent contractor.

-

Is airSlate SignNow secure for self employed independent contractors?

Absolutely! Security is a top priority for airSlate SignNow, making it a safe choice for self employed independent contractors. The platform uses advanced encryption protocols to protect sensitive documents, ensuring compliance with legal standards. You can sign and send important documents with confidence, knowing that your data is secure.

-

How can self employed independent contractors get support with airSlate SignNow?

Self employed independent contractors can access comprehensive support through airSlate SignNow's customer service channels. Whether through live chat, email, or extensive online resources such as FAQs and tutorials, help is readily available. This ensures that all contractors can effectively utilize the platform and resolve any issues promptly.

Get more for Self Employed Independent Contractor

- Wichita half fare card form

- Postnuptial agreement example mecklenburg county bar meckbar form

- Football registration form pdf

- Manatee county government administrative center honorable form

- Mdcps form fm 6743

- Change of address form jacksonville

- Monthly report answer all questions this report is due by mymanatee form

- Printing t5000500 9995584frp formsdadeschoolsnet

Find out other Self Employed Independent Contractor

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now