Employment Independent Contractor Form

What is the Employment Independent Contractor

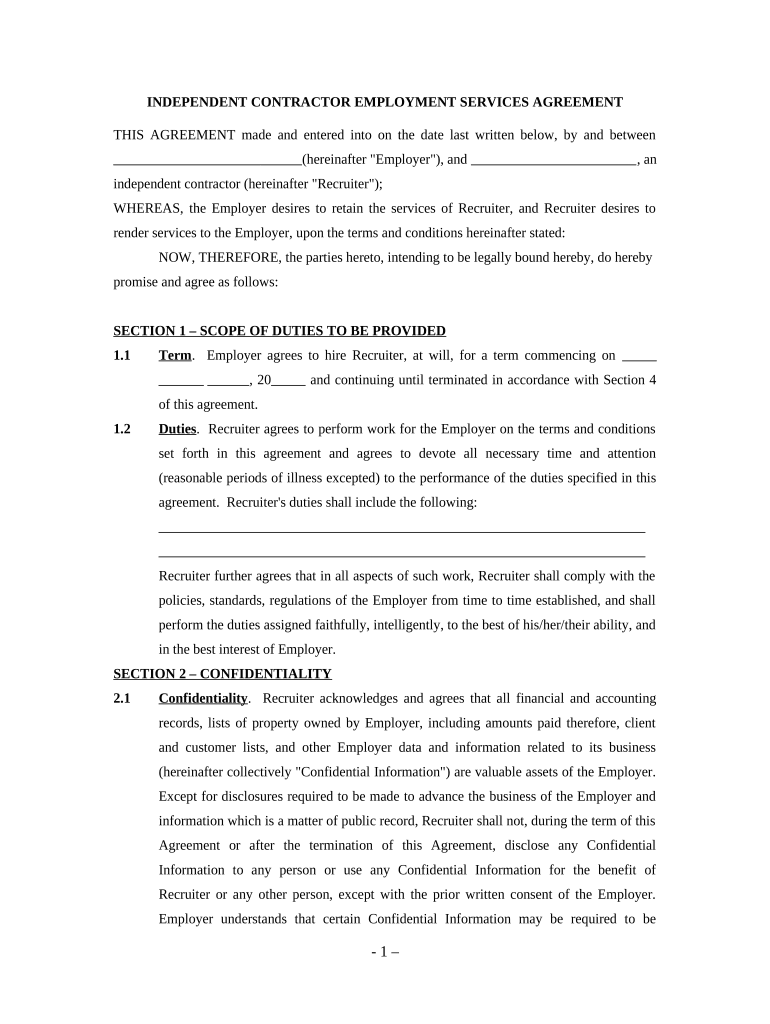

The employment independent contractor form is a critical document that outlines the relationship between a business and an independent contractor. This form establishes the terms of engagement, including the scope of work, payment terms, and responsibilities of both parties. Unlike traditional employment, independent contractors have more flexibility in how they complete their work, but they also assume greater responsibility for their taxes and benefits.

Steps to complete the Employment Independent Contractor

Completing the employment independent contractor form involves several important steps to ensure that all necessary information is accurately captured. Begin by gathering the required details, such as the contractor's full name, address, and Social Security number or Employer Identification Number (EIN). Next, specify the nature of the work to be performed, including timelines and deliverables. Clearly outline payment terms, including rates and payment schedules. Finally, both parties should review the form for accuracy and sign it to formalize the agreement.

Legal use of the Employment Independent Contractor

For the employment independent contractor form to be legally binding, it must comply with various legal standards. This includes ensuring that both parties agree to the terms laid out in the document. Compliance with federal and state laws is essential, particularly regarding tax obligations and labor regulations. Utilizing a reliable electronic signature platform can enhance the legal standing of the document, as it provides a secure method for signing and storing the agreement.

Key elements of the Employment Independent Contractor

Several key elements must be included in the employment independent contractor form to ensure clarity and legality. These elements typically encompass the contractor's information, a detailed description of the services to be provided, payment terms, deadlines, and any applicable confidentiality clauses. Additionally, it is important to specify the duration of the contract and the conditions under which it can be terminated. Including these elements helps prevent misunderstandings and protects both parties' interests.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding independent contractors and their tax obligations. It is crucial for businesses to classify workers correctly to avoid penalties. Independent contractors are responsible for their own taxes, including self-employment tax. Businesses should issue a Form 1099-NEC to contractors who earn $600 or more in a calendar year. Understanding these guidelines helps ensure compliance and proper reporting.

Filing Deadlines / Important Dates

Filing deadlines for the employment independent contractor form can vary based on the nature of the work and the payment structure. Generally, businesses must provide Form 1099-NEC to independent contractors by January 31 of the following year. Additionally, the IRS requires that businesses file their copies of Form 1099-NEC by the end of February if filing by paper, or by March 31 if filing electronically. Being aware of these deadlines is essential for maintaining compliance.

Eligibility Criteria

Eligibility to work as an independent contractor typically depends on the nature of the work and the relationship with the hiring business. Factors such as the level of control the business has over the contractor's work, the independence of the contractor, and the type of services provided play a significant role in determining eligibility. Understanding these criteria helps both businesses and contractors navigate their rights and responsibilities effectively.

Quick guide on how to complete employment independent contractor

Effortlessly Prepare Employment Independent Contractor on Any Device

The management of documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct form and safely archive it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Employment Independent Contractor on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and Electronically Sign Employment Independent Contractor with Ease

- Find Employment Independent Contractor and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just moments and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to secure your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Employment Independent Contractor while ensuring excellent communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the role of an employment independent contractor?

An employment independent contractor is a self-employed individual who provides services to clients or businesses under a contract. Unlike traditional employees, they have more flexibility in their work schedules and often handle their own taxes. Understanding the unique characteristics of an employment independent contractor can help both parties establish clear expectations and responsibilities.

-

How can airSlate SignNow assist employment independent contractors?

airSlate SignNow provides employment independent contractors with a streamlined solution for managing documents and eSignatures. This platform allows them to securely send, sign, and store contracts online, which simplifies the paperwork process. By using airSlate SignNow, independent contractors can focus more on their work and less on document management.

-

What features does airSlate SignNow offer for independent contractors?

AirSlate SignNow offers features tailored to the needs of employment independent contractors, including customizable templates, automated document workflows, and secure cloud storage. These functionalities allow contractors to create contracts quickly and ensure that they comply with legal requirements. Additionally, the platform's intuitive interface makes it easy for contractors to navigate and utilize its features.

-

Is airSlate SignNow cost-effective for employment independent contractors?

Yes, airSlate SignNow is designed to be a cost-effective solution for employment independent contractors. With various pricing plans that cater to different needs, independent contractors can choose a plan that fits their budget while still benefiting from comprehensive document management features. This affordability helps contractors manage their costs while maintaining professionalism.

-

Can airSlate SignNow integrate with other tools for independent contractors?

Absolutely! airSlate SignNow can integrate with various tools commonly used by employment independent contractors, such as project management software, customer relationship management systems, and payment processors. These integrations enhance workflow efficiency and help independent contractors automate their processes, allowing them to serve clients more effectively.

-

How secure is airSlate SignNow for employment independent contractor documents?

Security is a top priority for airSlate SignNow, which employs robust measures to protect sensitive documents for employment independent contractors. The platform uses encryption and complies with major security standards, ensuring that contractors' data remains confidential and secure. This focus on security fosters trust and allows independent contractors to handle client information with confidence.

-

Can employment independent contractors use airSlate SignNow on mobile devices?

Yes, employment independent contractors can conveniently access airSlate SignNow on mobile devices through its responsive web platform or mobile app. This allows contractors to send and sign documents on the go, ensuring that they stay connected and productive, regardless of their location. The mobile accessibility of airSlate SignNow makes it an ideal tool for busy independent contractors.

Get more for Employment Independent Contractor

- 2021 form 990 pf return of private foundation or section 4947a1 trust treated as private foundation

- As of 12720 this new version of the it 4 combines and replaces the following forms it 4 previous version it 4nr it 4 mil and it

- Wwwirsgovpubirs soiinternal revenue service instructions for form 990 pf

- Get the free about form 8949internal revenue service irsgov

- Form 1099 int rev january 2022 interest income

- 1120 pol u s income tax return for certain political form

- Form 7200 rev april 2021 internal revenue service

- Wwwirsgovadvocatereports to congressreports to congressinternal revenue service irs tax forms

Find out other Employment Independent Contractor

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation