Request Copy Form

What is the request copy form?

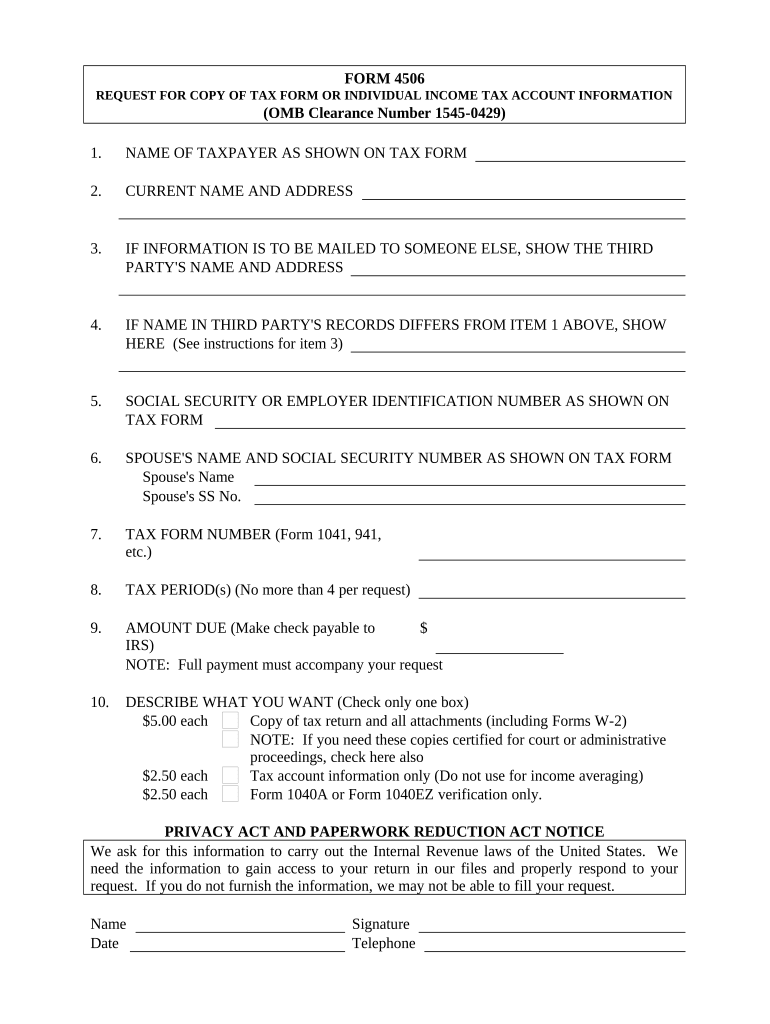

The request copy form is a document used to formally request a copy of a specific record or document, often related to tax information or personal records. This form is essential for individuals or businesses needing to obtain copies of documents for legal, financial, or personal purposes. It typically includes details such as the requester’s information, the type of document requested, and any relevant identification numbers. By using this form, individuals can ensure that their requests are processed efficiently and accurately.

How to use the request copy form

Using the request copy form involves several straightforward steps. First, gather all necessary information, including your personal details and the specifics of the document you are requesting. Next, fill out the form carefully, ensuring all fields are completed accurately. After completing the form, review it for any errors before submitting it. Depending on the issuing agency, you may be able to submit the form electronically, by mail, or in person. Always check the specific submission guidelines for the agency handling your request.

Steps to complete the request copy form

Completing the request copy form requires attention to detail. Follow these steps for a successful submission:

- Gather necessary information, such as your name, address, and identification number.

- Identify the specific document you are requesting, including any relevant dates or reference numbers.

- Fill out the form, ensuring all required fields are completed.

- Review the form for accuracy and completeness.

- Submit the form according to the guidelines provided by the issuing agency.

Legal use of the request copy form

The request copy form is legally recognized when completed and submitted according to established guidelines. It serves as a formal request for documentation, which can be critical in legal or financial matters. To ensure its legal validity, it is important to comply with all relevant laws and regulations, including providing accurate information and submitting the form to the correct agency. This compliance helps safeguard your rights and ensures that your request is honored.

Required documents

When submitting a request copy form, certain documents may be required to authenticate your identity and support your request. Commonly required documents include:

- A government-issued identification, such as a driver's license or passport.

- Proof of address, such as a utility bill or bank statement.

- Any reference numbers or previous correspondence related to the document being requested.

Having these documents ready can help streamline the process and reduce delays in obtaining the requested copies.

Form submission methods

The request copy form can typically be submitted through various methods depending on the issuing agency's policies. Common submission methods include:

- Online submission through the agency's official website.

- Mailing the completed form to the designated address.

- Delivering the form in person at the agency's office.

It is essential to check the specific submission guidelines for the agency to ensure your request is processed promptly.

Quick guide on how to complete request copy form

Effortlessly manage Request Copy Form on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documentation, allowing you to easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly and without hassle. Handle Request Copy Form on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to modify and eSign Request Copy Form without any stress

- Obtain Request Copy Form and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with the specific tools offered by airSlate SignNow.

- Formulate your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and press the Done button to save your modifications.

- Select your preferred method to send your form, whether via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious document searches, or inaccuracies necessitating the printing of new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign Request Copy Form to ensure efficient communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a request copy form in airSlate SignNow?

A request copy form is a feature that allows users to easily request copies of their signed documents. With airSlate SignNow, you can seamlessly integrate this function into your workflow, ensuring that important documents are always accessible. This functionality helps streamline processes and improve efficiency in document management.

-

How much does it cost to use airSlate SignNow for requesting copy forms?

airSlate SignNow offers competitive pricing plans that cater to different business needs. Whether you're an individual, a small business, or an enterprise, you can find affordable options to help you request copy forms and manage your documents effectively. Pricing details are accessible on our website for your convenience.

-

Can I customize my request copy form in airSlate SignNow?

Yes, you can easily customize your request copy form using airSlate SignNow's user-friendly interface. This allows you to include specific fields, branding elements, and other details that reflect your organization's identity. Customization enhances user experience and ensures that the forms meet your specific requirements.

-

Are there any integrations available for the request copy form feature?

Absolutely! airSlate SignNow offers integrations with various third-party applications, making it easy to synchronize your workflows. You can integrate your request copy form with tools like Google Drive, Salesforce, and more, streamlining document management and enhancing productivity within your team.

-

How does airSlate SignNow ensure the security of my request copy forms?

airSlate SignNow prioritizes the security of your documents, employing industry-standard encryption protocols. When you request a copy form, you can trust that your sensitive information is protected both in transit and at rest. We strive to provide a secure platform for all your document signing and management needs.

-

What benefits can I expect from using the request copy form feature?

The request copy form feature in airSlate SignNow offers numerous benefits, including improved efficiency and organization. By using this feature, you save time and reduce errors associated with manual document handling. Additionally, easy access to signed documents ensures that your workflow remains uninterrupted.

-

Can I track the status of my request copy forms?

Yes, airSlate SignNow includes tracking capabilities that allow you to monitor the status of your request copy forms. This feature provides real-time updates, ensuring that you never miss an important document. It enhances transparency and accountability in your document workflows.

Get more for Request Copy Form

- Minnesota form mwr reciprocity exemptionaffidavit of

- Wwwrevenuestatemnus sites defaultwithholding fact sheet 2 submitting form w 2 and w 2c

- Wwwgooglecom chromegoogle chrome download the fast secure browser from google form

- Mtrevenuegovaboutbusiness and income taxbusiness ampamp income taxes division montana department of revenue form

- Fillable online understand the geothermal tax credit form

- Form 103 long1pdf cass county government

- Fillable online schedule in 529 schedule in 529 indianas form

- Fillable online forms in state form 54259 fax email print

Find out other Request Copy Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors