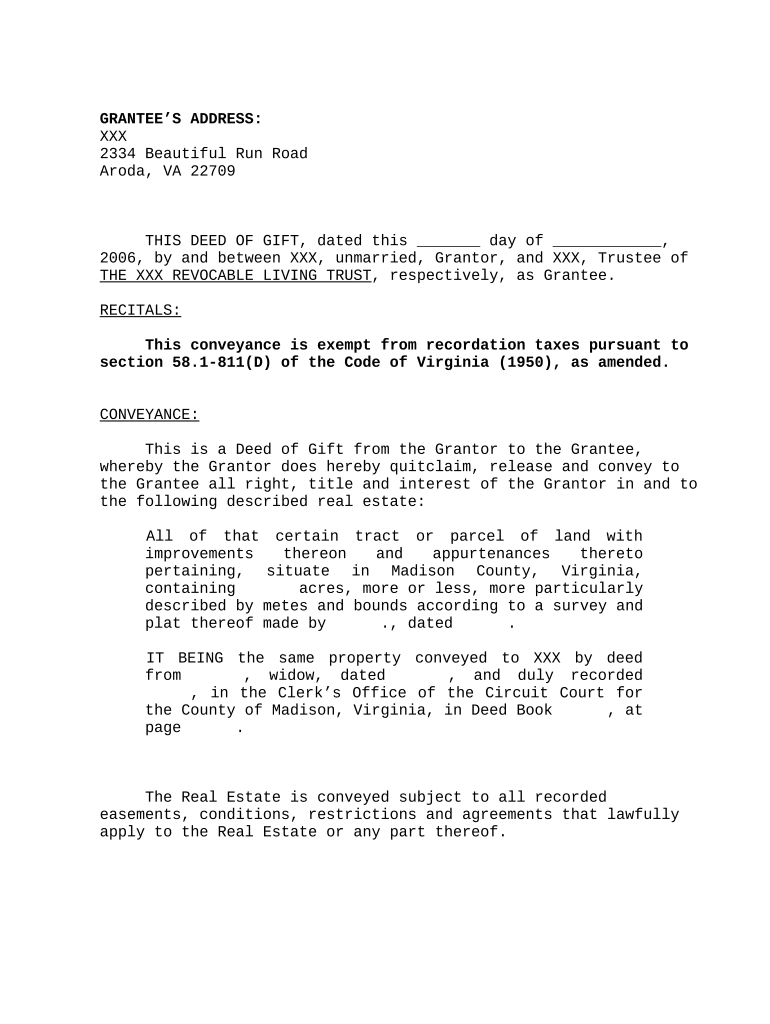

Deed Gift Trust Form

What is the Deed Gift Trust

A deed gift trust is a legal arrangement that allows an individual to transfer assets to a trust for the benefit of another person, typically a family member. This type of trust is often used to manage and protect assets while providing financial support to beneficiaries. The trust is established through a formal deed, which outlines the terms and conditions of the asset transfer, ensuring that the grantor's intentions are clearly documented. By utilizing a deed gift trust, individuals can potentially reduce their estate tax liability and provide for their loved ones in a structured manner.

How to use the Deed Gift Trust

Using a deed gift trust involves several key steps. First, the grantor must identify the assets they wish to place in the trust, which can include real estate, cash, or investments. Next, the grantor should consult with a legal professional to draft the trust deed, ensuring that it complies with state laws and accurately reflects their wishes. Once the deed is executed, the assets are transferred to the trust, and the trustee is responsible for managing them according to the terms set forth in the deed. Beneficiaries can receive distributions from the trust as specified, providing them with financial support while the grantor retains certain controls over the assets.

Steps to complete the Deed Gift Trust

Completing a deed gift trust involves a structured process to ensure legal compliance and clarity. The following steps are typically involved:

- Determine the assets to be included in the trust.

- Consult with a qualified attorney to draft the trust deed.

- Review the deed for accuracy and compliance with state laws.

- Execute the deed in the presence of witnesses or a notary, as required.

- Transfer the identified assets into the trust, ensuring proper documentation.

- Inform the beneficiaries about the trust and their rights under it.

Legal use of the Deed Gift Trust

The legal use of a deed gift trust is governed by state laws, which may vary significantly. Generally, the trust must be established with clear intent and proper documentation to be recognized by courts. It is essential to ensure that the trust complies with relevant tax laws and regulations to avoid penalties. The grantor should also consider the implications of gift taxes, as transferring assets into the trust may trigger tax liabilities. Consulting with legal and tax professionals can help navigate these complexities and ensure that the trust serves its intended purpose legally and effectively.

Key elements of the Deed Gift Trust

Several key elements define a deed gift trust, making it a unique financial instrument:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust and its assets.

- Beneficiaries: Individuals or entities that receive benefits from the trust.

- Deed: The legal document that outlines the terms of the trust, including asset management and distribution guidelines.

- Asset Protection: The trust can provide a layer of protection for assets against creditors and legal claims.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the taxation of deed gift trusts. When assets are transferred into the trust, the grantor may be subject to gift tax rules, which apply if the value of the assets exceeds the annual exclusion limit. Additionally, the trust may have ongoing tax implications based on the income generated by the assets. It is crucial for grantors to understand these guidelines to ensure compliance and optimize their tax situation. Consulting a tax advisor can provide clarity on how these regulations impact the establishment and management of a deed gift trust.

Quick guide on how to complete deed gift trust

Effortlessly Prepare Deed Gift Trust on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without interruptions. Handle Deed Gift Trust on any platform using airSlate SignNow's applications for Android or iOS and enhance any document-related workflow today.

The most efficient method to modify and electronically sign Deed Gift Trust effortlessly

- Locate Deed Gift Trust and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive details using tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign feature, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign Deed Gift Trust to ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a deed gift trust?

A deed gift trust is a legal arrangement where assets are transferred to a trust for the benefit of beneficiaries without retaining personal control over those assets. This structure ensures that the assets are managed according to the trust's terms and can provide tax advantages for both givers and recipients.

-

How much does it cost to create a deed gift trust?

The cost of establishing a deed gift trust can vary signNowly based on the complexity of the trust and any legal fees involved. Typically, you can expect to pay for drafting the necessary documentation and potential ongoing management fees to ensure the trust meets all legal requirements.

-

What are the benefits of using a deed gift trust?

Using a deed gift trust offers several benefits, including asset protection, tax benefits, and the ability to control how your assets are distributed after your passing. This structure helps ensure that beneficiaries receive support according to your wishes while potentially minimizing estate taxes.

-

How can airSlate SignNow assist with deed gift trust documentation?

AirSlate SignNow simplifies the process of creating and managing documents related to your deed gift trust. With its easy-to-use eSignature solution, you can quickly send and sign essential trust documents securely, ensuring compliance and saving time in the process.

-

Are there specific features of airSlate SignNow that support deed gift trust management?

Yes, airSlate SignNow offers features like templates for trust documents, real-time tracking of signatures, and secure cloud storage, which are particularly useful for managing the complexities of a deed gift trust. These features help ensure all necessary documentation is easily accessible and efficiently managed.

-

Can I integrate airSlate SignNow with other legal management tools for my deed gift trust?

Absolutely! airSlate SignNow provides seamless integrations with various legal management software, allowing you to incorporate your deed gift trust into your overall estate planning processes. This capability enhances your workflow by streamlining document management and electronic signatures.

-

What should I consider before setting up a deed gift trust?

Before establishing a deed gift trust, consider your financial goals, the specific assets you wish to transfer, and the potential implications for your beneficiaries. It's also advisable to consult with a financial advisor or attorney to ensure that this trust aligns with your overall estate planning strategy.

Get more for Deed Gift Trust

- Enclosed herewith please find an authority to cancel with regard to the deed of trust in form

- Dear sir please find attached herewith the scanned copies form

- Request letter for work immersion form

- Enclosed herewith please find a copy of an entry of appearance and a motion for leave to form

- Enclosed herewith please find a copy of a letter and general and absolute release which form

- 489 statutory notices of deficiencyinternal revenue service form

- County court judge of form

- Sample letter of request for representation form

Find out other Deed Gift Trust

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT