Assignment to Living Trust Vermont Form

What is the Assignment To Living Trust Vermont

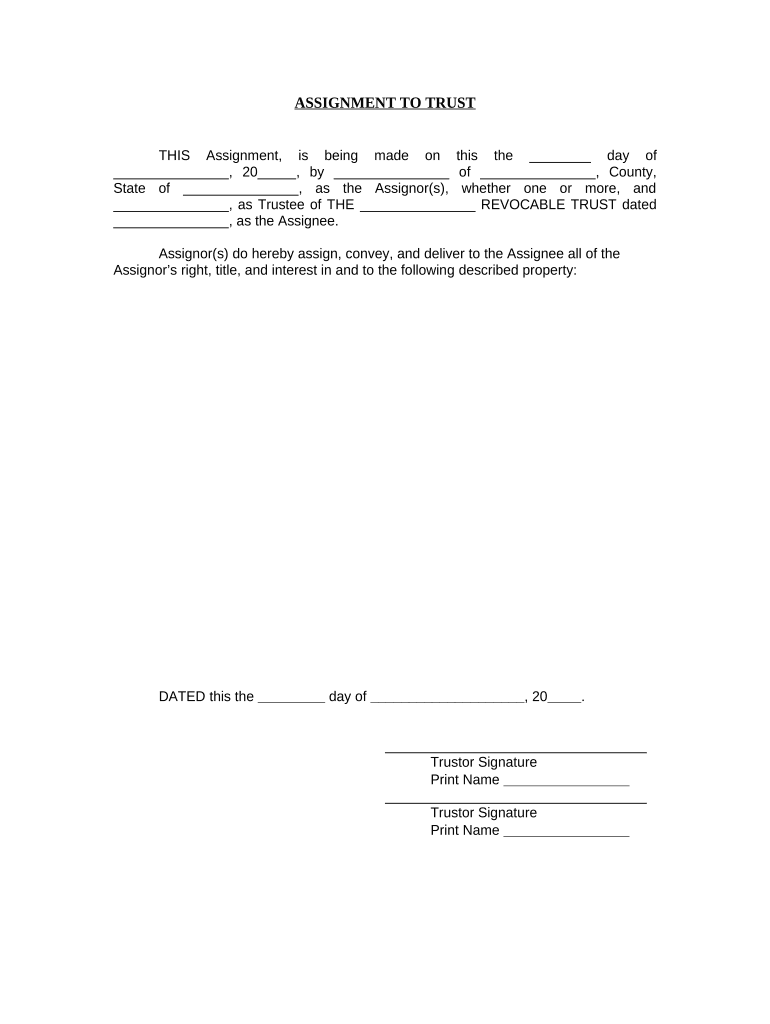

The Assignment To Living Trust Vermont is a legal document used to transfer ownership of assets into a living trust. This form is essential for individuals who wish to manage their estate planning effectively. By assigning assets to a living trust, the grantor can ensure that their property is managed according to their wishes during their lifetime and distributed to beneficiaries after death, avoiding probate. This document typically includes details about the grantor, the trust, and the assets being transferred.

Steps to complete the Assignment To Living Trust Vermont

Completing the Assignment To Living Trust Vermont involves several key steps:

- Gather necessary information: Collect details about the assets you wish to assign, including property titles, bank accounts, and other valuables.

- Draft the assignment: Fill out the form with accurate information regarding the grantor, trustee, and assets being transferred.

- Sign the document: Ensure that the assignment is signed by the grantor and, if required, the trustee. Consider having the signatures notarized for added legal validity.

- Store the document securely: Keep the completed assignment in a safe place, such as a safe deposit box or with your estate planning attorney.

Legal use of the Assignment To Living Trust Vermont

The legal use of the Assignment To Living Trust Vermont is governed by state laws. It is crucial to ensure that the document complies with Vermont's legal requirements for living trusts. This includes proper execution, which typically requires the grantor's signature and may necessitate notarization. Additionally, the assets assigned must be clearly identified to avoid any disputes regarding ownership. Adhering to these legal standards helps ensure that the assignment is enforceable in court.

Key elements of the Assignment To Living Trust Vermont

Several key elements must be included in the Assignment To Living Trust Vermont to ensure its validity:

- Grantor information: Name and address of the individual creating the trust.

- Trustee details: Information about the person or entity managing the trust.

- Asset description: A detailed list of the assets being assigned to the trust, including property addresses and account numbers.

- Signatures: Required signatures of the grantor and trustee, along with dates.

State-specific rules for the Assignment To Living Trust Vermont

Vermont has specific rules regarding the creation and execution of living trusts. It is important to be aware of these regulations to ensure compliance. For instance, Vermont does not require living trusts to be recorded, but it is advisable to keep the documents accessible. Additionally, the state allows for the revocation or amendment of living trusts, which must be documented in writing. Understanding these state-specific rules can help in effectively managing your estate planning.

Form Submission Methods (Online / Mail / In-Person)

The Assignment To Living Trust Vermont does not typically require submission to a government agency, as it is primarily a private document. However, if you are working with an attorney or financial institution, they may have specific submission requirements. Generally, you can keep the completed form in your records, share it with your trustee, or provide copies to relevant parties as needed. Ensure that all parties involved have access to the document for smooth management of the trust.

Quick guide on how to complete assignment to living trust vermont

Effortlessly Prepare Assignment To Living Trust Vermont on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Assignment To Living Trust Vermont on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and Electronically Sign Assignment To Living Trust Vermont with Ease

- Find Assignment To Living Trust Vermont and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device of your choosing. Edit and electronically sign Assignment To Living Trust Vermont to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Assignment To Living Trust in Vermont?

An Assignment To Living Trust in Vermont refers to the process of transferring ownership of your assets into a trust, allowing for smoother asset management and distribution upon death. This legal process is essential for estate planning, ensuring that your wishes are carried out as per your instructions. With airSlate SignNow, you can easily create and manage these documents digitally.

-

How does airSlate SignNow help with the Assignment To Living Trust in Vermont?

airSlate SignNow simplifies the process of creating and signing documents related to the Assignment To Living Trust in Vermont. Our platform allows you to draft, send, and eSign trust documents seamlessly, ensuring compliance with Vermont law. This streamlines the entire procedure, making it more efficient for users.

-

Is there a cost associated with using airSlate SignNow for Assignment To Living Trust in Vermont?

Yes, there is a cost associated with using airSlate SignNow, but we offer cost-effective solutions for your Assignment To Living Trust in Vermont. Our pricing plans are designed to fit a variety of budgets and needs, ensuring that you receive value and efficiency. You can choose from different tiers to find the right fit for your estate planning needs.

-

What features does airSlate SignNow offer for Assignment To Living Trust in Vermont?

airSlate SignNow offers a range of features for managing your Assignment To Living Trust in Vermont, including eSigning, document templates, and easy collaboration. These features help ensure that your trust documents are not only legally compliant but also user-friendly. Our platform allows you to keep everything organized in one place.

-

What are the benefits of creating an Assignment To Living Trust in Vermont?

Creating an Assignment To Living Trust in Vermont has numerous benefits, including avoiding probate, maintaining privacy, and providing clear asset distribution guidelines. This type of trust allows you to manage assets during your lifetime while facilitating an easier transfer to your heirs after your passing. airSlate SignNow makes this process straightforward and efficient.

-

Can airSlate SignNow integrate with other tools for Assignment To Living Trust in Vermont?

Yes, airSlate SignNow integrates with various tools and platforms to enhance your experience while managing your Assignment To Living Trust in Vermont. Our integrations allow you to connect with payment processors, CRMs, and other essential software to streamline your workflow. This interoperability ensures a seamless experience and better document management.

-

What documents do I need to set up an Assignment To Living Trust in Vermont?

To set up an Assignment To Living Trust in Vermont, you typically need to provide financial documents, property deeds, and a list of beneficiaries. Additionally, having any previous estate planning documents on hand can be beneficial. Using airSlate SignNow, you can easily upload and organize all necessary documents required for a smooth process.

Get more for Assignment To Living Trust Vermont

- Unmarried certificate format for kanyashree pdf

- Pma entrance exam reviewer pdf form

- Restaurant business plan sample in ethiopia pdf form

- 11th class physics target pdf download form

- All things algebra unit 7 answer key form

- Klb biology book 4 pdf download form

- Create fake chase bank statement template create fake chase bank statement template form

- Bayonne opra request form forward jfcii edit doc

Find out other Assignment To Living Trust Vermont

- Sign Washington Affidavit of Death Easy

- Help Me With Sign Pennsylvania Cohabitation Agreement

- Sign Montana Child Support Modification Online

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist