Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children Wisconsin Form

What is the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Wisconsin

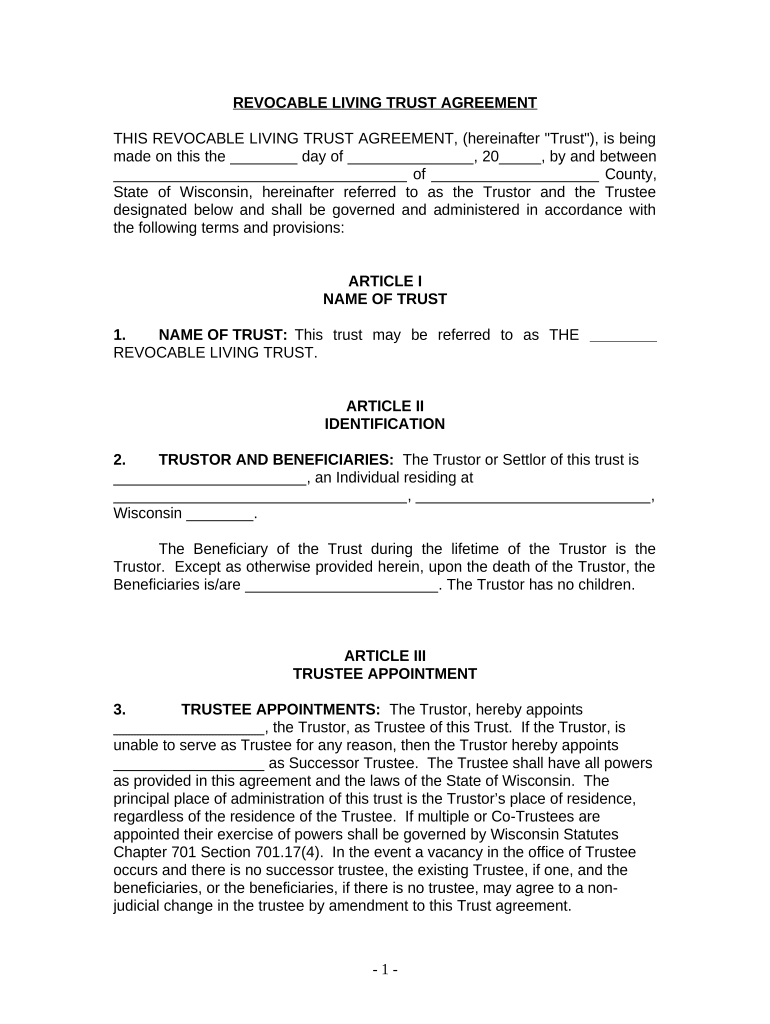

A living trust is a legal document that allows an individual to manage their assets during their lifetime and specify how those assets will be distributed after their death. For individuals who are single, divorced, widowed, or widowers without children in Wisconsin, a living trust can provide a way to ensure that their estate is handled according to their wishes. This type of trust can help avoid probate, maintain privacy, and provide flexibility in managing assets. It is particularly important for those without children, as they may have different considerations for asset distribution.

Steps to Complete the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Wisconsin

Completing a living trust involves several key steps:

- Identify your assets: List all the assets you wish to include in the trust, such as real estate, bank accounts, and investments.

- Select a trustee: Choose a trustworthy individual or institution to manage the trust. This can be yourself or someone else.

- Draft the trust document: Create a legal document that outlines the terms of the trust, including how assets will be managed and distributed.

- Sign the document: Ensure that the trust is signed in accordance with Wisconsin law, which may require witnesses or notarization.

- Fund the trust: Transfer ownership of the identified assets into the trust to make it effective.

Legal Use of the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Wisconsin

The legal use of a living trust in Wisconsin allows individuals to designate how their assets will be managed and distributed after their death. This legal framework provides several benefits, including avoiding probate, which can be a lengthy and costly process. Additionally, a living trust can help manage assets in the event of incapacity, ensuring that the individual's wishes are followed without court intervention. It is essential to ensure that the trust complies with state laws to be legally binding.

State-Specific Rules for the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Wisconsin

In Wisconsin, specific rules govern the creation and management of living trusts. These rules include:

- Trust creation: The trust must be created in writing and signed by the grantor.

- Trustee requirements: The trustee must be a competent adult or a qualified institution.

- Asset transfer: Assets must be formally transferred into the trust to be effective.

- Revocability: A living trust can be revocable, allowing the grantor to modify or dissolve it at any time during their lifetime.

How to Obtain the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Wisconsin

To obtain a living trust in Wisconsin, individuals can follow these steps:

- Consult an attorney: Seek legal advice to ensure that the trust meets personal needs and complies with state laws.

- Use online resources: Various online platforms provide templates and guidance for creating a living trust.

- Personalize the document: Customize the trust document to reflect individual wishes regarding asset management and distribution.

- Finalize and execute: Sign the document in accordance with Wisconsin's legal requirements and fund the trust with assets.

Key Elements of the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Wisconsin

Key elements of a living trust include:

- Grantor: The individual creating the trust who retains control over the assets.

- Trustee: The person or entity responsible for managing the trust assets.

- Beneficiaries: Individuals or entities designated to receive the assets upon the grantor's death.

- Terms of distribution: Specific instructions on how and when assets will be distributed to beneficiaries.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with no children wisconsin

Complete Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Wisconsin smoothly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to design, alter, and eSign your documents efficiently without delays. Handle Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Wisconsin on any platform using airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to modify and eSign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Wisconsin with ease

- Locate Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Wisconsin and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to submit your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management in just a few clicks from your device of choice. Modify and eSign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Wisconsin to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Wisconsin?

A Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Wisconsin is a legal document that manages your assets during your lifetime and distributes them after your death. This type of trust helps avoid probate, ensuring a smoother transition of your estate to your beneficiaries, even if you have no children.

-

How much does it cost to create a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Wisconsin?

The cost to create a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Wisconsin can vary based on complexity and the service provider. Generally, you can expect to pay anywhere from $500 to $3,000, depending on the features and legal assistance you choose.

-

What are the benefits of establishing a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Wisconsin?

The benefits of a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Wisconsin include avoiding probate, maintaining privacy, and ensuring your wishes are honored regarding asset distribution. Additionally, it provides peace of mind, knowing your affairs are in order.

-

Can I modify or revoke a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Wisconsin?

Yes, you can modify or revoke a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Wisconsin at any time while you are alive. Flexibility is a key feature of living trusts, allowing you to adjust the trust as your circumstances change.

-

How does airSlate SignNow support the creation of a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Wisconsin?

AirSlate SignNow offers an easy-to-use platform for signing and managing documents related to your Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Wisconsin. With its user-friendly interface, you can efficiently prepare, sign, and store your trust documents securely.

-

What features should I look for when choosing a service for a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Wisconsin?

When choosing a service for a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Wisconsin, look for comprehensive support, easy document management, and security features. Additionally, consider services that offer customization options to fit your specific needs.

-

Is it necessary to hire an attorney for a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Wisconsin?

While it is not strictly necessary to hire an attorney for a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Wisconsin, consulting one can help ensure all legal aspects are properly addressed. Legal professionals can provide guidance tailored to your unique situation.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Wisconsin

- Individual to four individuals with a form

- Control number tx 048 78 form

- Control number tx 049 78 form

- Renunciation and disclaimer of proeprty form

- Control number tx 053 78 form

- Frequently asked legal questions texas form

- Control number tx 055 78 form

- Revelstoke crossing qampampampa documentretailgrocery store form

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Wisconsin

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors