Printable Daycare Tax Forms for Parents

What is the printable daycare tax form for parents?

The printable daycare tax form is a crucial document for parents seeking to claim childcare expenses on their tax returns. This form provides essential information regarding the amount spent on daycare services, which can potentially reduce taxable income. Typically, parents will receive this form from their daycare provider at the end of the year, summarizing the total payments made for childcare. It is important to ensure that all information is accurate and complete to maximize potential tax benefits.

Steps to complete the printable daycare tax forms for parents

Completing the daycare tax form involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all relevant receipts and records of payments made to the daycare. Next, input the total amount spent on childcare services into the designated fields of the form. Be sure to include the daycare provider's tax identification number, which is necessary for verification purposes. Review the form carefully for any errors before submission, as inaccuracies can lead to delays or penalties.

How to obtain the printable daycare tax forms for parents

Parents can typically obtain the printable daycare tax form directly from their daycare provider. Most providers issue these forms at the end of the calendar year, summarizing the total payments made for childcare services. If the form is not provided, parents can request it from the daycare administration. Additionally, some online resources may offer templates for daycare tax forms, but it is advisable to use the official document provided by the daycare to ensure compliance with tax regulations.

Legal use of the printable daycare tax forms for parents

The legal use of daycare tax forms is governed by IRS regulations, which outline how parents can claim childcare expenses on their tax returns. To be eligible for tax deductions, parents must ensure that the form is filled out correctly and submitted with their tax filings. The information provided must accurately reflect the payments made to the daycare, including the provider's tax identification number. Using the form legally can help parents receive the appropriate tax benefits while remaining compliant with federal tax laws.

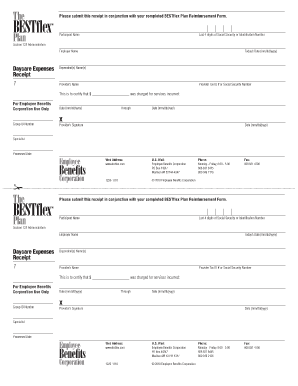

Key elements of the printable daycare tax forms for parents

Several key elements must be included in the printable daycare tax form to ensure it meets IRS requirements. These elements typically include:

- Parent's Information: Name, address, and Social Security number.

- Daycare Provider's Information: Name, address, and tax identification number.

- Total Amount Paid: The total dollar amount spent on daycare services throughout the year.

- Child's Information: Names and ages of children receiving care.

Including all these elements is essential for the form to be valid and for parents to claim their childcare tax credits accurately.

Filing deadlines / important dates

Filing deadlines for daycare tax forms coincide with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth each year. Parents should ensure that they have received their daycare tax forms from providers well in advance of this date to allow sufficient time for review and submission. If additional time is needed, parents may file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties.

Quick guide on how to complete printable daycare tax forms for parents

Complete Printable Daycare Tax Forms For Parents effortlessly on any device

Web-based document management has gained popularity among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without any holdups. Manage Printable Daycare Tax Forms For Parents on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest method to modify and eSign Printable Daycare Tax Forms For Parents without any hassle

- Locate Printable Daycare Tax Forms For Parents and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize key sections of your documents or redact confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all information carefully and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Printable Daycare Tax Forms For Parents to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable daycare tax forms for parents

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are daycare tax forms and why are they important?

Daycare tax forms are essential documents that help both parents and daycare providers manage tax deductions and credits. These forms ensure compliance with IRS regulations, making it easier for daycare owners to track eligible expenses. Understanding and utilizing daycare tax forms can signNowly impact financial planning for families and providers alike.

-

How can airSlate SignNow assist with daycare tax forms?

airSlate SignNow streamlines the process of managing daycare tax forms by providing an easy-to-use platform for eSigning and document management. This allows daycare providers to quickly send, receive, and store necessary forms securely. With efficient document handling, you can focus more on providing quality care rather than paperwork.

-

Are there any costs associated with using airSlate SignNow for daycare tax forms?

airSlate SignNow offers various pricing plans tailored to suit different needs, including affordable options for small businesses like daycare providers. You can choose a plan that fits your budget while accessing features to manage your daycare tax forms efficiently. Explore our website to find the best plan for your organization.

-

What features does airSlate SignNow offer to simplify daycare tax forms?

airSlate SignNow provides features like electronic signatures, customizable templates, and cloud storage that simplify the handling of daycare tax forms. These tools help automate the documentation process, freeing up time for daycare providers to focus on their core responsibilities. Our platform increases organization and ensures you stay compliant with tax regulations.

-

Can airSlate SignNow integrate with accounting software for daycare tax forms?

Yes, airSlate SignNow seamlessly integrates with various accounting software, allowing you to manage your daycare tax forms effortlessly alongside financial records. This integration helps ensure accurate reporting and timely submissions, minimizing the risk of errors during tax season. It's designed to make your year-end accounting as smooth as possible.

-

What benefits do daycare providers gain from using airSlate SignNow?

By using airSlate SignNow, daycare providers can save time and reduce stress when managing daycare tax forms. The user-friendly interface facilitates quick document handling, while built-in security features protect sensitive information. Ultimately, this solution enhances overall operational efficiency, enabling providers to focus on quality care.

-

Is airSlate SignNow suitable for daycare centers of all sizes?

Absolutely! airSlate SignNow is designed to cater to daycare centers of all sizes, from small home-based providers to large daycare organizations. Regardless of your operation's scale, our platform can adapt to your unique needs, offering the tools necessary to manage daycare tax forms effectively and efficiently.

Get more for Printable Daycare Tax Forms For Parents

Find out other Printable Daycare Tax Forms For Parents

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself