Wisconsin Trust Form

What is the Wisconsin Trust

The Wisconsin Trust is a legal arrangement that allows individuals to manage their assets during their lifetime and dictate how those assets are distributed after their death. This type of trust can help avoid probate, provide tax benefits, and ensure that assets are handled according to the grantor's wishes. Trusts can be revocable or irrevocable, with revocable trusts allowing the grantor to modify terms during their lifetime, while irrevocable trusts cannot be changed once established.

How to use the Wisconsin Trust

Using the Wisconsin Trust involves several steps, starting with identifying the assets to be placed in the trust. The grantor must then draft a trust document that outlines the terms, including the beneficiaries and the trustee responsible for managing the trust. Once the trust is established, the grantor should transfer ownership of the specified assets into the trust. This process may require retitling property, updating beneficiary designations, and ensuring all legal formalities are observed.

Key elements of the Wisconsin Trust

Several key elements define the Wisconsin Trust, including:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust's assets and carrying out its terms.

- Beneficiaries: Individuals or entities that will receive benefits from the trust, either during the grantor's lifetime or after their death.

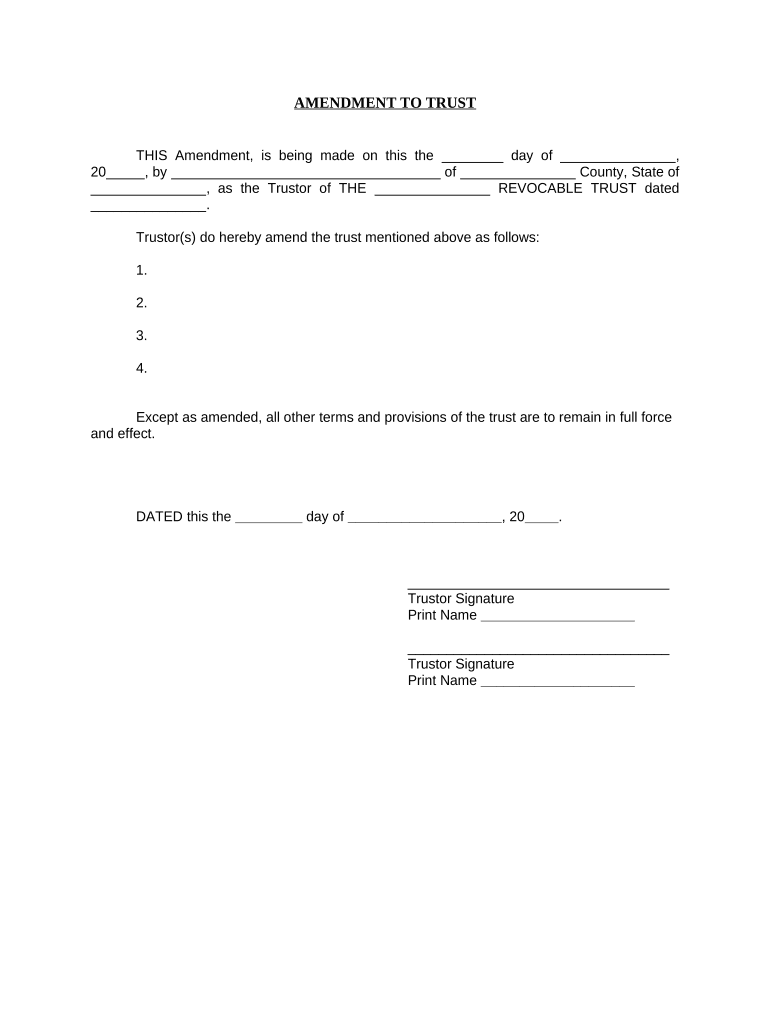

- Trust Document: A legal document that outlines the terms, conditions, and instructions for managing the trust.

Steps to complete the Wisconsin Trust

Completing a Wisconsin Trust involves the following steps:

- Determine the type of trust needed based on personal goals and circumstances.

- Draft the trust document, ensuring it complies with Wisconsin state laws.

- Choose a reliable trustee who will manage the trust responsibly.

- Transfer assets into the trust, which may include real estate, bank accounts, and investments.

- Review and update the trust periodically to reflect any changes in circumstances or wishes.

Legal use of the Wisconsin Trust

The legal use of the Wisconsin Trust is governed by state laws that outline how trusts must be established, managed, and dissolved. To ensure compliance, it is essential to follow the legal requirements for drafting the trust document, appointing a trustee, and transferring assets. Additionally, the trust must be executed with the necessary formalities, such as notarization, to be considered valid in a court of law.

State-specific rules for the Wisconsin Trust

Wisconsin has specific rules regarding the creation and management of trusts. These include regulations on the powers of trustees, the rights of beneficiaries, and the procedures for modifying or revoking a trust. It is crucial for individuals to familiarize themselves with these state-specific rules to ensure that their trust operates effectively and complies with all legal requirements.

Quick guide on how to complete wisconsin trust 497430872

Complete Wisconsin Trust effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed paperwork, allowing you to find the correct template and securely store it online. airSlate SignNow provides you with all the resources necessary to generate, edit, and eSign your documents quickly and without holdups. Manage Wisconsin Trust on any device using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

The simplest way to edit and eSign Wisconsin Trust without hassle

- Find Wisconsin Trust and click Get Form to begin.

- Use the tools available to complete your form.

- Emphasize important parts of your documents or redact sensitive details with the tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Wisconsin Trust and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Wisconsin trust and how does airSlate SignNow help with it?

A Wisconsin trust is a legal arrangement that allows individuals to manage their assets efficiently. airSlate SignNow simplifies the process of creating and signing trust documents, ensuring that your agreements comply with Wisconsin laws. With our eSignature solution, you can streamline the execution of your trust documents securely and quickly.

-

How much does it cost to use airSlate SignNow for managing Wisconsin trust documents?

airSlate SignNow offers a range of pricing plans that cater to different needs, making it a cost-effective solution for managing Wisconsin trust documents. You can choose from monthly or annual subscriptions, ensuring you find the right plan that fits your budget. Additionally, our features reduce the need for costly administrative tasks.

-

What features does airSlate SignNow provide for Wisconsin trust management?

airSlate SignNow offers features such as customizable templates, collaborative editing, and secure document storage, all tailored to assist with Wisconsin trust documentation. Our platform allows for multiple parties to sign and review documents easily, facilitating seamless communication. These features ensure that you can manage your trust efficiently.

-

Are there any benefits to using airSlate SignNow for Wisconsin trust documents compared to traditional methods?

Using airSlate SignNow for Wisconsin trust documents has several benefits over traditional methods. It saves time and effort by reducing paperwork, provides a secure way to sign documents, and allows for remote collaboration. This efficiency can lead to quicker settlements and more effective asset management.

-

Can I integrate airSlate SignNow with other tools for managing my Wisconsin trust?

Yes, airSlate SignNow can be integrated with a variety of business tools and applications, making it easier to manage your Wisconsin trust documentation. Whether you use cloud storage services or project management systems, our integrations allow for a smoother workflow. This capability enhances your overall efficiency in trust management.

-

Is airSlate SignNow secure for signing Wisconsin trust documents?

Absolutely! airSlate SignNow employs robust security measures to protect your Wisconsin trust documents. With end-to-end encryption, audit trails, and compliance with eSignature laws, you can trust that your sensitive information remains safe throughout the signing process.

-

How does airSlate SignNow support different types of Wisconsin trusts?

airSlate SignNow can accommodate various types of Wisconsin trusts, including revocable and irrevocable trusts. Our platform allows users to easily draft, modify, and execute trust documents according to their specific requirements. Such flexibility makes it an ideal choice for any trust-related needs.

Get more for Wisconsin Trust

- As tenant you are responsible for having your electricgas utilities turned on form

- This warning in no way impairs any of form

- Notice of name change for insurance companies form

- Effective date of name change form

- Delaware relative caregivers school authorization information

- Appointment of guardians for children under georgia law form

- Delaware notarial certificates 1 for an acknowledgment in form

- Filing without an attorneydistrict of delawareunited states form

Find out other Wisconsin Trust

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement