Wisconsin Notice Form

What is the Wisconsin Notice Form

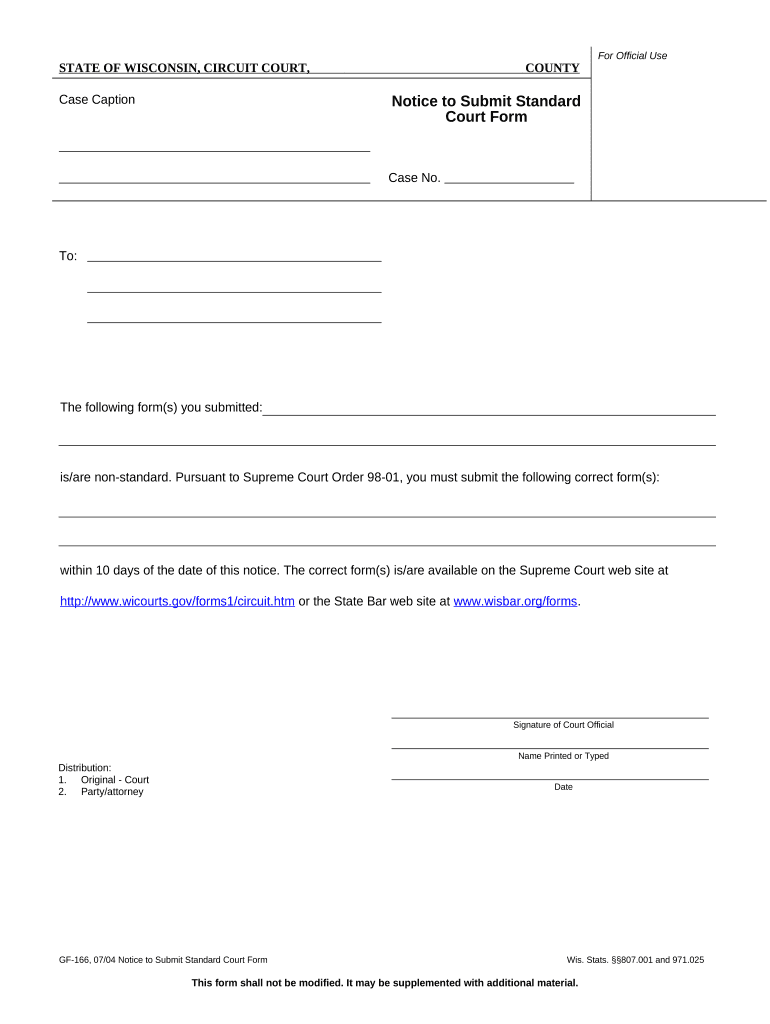

The Wisconsin Notice Form is a legal document used primarily in the context of circuit court proceedings. It serves to notify involved parties about specific actions or decisions made within a case. This form is essential for ensuring that all parties are adequately informed and have the opportunity to respond or take necessary actions. The notice typically includes details such as the nature of the action, relevant dates, and instructions for further steps.

How to use the Wisconsin Notice Form

Using the Wisconsin Notice Form involves several steps to ensure proper completion and submission. First, gather all necessary information related to the case, including names of the parties involved and case numbers. Next, fill out the form accurately, ensuring that all required fields are completed. Once the form is filled out, it should be signed and dated. Depending on the specific requirements of the circuit court, the form may need to be filed electronically or submitted in person. It is crucial to follow the court's guidelines to ensure the notice is valid.

Steps to complete the Wisconsin Notice Form

Completing the Wisconsin Notice Form involves a systematic approach:

- Start by downloading the form from the appropriate court website or obtaining a physical copy from the court.

- Read the instructions carefully to understand what information is required.

- Fill in the necessary details, including the names of the parties, case number, and specific actions being notified.

- Review the completed form for accuracy and completeness.

- Sign and date the form as required.

- Submit the form according to the court's filing procedures, whether online, by mail, or in person.

Legal use of the Wisconsin Notice Form

The legal use of the Wisconsin Notice Form is governed by state laws and court rules. It is critical that the form is filled out correctly and submitted within any specified timelines to ensure its validity. Failure to properly use the notice form may result in delays or complications in legal proceedings. The form must comply with relevant statutes and regulations to be considered legally binding.

Key elements of the Wisconsin Notice Form

Key elements of the Wisconsin Notice Form include:

- The title of the document, indicating it is a notice form.

- Identification of the parties involved in the case.

- The case number associated with the legal matter.

- A clear statement of the action being notified.

- Instructions for the recipient on how to respond or proceed.

- Signature lines for the parties involved, if required.

State-specific rules for the Wisconsin Notice Form

Wisconsin has specific rules that govern the use of the Notice Form, including formatting requirements and submission procedures. It is important to consult the Wisconsin court system's guidelines to ensure compliance. These rules may dictate how the form should be filled out, what information must be included, and the deadlines for submission. Understanding these state-specific rules is essential for the effective use of the form in legal proceedings.

Quick guide on how to complete wisconsin notice form

Complete Wisconsin Notice Form effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents swiftly without any delays. Manage Wisconsin Notice Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Wisconsin Notice Form without hassle

- Find Wisconsin Notice Form and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your adjustments.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, exhausting form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Wisconsin Notice Form and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Wisconsin notice form and why do I need it?

A Wisconsin notice form is a legal document used to notify parties about specific actions or requirements in compliance with state laws. It's essential for ensuring that all parties are appropriately informed and can take necessary actions accordingly. Using airSlate SignNow, you can easily create, sign, and manage your Wisconsin notice forms electronically.

-

How can airSlate SignNow help with completing a Wisconsin notice form?

airSlate SignNow simplifies the process of creating and completing a Wisconsin notice form by offering a user-friendly platform for document management. You can customize templates, add e-signatures, and collaborate with others in real-time. This streamlines the workflow associated with your legal documents.

-

Is airSlate SignNow cost-effective for small businesses needing Wisconsin notice forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses that need to handle Wisconsin notice forms. With competitive pricing plans, you can access essential features without breaking the bank, helping you save on administrative costs while ensuring compliance.

-

What features does airSlate SignNow offer for managing Wisconsin notice forms?

airSlate SignNow provides several features for managing Wisconsin notice forms, including customizable templates, secure electronic signatures, and document tracking. Additionally, you can automate follow-ups and reminders to ensure timely completion of your documents, enhancing overall efficiency in the process.

-

Are there any integrations available with airSlate SignNow when using Wisconsin notice forms?

Yes, airSlate SignNow offers integrations with various applications that can help streamline the management of your Wisconsin notice forms. Whether you need to connect with CRM platforms or cloud storage solutions, these integrations enhance your workflow and improve productivity.

-

Can multiple users collaborate on a Wisconsin notice form using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate seamlessly on a Wisconsin notice form. You can invite team members to review, comment, or sign documents, ensuring everyone can contribute efficiently to completing the notice.

-

What are the benefits of using airSlate SignNow for Wisconsin notice forms?

Using airSlate SignNow for your Wisconsin notice forms provides several benefits, including enhanced security, reduced turnaround times, and legally binding e-signatures. The platform's ease of use ensures that even those with minimal tech skills can navigate the process effortlessly, making it ideal for all users.

Get more for Wisconsin Notice Form

- This framing contract contract effective as of the date of the last party to form

- This security contract contract effective as of the date of the last party form

- Quotcontr form

- Scope of work paving is the creation of a site wearing surface generally form

- Scope of work site work is the clearing grubbing and filling of a property and form

- Why combine a refrigeration ampamp commercial hvac service contract form

- This drainage contract contract effective as of the date of the last party form

- Ls 246 chapter 11 final flashcardsquizlet form

Find out other Wisconsin Notice Form

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy