Estate Receipt Form

What is the estate receipt?

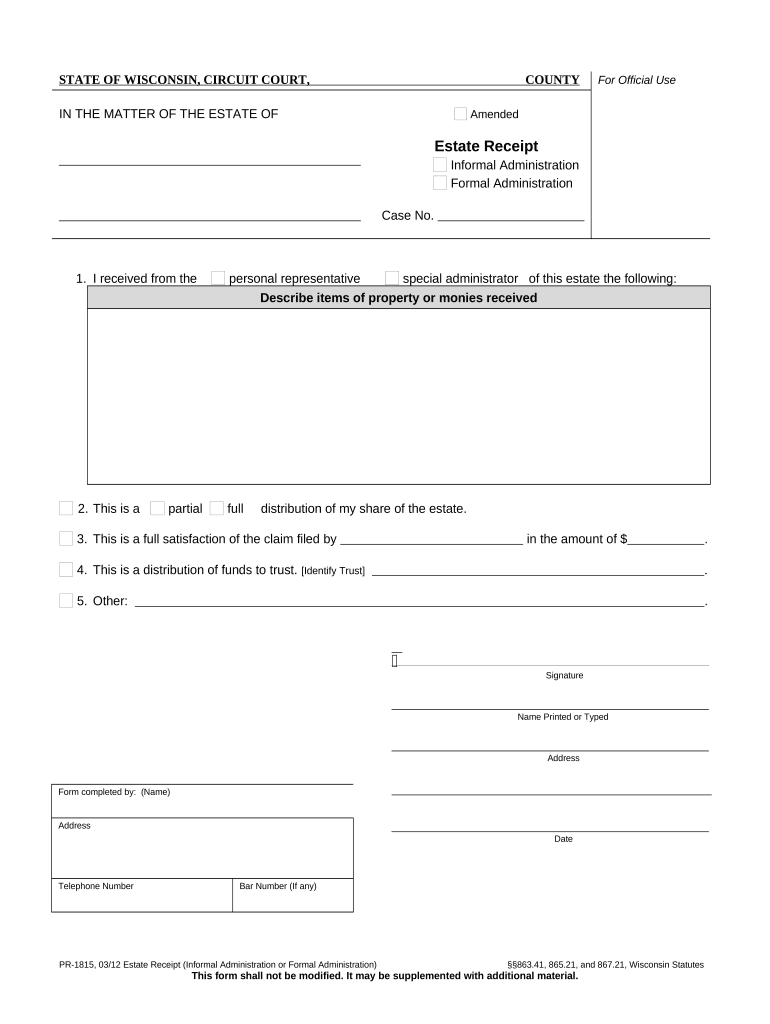

The estate receipt is a formal document that serves as proof of the transfer of assets from a deceased person's estate to the beneficiaries. It is essential in the estate settlement process, ensuring that all parties involved have a clear understanding of what has been distributed. This document typically includes details such as the names of the beneficiaries, the assets received, and the date of transfer. The estate receipt is crucial for maintaining transparency and accountability in the distribution of an estate's assets.

How to use the estate receipt

Using the estate receipt involves several key steps. First, once the estate has been settled and assets distributed, the executor or administrator should prepare the estate receipt for each beneficiary. This document should be signed by the beneficiary to acknowledge receipt of their share. It is advisable for the executor to keep a copy of each signed receipt for their records. Additionally, beneficiaries may need to present the estate receipt for tax purposes or when dealing with financial institutions, as it serves as proof of ownership of the inherited assets.

Steps to complete the estate receipt

Completing the estate receipt involves a straightforward process. Begin by gathering all necessary information regarding the assets distributed to each beneficiary. This includes details such as asset descriptions, values, and the date of transfer. Next, fill out the estate receipt form, ensuring that all fields are accurately completed. Each beneficiary should then review the information for accuracy before signing the document. Finally, provide copies of the signed receipts to each beneficiary and retain copies for the estate's records.

Legal use of the estate receipt

The estate receipt holds legal significance, as it serves as evidence of the transfer of assets. It can be used in court to demonstrate that beneficiaries have received their rightful shares of the estate. Moreover, the estate receipt may be required for tax filings, as it helps establish the basis for any capital gains taxes that may be applicable when beneficiaries sell inherited assets. Ensuring that the estate receipt is correctly completed and signed is vital for its legal standing.

Key elements of the estate receipt

Several key elements must be included in the estate receipt to ensure its validity. These elements typically consist of:

- The name and contact information of the executor or administrator.

- The names of the beneficiaries receiving the assets.

- A detailed description of the assets distributed, including their values.

- The date of the transfer of assets.

- Signatures of the beneficiaries acknowledging receipt of their shares.

Including these elements helps to create a comprehensive record of the asset distribution process.

State-specific rules for the estate receipt

Estate receipt requirements can vary by state, so it is important to be aware of local regulations. Some states may have specific forms or additional documentation that must accompany the estate receipt. Additionally, certain jurisdictions may have unique rules regarding the timing of when receipts must be issued or how they should be filed. Consulting with a legal professional familiar with estate law in your state can help ensure compliance with all relevant regulations.

Quick guide on how to complete estate receipt

Effortlessly Prepare Estate Receipt on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, enabling you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and seamlessly. Manage Estate Receipt on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to Modify and eSign Estate Receipt with Ease

- Obtain Estate Receipt and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Highlight important sections or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all information and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether it be via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form retrieval, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Estate Receipt and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an estate receipt form?

An estate receipt form is a document that provides a formal acknowledgment of the receipt of assets from an estate. It outlines what has been received, helping to maintain accurate records for both the estate and its beneficiaries. Using airSlate SignNow, you can easily create and eSign this form to streamline the process.

-

How can I create an estate receipt form using airSlate SignNow?

Creating an estate receipt form with airSlate SignNow is simple and user-friendly. You can start with a template or create a custom form from scratch. The platform enables you to add necessary fields and eSignatures, making it efficient for managing estate transactions.

-

What are the costs associated with using airSlate SignNow for estate receipt forms?

airSlate SignNow offers various pricing plans, including a free trial to get you started. The plans are designed to accommodate different business needs, ensuring you can efficiently handle your estate receipt forms without breaking the bank. Explore the pricing page for more details.

-

Can I integrate airSlate SignNow with other tools for managing estate receipt forms?

Yes, airSlate SignNow offers seamless integrations with a range of applications, including CRM systems and cloud storage services. This flexibility allows you to streamline your workflow for managing estate receipt forms, ensuring your documents are always accessible and organized.

-

What benefits does airSlate SignNow provide for estate receipt forms?

One of the key benefits of using airSlate SignNow for estate receipt forms is the ease of use, enabling quick document setup and eSigning. Additionally, the platform enhances document security and provides tracking features, so you can monitor the status of your estate receipt forms at any time.

-

Is there a mobile app for managing estate receipt forms?

Yes, airSlate SignNow offers a mobile app that allows you to manage estate receipt forms directly from your smartphone or tablet. This portability ensures that you can send, receive, and eSign documents on the go, providing great flexibility for busy professionals.

-

How secure are estate receipt forms created with airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including estate receipt forms. The platform utilizes advanced encryption and compliance measures to ensure that your information is kept safe and confidential throughout the signing process.

Get more for Estate Receipt

- Writing performance objectives for job components a brief

- Personnel file inspection requirements form

- Managing the work environment and safe work australia form

- Employee must complete information please type

- Job analysis interview and information sheet

- It quality objectivesquality goalswhat is it quality form

- Adding phone dial in contactszoom help center form

- Job analysis information sheet

Find out other Estate Receipt

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed