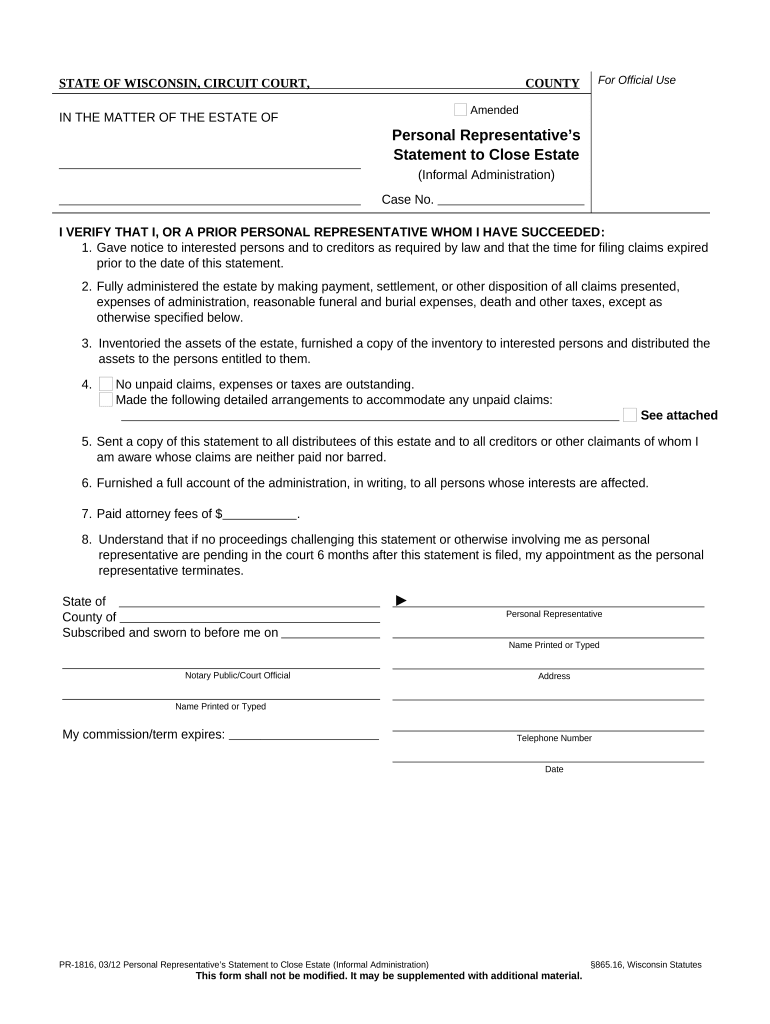

Wisconsin Personal Representative Form

What is the Wisconsin Personal Representative

The Wisconsin personal representative is an individual appointed to manage the estate of a deceased person. This role is crucial in ensuring that the decedent's assets are distributed according to their wishes and state laws. The personal representative is responsible for settling debts, filing necessary tax returns, and distributing assets to beneficiaries. In Wisconsin, this position is often referred to as an executor or administrator, depending on whether the decedent left a will.

Steps to complete the Wisconsin Personal Representative

Completing the Wisconsin personal representative deed involves several key steps to ensure compliance with legal requirements. First, the personal representative must gather all relevant documents, including the will, death certificate, and a list of assets and liabilities. Next, they must file the will with the probate court and petition for appointment as personal representative. Once appointed, the representative should notify all beneficiaries and creditors of the estate. Following this, they will need to manage estate assets, pay debts, and eventually distribute the remaining assets to beneficiaries. Throughout this process, maintaining accurate records is essential for transparency and legal compliance.

Legal use of the Wisconsin Personal Representative

The legal use of the Wisconsin personal representative is governed by state probate laws. This individual must act in the best interests of the estate and its beneficiaries, adhering to fiduciary duties. The personal representative has the authority to make decisions regarding the estate, including selling property, paying debts, and filing tax returns. It is important for the representative to understand their legal obligations, as failure to comply with these duties can result in personal liability or legal penalties.

Required Documents

To effectively act as a personal representative in Wisconsin, certain documents are required. These typically include the decedent's will, a certified copy of the death certificate, and a petition for probate. Additionally, the personal representative may need to provide a bond, depending on the circumstances of the estate. Keeping these documents organized and accessible is vital for a smooth probate process.

State-specific rules for the Wisconsin Personal Representative

Wisconsin has specific rules that govern the duties and responsibilities of a personal representative. These rules include timelines for filing documents with the probate court, requirements for notifying beneficiaries and creditors, and guidelines for asset management. Understanding these state-specific regulations is essential for ensuring that the estate is administered correctly and efficiently.

Examples of using the Wisconsin Personal Representative

Examples of situations where a Wisconsin personal representative is utilized include handling estates with significant assets, resolving disputes among beneficiaries, or managing complex tax issues. For instance, if a decedent owned real estate, the personal representative would need to assess its value, maintain it during the probate process, and ultimately facilitate its sale or transfer to beneficiaries. Each case may present unique challenges that require careful navigation by the personal representative.

Quick guide on how to complete wisconsin personal representative 497431329

Effortlessly Create Wisconsin Personal Representative on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without any delays. Manage Wisconsin Personal Representative on any device with the airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

The simplest way to modify and eSign Wisconsin Personal Representative effortlessly

- Locate Wisconsin Personal Representative and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors necessitating the printing of new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Wisconsin Personal Representative and ensure excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a personal representative deed?

A personal representative deed is a legal document executed by a personal representative, typically in the context of managing the estate of a deceased individual. This deed authorizes the representative to transfer property and assets in accordance with the deceased's wishes and applicable laws. Utilizing airSlate SignNow can simplify the process of creating and signing a personal representative deed, making it quicker and more efficient.

-

How can airSlate SignNow help with personal representative deeds?

airSlate SignNow provides a user-friendly platform that allows you to easily create, send, and eSign personal representative deeds. With customizable templates and secure electronic signatures, the process becomes expedited, eliminating the need for physical paperwork and streamlining your workflow. This ensures that your personal representative deed is completed accurately and efficiently.

-

What are the benefits of using airSlate SignNow for personal representative deeds?

Using airSlate SignNow for personal representative deeds offers numerous benefits, including time savings, improved accuracy, and enhanced document security. The platform allows for real-time collaboration, ensuring all parties involved in the deed can review and sign promptly. Additionally, you can store and access documents securely from anywhere, simplifying estate management.

-

Is there a cost associated with creating a personal representative deed using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans tailored to different user needs, making it cost-effective for individuals and businesses. The pricing includes features designed specifically for document management, including personal representative deeds. You can choose a plan that suits your budget while still accessing the necessary tools for effective estate management.

-

What features does airSlate SignNow offer for managing personal representative deeds?

AirSlate SignNow includes features such as customizable templates, electronic signatures, real-time document tracking, and cloud storage for all your personal representative deeds. These tools enhance the efficiency of executing legal documents while ensuring compliance with legal standards. With seamless integration options, you can manage all your documents in one place.

-

Can multiple parties sign a personal representative deed using airSlate SignNow?

Absolutely! AirSlate SignNow allows multiple parties to sign a personal representative deed simultaneously or in sequence. This flexibility ensures that all necessary stakeholders can provide their signatures, expediting the process and reducing the time it takes to finalize the deed. The platform also sends reminders to those who need to sign, ensuring no one is left behind.

-

What integrations are available for personal representative deeds with airSlate SignNow?

AirSlate SignNow integrates with various popular applications and platforms, including cloud storage services and CRM software, which enhances the management of personal representative deeds. These integrations allow users to import and export documents easily, streamline workflows, and ensure that all necessary information is accessible in one place. This connectivity can signNowly simplify your estate management tasks.

Get more for Wisconsin Personal Representative

- This financing statement amendment form

- Check one of these three boxes to indicate the claim made by this information statement

- Passed away on form

- Children and grandchildren form

- State tax form 214

- Control number md 00002 form

- For change of name to form

- Courtsingov verified petition for name change for a form

Find out other Wisconsin Personal Representative

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter