Wi Garnishment Form

What is the Wi Garnishment

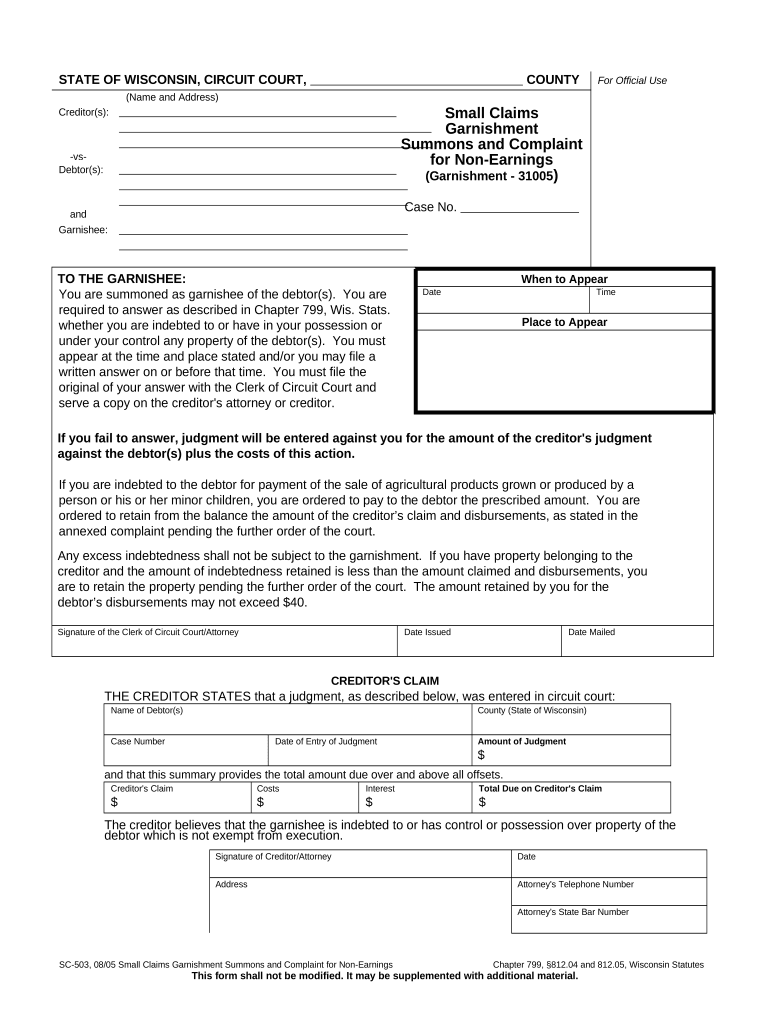

The Wi garnishment is a legal process through which a creditor can collect a debt by obtaining a court order to seize a portion of a debtor's wages or bank account. This action is typically initiated when a debtor fails to pay a judgment, such as for a small complaint. The garnishment allows creditors to recover funds directly from the debtor's income or assets, ensuring that debts are settled in a timely manner.

How to use the Wi Garnishment

Using the Wi garnishment involves several steps. First, a creditor must obtain a court judgment against the debtor. Once the judgment is secured, the creditor can file a garnishment action with the court. This process includes submitting the necessary forms and providing evidence of the debt. After the court approves the garnishment, the creditor can notify the debtor's employer or bank to withhold the specified amount from the debtor's wages or account.

Steps to complete the Wi Garnishment

Completing the Wi garnishment requires careful adherence to legal procedures. The steps include:

- Obtain a court judgment against the debtor.

- File a garnishment application with the court.

- Provide documentation supporting the debt.

- Receive court approval for the garnishment.

- Notify the debtor's employer or bank to initiate withholding.

Each step must be executed in compliance with state laws to ensure the garnishment is enforceable.

Legal use of the Wi Garnishment

The legal use of the Wi garnishment is governed by state laws and federal regulations. Creditors must follow specific procedures to ensure that the garnishment is valid. This includes providing the debtor with proper notice of the garnishment and adhering to limits on the amount that can be garnished from wages. Understanding these legal requirements is crucial for both creditors and debtors to protect their rights during the garnishment process.

Key elements of the Wi Garnishment

Key elements of the Wi garnishment include:

- The court judgment confirming the debt.

- The amount to be garnished from the debtor's wages or account.

- Notification requirements for the debtor.

- Compliance with state and federal garnishment laws.

These elements ensure that the garnishment process is conducted fairly and legally.

Filing Deadlines / Important Dates

Filing deadlines and important dates for the Wi garnishment process can vary by jurisdiction. It is essential for creditors to be aware of these timelines to ensure timely action. Generally, creditors must file their garnishment application within a specified period after obtaining a judgment. Additionally, there may be deadlines for notifying the debtor and for the debtor to respond to the garnishment notice. Adhering to these deadlines helps maintain the validity of the garnishment.

Penalties for Non-Compliance

Failure to comply with the legal requirements of the Wi garnishment can result in significant penalties. Creditors who do not follow proper procedures may face legal challenges, including the dismissal of the garnishment order. Additionally, they may be liable for damages if the garnishment is deemed unlawful. Debtors also have rights and can contest garnishments that do not adhere to legal standards, potentially leading to further legal complications for creditors.

Quick guide on how to complete wi garnishment

Complete Wi Garnishment effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Wi Garnishment on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign Wi Garnishment with ease

- Find Wi Garnishment and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of your documents or hide sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your updates.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Wi Garnishment and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is WI garnishment and how can airSlate SignNow assist?

WI garnishment refers to the legal process of withholding an employee's earnings to pay off debts. airSlate SignNow provides a streamlined platform for managing and signing related documents efficiently, ensuring compliance and faster processing times.

-

How does airSlate SignNow help with WI garnishment documentation?

With airSlate SignNow, you can easily create, send, and eSign WI garnishment documents. Our user-friendly interface ensures that all parties involved can access and sign the necessary forms quickly, improving overall efficiency.

-

What are the pricing options for airSlate SignNow related to WI garnishment?

airSlate SignNow offers flexible pricing plans designed to meet the needs of businesses dealing with WI garnishment cases. Plans are budget-friendly and scalable, allowing you to choose the right features that suit your volume of document management.

-

Are there any special features in airSlate SignNow for managing WI garnishment?

Yes, airSlate SignNow includes features specifically beneficial for WI garnishment management, such as document templates, automated reminders, and real-time tracking of signing processes. This allows for a more organized approach to handling garnishment cases.

-

Can airSlate SignNow integrate with other tools for handling WI garnishment?

Absolutely! airSlate SignNow integrates seamlessly with various tools such as CRMs and HR software, enhancing your capability to manage WI garnishment processes. This integration helps streamline your workflow and centralizes all documentation in one place.

-

What benefits does airSlate SignNow offer for small businesses dealing with WI garnishment?

For small businesses, airSlate SignNow offers an affordable way to handle WI garnishment documentation efficiently. The platform not only reduces paper costs but also saves time in managing employee documents through quick eSigning and automated processes.

-

Is airSlate SignNow secure for managing sensitive WI garnishment documents?

Yes, airSlate SignNow prioritizes security with features like data encryption and secure storage to protect sensitive WI garnishment documents. You can trust our platform to maintain confidentiality and compliance with applicable regulations.

Get more for Wi Garnishment

- Cc 79 claim of appeal on application for michigan courts form

- Nal school safety center ncjrs form

- Motion to set aside default judgment justiaforms

- 2nd copy prosecutor form

- Continuous construction form

- Acknowledged before me in county michigan on form

- Form mc 03 if you received a complaint you are required

- Nj notice to quit and demand for possession form

Find out other Wi Garnishment

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors