Repull Credit Authorization Form

What is the repull credit authorization?

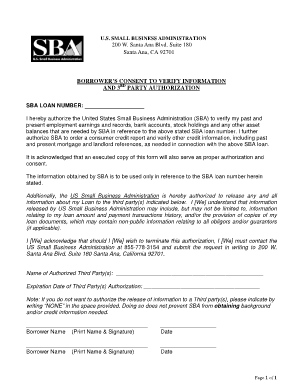

The repull credit authorization form is a crucial document used primarily by lenders and financial institutions to obtain permission from borrowers to access their credit reports. This form is essential in the lending process, as it ensures that the lender has the necessary consent to review the borrower's credit history, which aids in making informed lending decisions. It is often required for various types of loans, including those backed by the Small Business Administration (SBA). The form helps protect both parties by establishing clear consent and expectations regarding the use of personal financial information.

How to complete the repull credit authorization

Filling out the repull credit authorization form involves several straightforward steps. First, gather all necessary personal information, including your full name, Social Security number, address, and contact details. Next, clearly indicate the purpose of the authorization, which typically involves allowing a lender to access your credit report. After completing the required fields, review the form for accuracy. Finally, sign and date the document to validate your consent. If using a digital platform, ensure you follow the prompts to eSign securely, which may include verifying your identity through additional methods.

Legal use of the repull credit authorization

The repull credit authorization form must comply with various legal standards to be considered valid. In the United States, the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA) provide the legal framework for electronic signatures and documents. To ensure legal compliance, the form should include specific elements such as the borrower's explicit consent, a clear description of the information being accessed, and the purpose of the authorization. Additionally, lenders must safeguard the borrower's information in accordance with privacy regulations, including the Fair Credit Reporting Act (FCRA).

Key elements of the repull credit authorization

When completing the repull credit authorization form, several key elements must be included to ensure its effectiveness and legality. These elements typically include:

- Borrower's Information: Full name, address, and Social Security number.

- Authorization Statement: A clear statement granting permission to access the credit report.

- Purpose of Authorization: A brief explanation of why the credit report is being requested.

- Expiration Date: Indicate how long the authorization remains valid.

- Signature and Date: The borrower's signature and the date of signing to confirm consent.

Steps to obtain the repull credit authorization

Obtaining the repull credit authorization form is a straightforward process. Typically, lenders or financial institutions provide this form as part of the loan application package. If you are working with an SBA lender, they will likely have their version of the form readily available. Alternatively, you can request the form directly from your lender or download it from their website. Ensure that you review the specific requirements and instructions provided by the lender to complete the form accurately.

Examples of using the repull credit authorization

The repull credit authorization form is used in various scenarios, particularly in the lending process. For instance, a small business owner applying for an SBA loan may be required to submit this form to allow the lender to access their personal and business credit reports. Another example includes refinancing a loan, where the lender needs to reassess the borrower's creditworthiness. In both cases, the form serves as a legal document that protects the lender's right to obtain necessary financial information while ensuring the borrower's consent is documented.

Quick guide on how to complete repull credit authorization

Effortlessly Prepare Repull Credit Authorization on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Handle Repull Credit Authorization on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Repull Credit Authorization with Ease

- Obtain Repull Credit Authorization and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive content using tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to preserve your changes.

- Choose your preferred method of sending the form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and eSign Repull Credit Authorization and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a credit report authorization form sba?

A credit report authorization form sba is a document that allows businesses to obtain a credit report for their clients or applicants, which is often necessary for loan applications or credit assessments. This form ensures compliance with legal requirements and helps streamline the lending process.

-

How can I create a credit report authorization form sba using airSlate SignNow?

Creating a credit report authorization form sba with airSlate SignNow is simple. You can either use our pre-made templates or customize your own, making it easy to send and eSign the form. Our user-friendly platform ensures that you can have it ready in minutes.

-

What are the costs associated with using airSlate SignNow for a credit report authorization form sba?

airSlate SignNow offers various pricing plans tailored to different business needs, allowing you to choose the one that fits your budget. Many plans include unlimited document signing and access to vital features for managing your credit report authorization form sba efficiently.

-

What features does airSlate SignNow offer for the credit report authorization form sba?

airSlate SignNow provides robust features for the credit report authorization form sba, including customizable templates, automated workflows, and advanced security measures. These tools simplify the signing process while ensuring that your documents are secure and compliant with regulations.

-

How does using eSignatures benefit my credit report authorization form sba?

Using eSignatures for your credit report authorization form sba streamlines the signing process, making it faster and more efficient. It reduces paper usage and eliminates the need for physical mail, enabling quicker access to credit reports and improving turnaround times for your clients.

-

Can I integrate airSlate SignNow with other applications for my credit report authorization form sba?

Yes, airSlate SignNow offers seamless integrations with various business applications that can help you manage your credit report authorization form sba more effectively. This includes CRM systems, document management platforms, and accounting software, allowing you to synchronize data across tools easily.

-

Is it secure to use airSlate SignNow for processing a credit report authorization form sba?

Absolutely! airSlate SignNow employs advanced encryption and security measures to ensure that your credit report authorization form sba is processed securely. Your data is protected at every step, ensuring confidentiality and compliance with industry regulations.

Get more for Repull Credit Authorization

- Alabama assumption agreement of mortgage and release of original mortgagors form

- Alabama petition for consent settlement of estate by personal representative form

- Alabama waiver and consent to final settlement of estate by heir form

- Alabama motion for pendente lite relief form

- Alabama final judgment of divorce form

- Alabama petition for appointment of guardian and conservator form

- Alabama verification of petition or appointment of guardian and conservator form

- Alabama answer to divorce and counterclaim for divorce form

Find out other Repull Credit Authorization

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter