Borrower's Consent to Verify Information and 3rd Party Authorization Third Party Consent 2019-2026

Understanding the Borrower's Consent to Verify Information and Third Party Authorization

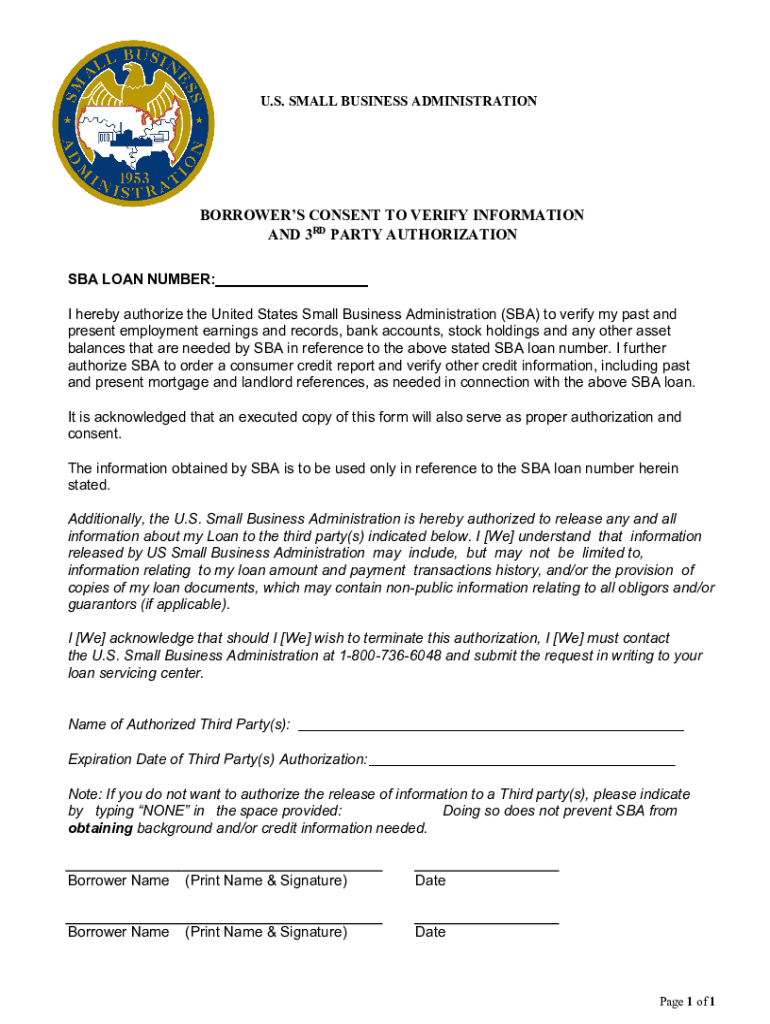

The Borrower's Consent to Verify Information and Third Party Authorization is a crucial document in the small business administration loan process. This form allows lenders to obtain necessary information from third parties to assess a borrower's eligibility for a loan. By signing this authorization, borrowers enable lenders to verify income, credit history, and other financial details, which are essential for making informed lending decisions. This process ensures that the information provided by the borrower is accurate and up-to-date, thereby facilitating a smoother loan application experience.

Steps to Complete the Borrower's Consent to Verify Information and Third Party Authorization

Completing the Borrower's Consent to Verify Information and Third Party Authorization involves several straightforward steps:

- Gather necessary personal and financial information, including Social Security number and income details.

- Carefully read the consent form to understand what information will be verified and who will access it.

- Fill out the form with accurate details, ensuring all required fields are completed.

- Sign and date the form, confirming your consent for the lender to access your information.

- Submit the completed form along with your loan application to the lender.

Legal Use of the Borrower's Consent to Verify Information and Third Party Authorization

The Borrower's Consent to Verify Information and Third Party Authorization is legally binding when completed correctly. It complies with various regulations, including the Fair Credit Reporting Act (FCRA), which governs how lenders can obtain and use consumer information. By signing this document, borrowers grant permission for lenders to access their financial records, which is essential for the approval process of small business administration loans. It is important for borrowers to understand their rights regarding this authorization and ensure that their information is handled securely and responsibly.

Eligibility Criteria for Small Business Administration Loans

Eligibility for small business administration loans typically includes several key criteria:

- The business must be a for-profit entity operating in the United States.

- The business should meet the SBA's size standards, which vary by industry.

- Borrowers must demonstrate a need for the loan and the ability to repay it.

- Personal credit history will be evaluated, and a good credit score can enhance approval chances.

Required Documents for the Borrower's Consent to Verify Information and Third Party Authorization

To complete the Borrower's Consent to Verify Information and Third Party Authorization, borrowers typically need to provide several documents:

- Proof of identity, such as a government-issued ID.

- Financial statements, including tax returns and profit and loss statements.

- Bank statements that reflect the business's financial health.

- Any additional documentation required by the lender, which may vary based on the loan type.

Application Process and Approval Time for Small Business Administration Loans

The application process for small business administration loans involves several stages:

- Complete the loan application and gather necessary documentation, including the Borrower's Consent to Verify Information.

- Submit the application to an SBA-approved lender.

- The lender will review the application, verify the information, and assess the borrower's eligibility.

- Approval times can vary, but borrowers can typically expect a decision within a few weeks, depending on the complexity of the application.

Quick guide on how to complete borrowers consent to verify information and 3rd party authorization third party consent

Effortlessly Prepare Borrower's Consent To Verify Information And 3rd Party Authorization Third Party Consent on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and without interruption. Handle Borrower's Consent To Verify Information And 3rd Party Authorization Third Party Consent on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to Edit and eSign Borrower's Consent To Verify Information And 3rd Party Authorization Third Party Consent with Ease

- Obtain Borrower's Consent To Verify Information And 3rd Party Authorization Third Party Consent and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Select key sections of your documents or redact sensitive data using the tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills your document management requirements in just a few clicks from your preferred device. Modify and eSign Borrower's Consent To Verify Information And 3rd Party Authorization Third Party Consent to ensure effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a small business administration loan?

A small business administration loan is a government-backed financing option designed to help small businesses secure funding. These loans typically have favorable terms, lower interest rates, and longer repayment periods. They can be used for various purposes, including purchasing equipment, operating expenses, or expanding your business.

-

How can airSlate SignNow help with small business administration loan applications?

airSlate SignNow streamlines the document management process, making it easier to prepare and submit your small business administration loan applications. Our platform allows you to create, send, and eSign documents quickly, ensuring that all necessary paperwork is completed accurately and on time. This efficiency can signNowly enhance your chances of securing funding.

-

What features does airSlate SignNow offer for small business owners?

airSlate SignNow provides features such as document templates, eSignature solutions, and collaboration tools that cater to small business owners applying for loans. These features speed up the loan application process and reduce the chances of errors, making it easier for you to manage your small business administration loan documents. Additionally, our service is user-friendly, allowing you to navigate easily.

-

Are there any costs associated with using airSlate SignNow for small business administration loans?

While airSlate SignNow offers competitive pricing plans to suit various business needs, the cost of using our platform can be considered an investment in securing your small business administration loan efficiently. By reducing paperwork errors and speeding up the application process, our service can save you both time and money in the long run. It's best to review our pricing page to find a plan that suits your needs.

-

What benefits can I expect from utilizing airSlate SignNow for my loan processes?

By utilizing airSlate SignNow, you can expect faster processing times for your small business administration loan applications, enhanced document security, and reduced operational costs. Our platform is designed to simplify your workflow, enabling you to focus on growing your business while we handle the complex document processes. Plus, our eSignature capabilities ensure compliance with legal standards.

-

How does airSlate SignNow integrate with other business tools?

airSlate SignNow offers seamless integrations with various business tools such as CRM systems, cloud storage services, and project management applications. This integration capability allows you to manage your small business administration loan documents alongside your other business processes efficiently. By centralizing your operations, you can enjoy a more streamlined workflow.

-

Is airSlate SignNow suitable for all types of small businesses?

Yes, airSlate SignNow is designed to cater to all types of small businesses, regardless of industry or size. Whether you are applying for a small business administration loan as a startup or an established company, our platform provides the tools you need to manage your paperwork effortlessly. Our user-friendly interface ensures that everyone can utilize it, regardless of technical expertise.

Get more for Borrower's Consent To Verify Information And 3rd Party Authorization Third Party Consent

- Michigan default request affidavit entry and judgment sum certain form

- Minnesota notice intent form

- Minnesota subcontractors form

- Bylaws 481379890 form

- Minnesota minnesota articles of incorporation for domestic nonprofit corporation form

- Minnesota assignment of mortgage by corporate mortgage holder form

- 90 day notice form

- Terminate tenancy form

Find out other Borrower's Consent To Verify Information And 3rd Party Authorization Third Party Consent

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later

- eSign Iowa Revocation of Power of Attorney Online

- How Do I eSign Maine Revocation of Power of Attorney

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple