IRP Form T 139 Georgia IRP Mileage Schedule B 2

What is the IRP Form T 139 Georgia IRP Mileage?

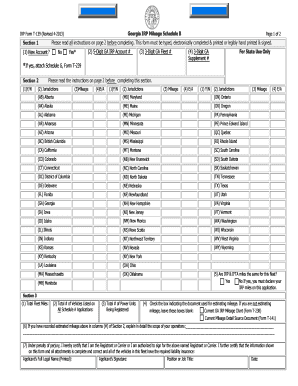

The IRP Form T 139 is a crucial document for commercial vehicle operators in Georgia. It serves as the Georgia IRP Mileage Schedule B 2, which is used to report the mileage traveled by vehicles registered under the International Registration Plan (IRP). This form is essential for calculating the appropriate fees based on the distance traveled in various jurisdictions. Accurate reporting ensures compliance with state regulations and helps avoid potential penalties.

Steps to Complete the IRP Form T 139 Georgia IRP Mileage

Completing the IRP Form T 139 involves several key steps to ensure accuracy and compliance. Start by gathering all necessary information, including total miles driven in each jurisdiction during the reporting period. Next, fill out the form by entering your vehicle details, including the vehicle identification number (VIN) and registration information. Be sure to provide accurate mileage figures for each state or province where the vehicle operated. Once completed, review the form for any errors before submission.

Legal Use of the IRP Form T 139 Georgia IRP Mileage

The IRP Form T 139 is legally binding when filled out correctly and submitted on time. It must comply with the regulations set forth by the Georgia Department of Revenue and the IRP guidelines. Failure to accurately report mileage or submit the form by the deadline can result in penalties, including fines or additional fees. Therefore, understanding the legal implications of this form is essential for vehicle operators to maintain compliance and avoid unnecessary complications.

How to Obtain the IRP Form T 139 Georgia IRP Mileage

The IRP Form T 139 can be obtained through the Georgia Department of Revenue's website or directly from their offices. It is advisable to download the most recent version to ensure compliance with current regulations. Additionally, many commercial vehicle operators may have access to the form through their fleet management software, which can streamline the process of completing and submitting the document.

State-Specific Rules for the IRP Form T 139 Georgia IRP Mileage

Georgia has specific rules regarding the completion and submission of the IRP Form T 139. These include guidelines on the reporting period, which typically aligns with the calendar year, and the requirement to report mileage accurately for each jurisdiction. It is essential to be aware of any updates to these rules, as they can change based on legislative adjustments or administrative updates from the Georgia Department of Revenue.

Form Submission Methods for the IRP Form T 139 Georgia IRP Mileage

The IRP Form T 139 can be submitted in several ways, including online through the Georgia Department of Revenue's eServices portal, by mail, or in person at designated offices. Each submission method has its own requirements and processing times. Choosing the appropriate method based on your needs and ensuring that the submission is completed by the deadline is crucial for maintaining compliance.

Quick guide on how to complete irp form t 139 georgia irp mileage schedule b 2

Effortlessly Prepare IRP Form T 139 Georgia IRP Mileage Schedule B 2 on Any Device

Digital document management has become widely adopted by businesses and individuals alike. It offers a superb eco-friendly alternative to conventional printed and signed documents, enabling you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and electronically sign your documents swiftly without delays. Manage IRP Form T 139 Georgia IRP Mileage Schedule B 2 across any platform with airSlate SignNow’s Android or iOS applications and enhance any document-oriented task today.

How to Modify and eSign IRP Form T 139 Georgia IRP Mileage Schedule B 2 Effortlessly

- Find IRP Form T 139 Georgia IRP Mileage Schedule B 2 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize crucial sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that function.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Edit and eSign IRP Form T 139 Georgia IRP Mileage Schedule B 2 and ensure effective communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is GA mileage and how is it calculated?

GA mileage refers to the distance traveled for business purposes within the state of Georgia. It is calculated based on the standard mileage rates set by the IRS, which take into account the costs of operating a vehicle. Using airSlate SignNow's features, you can easily document your GA mileage and maintain accurate records for tax deductions.

-

How does airSlate SignNow help with GA mileage tracking?

AirSlate SignNow offers features that streamline the tracking of GA mileage, allowing users to log trips directly from their mobile devices. By integrating GA mileage tracking into your workflows, you can automate the documentation process, ensuring accuracy and compliance for business travel records.

-

Is there a cost associated with using airSlate SignNow for GA mileage tracking?

While airSlate SignNow offers various pricing plans, users can access GA mileage tracking features at an affordable rate. The cost is typically justified by the time saved and the increased accuracy in managing mileage records, making it a cost-effective solution for businesses.

-

Can I integrate airSlate SignNow with other applications for better GA mileage management?

Yes, airSlate SignNow supports integrations with popular applications such as accounting software and CRM systems. This allows you to sync your mileage data seamlessly, enhancing your GA mileage management and providing a more comprehensive view of your business expenses.

-

What are the benefits of using airSlate SignNow for documenting GA mileage?

Using airSlate SignNow to document GA mileage offers numerous benefits, including ease of use and increased efficiency. It helps ensure that your mileage records are accurate and accessible, which can simplify tax filings and improve your reimbursement processes.

-

Is airSlate SignNow user-friendly for tracking GA mileage?

Absolutely! AirSlate SignNow is designed to be user-friendly, making it easy for individuals and businesses to track their GA mileage without technical hurdles. The intuitive interface allows users to quickly input and manage their mileage data wherever they are.

-

What type of businesses can benefit from GA mileage tracking with airSlate SignNow?

Any business that requires employees to travel for work can benefit from GA mileage tracking with airSlate SignNow. Small businesses, freelancers, and larger corporations alike can utilize this solution to ensure accurate tracking of their GA mileage and smooth financial management.

Get more for IRP Form T 139 Georgia IRP Mileage Schedule B 2

- Alabama ucc1 financing statement addendum alabama form

- Alabama ucc3 financing statement amendment alabama form

- Alabama ucc3 financing statement amendment addendum alabama form

- Legal last will and testament form for single person with no children alabama

- Legal last will and testament form for a single person with minor children alabama

- Legal last will and testament form for single person with adult and minor children alabama

- Legal last will and testament form for single person with adult children alabama

- Legal last will and testament for married person with minor children from prior marriage alabama form

Find out other IRP Form T 139 Georgia IRP Mileage Schedule B 2

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free