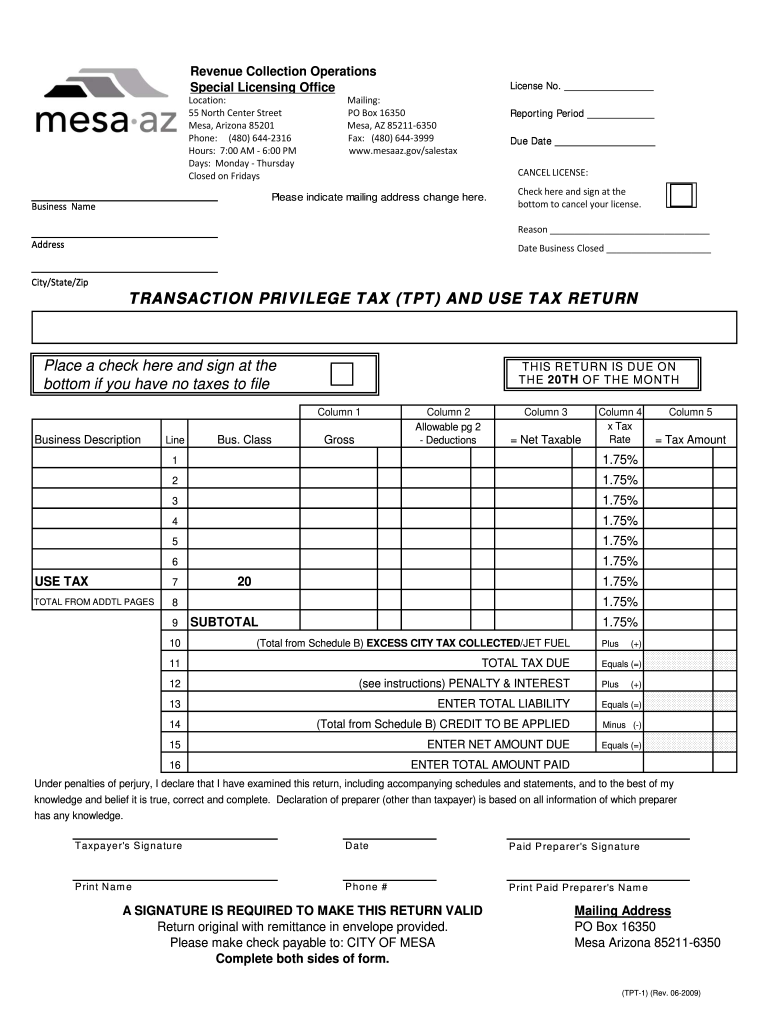

Mesa Sales Tax Form

What is the Arizona Return Form?

The Arizona return form, commonly referred to as the AZ tax return form, is a crucial document for individuals and businesses to report their income and calculate their tax liabilities in the state of Arizona. This form is essential for ensuring compliance with state tax laws and is required for both residents and non-residents earning income in Arizona. The form collects various financial details, including wages, interest, dividends, and other sources of income, allowing the Arizona Department of Revenue to assess the appropriate tax obligations.

Steps to Complete the Arizona Return Form

Filling out the Arizona return form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, such as W-2s, 1099s, and any other income statements. Next, follow these steps:

- Enter your personal information, including your name, address, and Social Security number.

- Report your total income from various sources, ensuring to include all applicable forms.

- Calculate your deductions and credits, which can reduce your taxable income.

- Determine your total tax liability based on the current Arizona tax rates.

- Review your calculations for accuracy before submitting the form.

Legal Use of the Arizona Return Form

The Arizona return form must be completed accurately to fulfill legal requirements. Submitting an incorrect or fraudulent return can lead to penalties, including fines and interest on unpaid taxes. It is vital to ensure that all information is truthful and complete. The form must also be signed and dated, as electronic signatures are accepted under the state's eSignature laws, provided that the submission meets the necessary legal standards.

Filing Deadlines / Important Dates

Timely submission of the Arizona return form is essential to avoid penalties. Typically, the deadline for filing individual tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to tax deadlines, especially in response to legislative updates or emergencies that may affect filing dates.

Form Submission Methods

The Arizona return form can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file online using approved e-filing software, which often provides a streamlined process and immediate confirmation of submission. Alternatively, forms can be mailed to the Arizona Department of Revenue or submitted in person at designated locations. Each method has its own advantages, such as the speed of online filing or the personal touch of in-person submission.

Required Documents

To complete the Arizona return form accurately, several documents are necessary. These include:

- W-2 forms from employers, detailing earned income and withheld taxes.

- 1099 forms for other income sources, such as freelance work or interest payments.

- Documentation for any deductions or credits claimed, such as receipts for charitable contributions or medical expenses.

- Federal tax return information, which may be needed for certain calculations.

Penalties for Non-Compliance

Failing to file the Arizona return form or submitting it late can result in significant penalties. The Arizona Department of Revenue may impose fines based on the amount of tax owed and the length of the delay. Additionally, interest accrues on any unpaid taxes from the original due date until the balance is settled. Understanding these penalties highlights the importance of timely and accurate filing to maintain compliance with state tax laws.

Quick guide on how to complete mesa sales tax form 2016

Effortlessly Prepare Mesa Sales Tax Form on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents rapidly without complications. Manage Mesa Sales Tax Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Alter and eSign Mesa Sales Tax Form with Ease

- Locate Mesa Sales Tax Form and then click Get Form to initiate.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with the features that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Mesa Sales Tax Form while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the cost associated with using airSlate SignNow for arizona return documentation?

The pricing for using airSlate SignNow to manage your arizona return documentation is highly competitive. We offer various plans to suit the needs of both individuals and businesses. Each plan includes the ability to send and eSign documents related to your arizona return seamlessly, ensuring cost-effectiveness in your operations.

-

How does airSlate SignNow simplify the arizona return process?

airSlate SignNow simplifies the arizona return process by providing an intuitive platform for document management. Users can easily prepare, send, and receive eSigned documents without the hassle of traditional paper-based methods. This not only saves time but also improves accuracy in your arizona return submissions.

-

Can I integrate airSlate SignNow with other tools for my arizona return needs?

Yes, airSlate SignNow offers various integrations with popular applications to enhance your arizona return workflow. You can connect with tools such as Google Drive, Dropbox, and more. These integrations allow you to streamline document storage and retrieval, making it easier to manage your arizona return documentation.

-

Is airSlate SignNow secure for handling arizona return documents?

Absolutely! Security is a top priority for airSlate SignNow when handling your arizona return documents. We implement advanced encryption protocols and compliance measures to protect your sensitive information, ensuring that your arizona return data is safe and secure throughout the signing process.

-

What features does airSlate SignNow offer to enhance my arizona return experience?

airSlate SignNow comes equipped with several features designed to enhance your arizona return experience. These include templates for common documents, in-person signing options, and automated reminders for signers. Such features help to streamline your processes and ensure timely submissions of your arizona return.

-

How can airSlate SignNow benefit small businesses managing arizona return paperwork?

For small businesses, airSlate SignNow offers an affordable and efficient solution for managing arizona return paperwork. It reduces manual effort and minimizes errors, which is crucial for small teams. With airSlate SignNow, small businesses can focus more on growth while handling arizona return documents with ease.

-

Can I track the status of my arizona return documents with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your arizona return documents in real time. You can see when documents are sent, viewed, and signed, which adds transparency to the process. This feature ensures that you are always updated on the status of your arizona return documentation.

Get more for Mesa Sales Tax Form

- United states of america plaintiff appellee v albert form

- F 1052 jurors may consider anything re truth or accuracy form

- 2055 public authority defenseusamdepartment of justice form

- United states of america plaintiff appellee v kathy form

- Memorandum of law on admissibility of tapes and transcripts form

- In the supreme court of the state of delaware david form

- In this case you have been permitted to take notes during the course form

- Actual possession legal definition of actual possession form

Find out other Mesa Sales Tax Form

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form