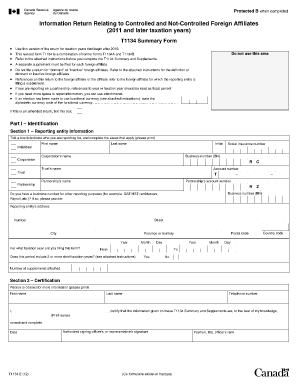

T1134 Form

What is the T1134?

The T1134 form is a crucial document used for reporting foreign income and assets for U.S. taxpayers. It is primarily utilized by individuals and businesses that have foreign investments or holdings, ensuring compliance with U.S. tax laws. This form helps the Internal Revenue Service (IRS) track overseas income and prevent tax evasion. Understanding the T1134 is essential for maintaining transparency in financial reporting and fulfilling legal obligations.

Steps to complete the T1134

Completing the T1134 form involves several key steps to ensure accuracy and compliance. Here’s a simplified guide:

- Gather necessary information about your foreign assets, including account numbers, values, and types of income generated.

- Fill out the form with precise details, ensuring that all required sections are completed. Pay attention to the instructions provided for each section.

- Review the form for any errors or omissions before submission. Double-check that all foreign income and assets are reported correctly.

- Submit the form by the specified deadline to avoid any penalties. Ensure you are aware of the submission methods available, such as online or mail.

Legal use of the T1134

The T1134 form is legally binding and must be filled out in accordance with IRS regulations. Its legal validity stems from compliance with U.S. tax laws, which require taxpayers to report foreign income accurately. Failure to comply can result in significant penalties. It is important to use reliable digital tools to complete the form, as these can enhance security and ensure that the document meets all legal standards.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the T1134 is critical to avoid penalties. Generally, the form must be submitted by April 15 of the following tax year. However, extensions may be available under certain circumstances. It is advisable to keep track of any changes in deadlines announced by the IRS to ensure timely submission.

Penalties for Non-Compliance

Non-compliance with T1134 filing requirements can lead to severe penalties. These may include fines that escalate with the duration of non-filing. Additionally, failure to report foreign income accurately may result in audits and further legal complications. It is essential for taxpayers to understand these risks and take the necessary steps to comply with reporting requirements.

Form Submission Methods

The T1134 form can be submitted through various methods, including online platforms, mail, or in-person submissions. Online submission is often the most efficient, providing immediate confirmation of receipt. When submitting by mail, ensure that the form is sent to the correct IRS address and consider using certified mail for tracking purposes. In-person submissions may be available at select IRS offices, depending on local regulations.

Quick guide on how to complete t1134

Complete T1134 effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It presents an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to access the necessary template and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly and without delays. Manage T1134 on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest method to edit and eSign T1134 seamlessly

- Find T1134 and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important parts of the documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign T1134 and ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t1134

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the t1134 instructions for eSigning documents?

The t1134 instructions guide users on how to complete tax forms electronically. With airSlate SignNow, users can easily follow these instructions to ensure compliance while eSigning important documents. Our platform simplifies the process, allowing you to focus on what matters most.

-

How can airSlate SignNow help with t1134 instructions?

airSlate SignNow streamlines the signing process by providing customizable templates and easy-to-follow workflows for t1134 instructions. You can upload your documents and use our intuitive tools to ensure all necessary fields are filled correctly. This efficiency can save businesses valuable time.

-

Are there any costs associated with using airSlate SignNow for t1134 instructions?

airSlate SignNow offers various pricing plans, allowing businesses to choose an option that fits their needs for handling t1134 instructions. We provide a cost-effective solution without sacrificing features, making it affordable for everyone. Explore our plans to find one that’s right for you.

-

What features does airSlate SignNow include for managing t1134 instructions?

Key features of airSlate SignNow for managing t1134 instructions include customizable templates, audit trails, and in-app communication tools. These features empower businesses to efficiently prepare, sign, and manage their documents, ensuring complete compliance with t1134 guidelines.

-

Can I integrate airSlate SignNow with other software for t1134 instructions?

Yes, airSlate SignNow integrates seamlessly with various software applications to enhance your workflow for t1134 instructions. Our platform can connect with popular tools like Salesforce, Google Drive, and more, enabling you to manage all your documents in one place effortlessly.

-

What benefits does airSlate SignNow provide for handling t1134 instructions?

Using airSlate SignNow for t1134 instructions can signNowly enhance your document management process. It ensures secure, legally-binding electronic signatures while reducing turnaround times. This means faster processing and increased efficiency for your business.

-

Is customer support available for questions about t1134 instructions?

Absolutely! airSlate SignNow provides dedicated customer support to assist you with any questions regarding t1134 instructions. Our team is available to guide you through any issues or to clarify any doubts you may have about our platform.

Get more for T1134

Find out other T1134

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding