1003 Commercial Loan Application PDF Form

What is the 1003 Commercial Loan Application Pdf

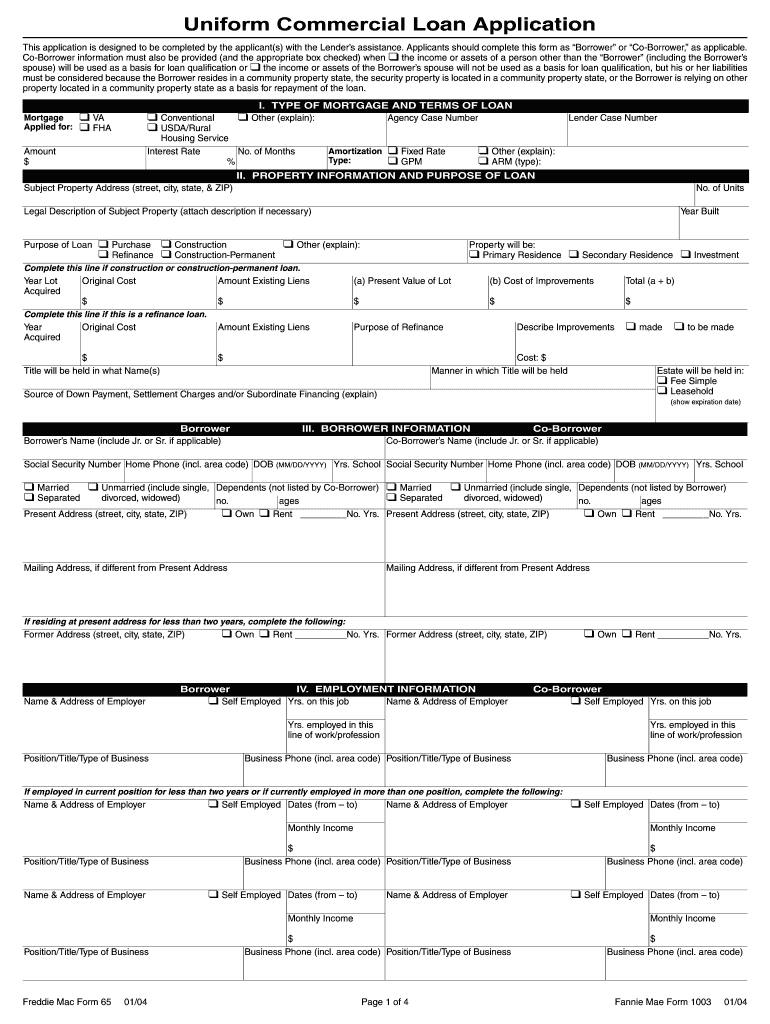

The 1003 Commercial Loan Application PDF is a standardized form used by lenders in the United States to assess the creditworthiness of individuals or businesses applying for commercial loans. This form, also known as the Uniform Commercial Loan Application, collects essential information about the borrower, including financial details, business structure, and the purpose of the loan. It serves as a critical document in the loan approval process, ensuring that lenders have a comprehensive understanding of the applicant's financial situation and business needs.

How to Use the 1003 Commercial Loan Application Pdf

Using the 1003 Commercial Loan Application PDF involves several straightforward steps. First, download the form from a reliable source. Next, carefully fill in the required fields, which typically include personal identification information, business details, and financial statements. It is important to provide accurate and complete information to avoid delays in processing. Once completed, the form can be printed for physical signatures or signed electronically using a secure eSignature platform. This ensures that the application is legally binding and compliant with relevant regulations.

Steps to Complete the 1003 Commercial Loan Application Pdf

Completing the 1003 Commercial Loan Application PDF requires attention to detail. Follow these steps for a smooth process:

- Download the form: Obtain the latest version of the 1003 application from a trusted source.

- Gather necessary documents: Collect financial statements, tax returns, and other supporting documents that may be required.

- Fill out the form: Provide accurate information in all sections, including personal details, business structure, and loan purpose.

- Review your application: Double-check all entries for accuracy and completeness.

- Sign the application: Use either a physical signature or an electronic signature to finalize the document.

- Submit the application: Send the completed form to your lender via the preferred submission method.

Key Elements of the 1003 Commercial Loan Application Pdf

The 1003 Commercial Loan Application PDF includes several key elements that are crucial for lenders to evaluate. These elements typically consist of:

- Borrower Information: Personal and business details of the applicant.

- Loan Amount Requested: The specific amount of funding being sought.

- Business Financials: Income statements, balance sheets, and cash flow projections.

- Collateral Information: Details about any assets being offered as security for the loan.

- Purpose of the Loan: A clear explanation of how the funds will be used.

Legal Use of the 1003 Commercial Loan Application Pdf

The legal use of the 1003 Commercial Loan Application PDF is governed by various regulations that ensure the integrity of the application process. For the application to be considered legally binding, it must be completed accurately and signed by the borrower. Additionally, the use of electronic signatures is permissible under the ESIGN Act and UETA, provided that the eSignature solution complies with security standards. This legal framework protects both the borrower and the lender during the loan application process.

Form Submission Methods

Submitting the 1003 Commercial Loan Application PDF can be done through various methods, depending on the lender's preferences. Common submission methods include:

- Online Submission: Many lenders offer secure online portals for submitting applications electronically.

- Email Submission: Some lenders may accept completed applications via email, ensuring that documents are sent securely.

- Mail Submission: Applicants can also print the completed form and send it via postal mail to the lender's office.

- In-Person Submission: For those who prefer a personal touch, submitting the application in person is often an option.

Quick guide on how to complete 1003 commercial loan application pdf

Finalize 1003 Commercial Loan Application Pdf effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, as you can obtain the correct format and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Handle 1003 Commercial Loan Application Pdf on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign 1003 Commercial Loan Application Pdf with ease

- Obtain 1003 Commercial Loan Application Pdf and click on Get Form to initiate.

- Make use of the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign 1003 Commercial Loan Application Pdf to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a 1003 commercial loan application pdf?

The 1003 commercial loan application pdf is a standardized form used by lenders to collect necessary information from borrowers when applying for a commercial loan. It allows for consistent data collection and ease of processing, ensuring that all relevant financial details, business information, and borrower history are included.

-

How can I easily fill out the 1003 commercial loan application pdf?

You can easily fill out the 1003 commercial loan application pdf using airSlate SignNow’s intuitive document editing features. Our platform allows you to upload the PDF, fill in the required fields, and save your progress without hassle, making the process efficient and user-friendly.

-

Is the 1003 commercial loan application pdf format compatible with other applications?

Yes, the 1003 commercial loan application pdf is compatible with various applications, including PDF readers and document management systems. By using airSlate SignNow, you can integrate with other tools to streamline your workflow, ensuring seamless data transfer and accessibility.

-

What are the benefits of using airSlate SignNow for the 1003 commercial loan application pdf?

Using airSlate SignNow for the 1003 commercial loan application pdf provides numerous benefits, including easy electronic signatures, secure document storage, and the ability to track document status in real-time. This not only speeds up the application process but also enhances security and compliance.

-

Can I customize the 1003 commercial loan application pdf?

Absolutely! With airSlate SignNow, you can customize the 1003 commercial loan application pdf by adding your company logo, modifying text fields, and including additional clauses as needed. This flexibility allows you to tailor the document to better fit your specific business requirements.

-

What pricing options are available for using airSlate SignNow with the 1003 commercial loan application pdf?

airSlate SignNow offers a variety of pricing plans to suit different business needs when working with the 1003 commercial loan application pdf. From basic plans for individual users to comprehensive solutions for large teams, you can choose a plan that aligns with your budget and requirements.

-

Does airSlate SignNow provide support for the 1003 commercial loan application pdf?

Yes, airSlate SignNow offers robust customer support for users of the 1003 commercial loan application pdf. Whether you have questions about the document features or need assistance with technical issues, our support team is available to help you through the process.

Get more for 1003 Commercial Loan Application Pdf

Find out other 1003 Commercial Loan Application Pdf

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy