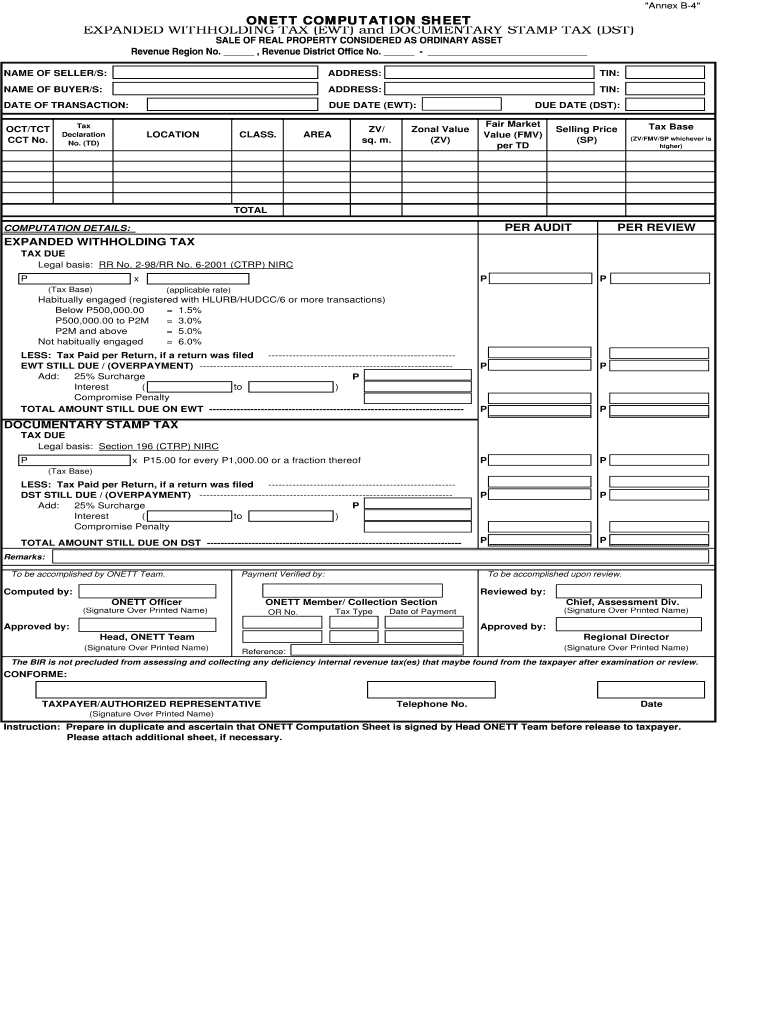

Onett Computation Sheet Form

What is the Onett Computation Sheet

The Onett computation sheet is a crucial document used for calculating estate tax liabilities in the United States. This form assists individuals and businesses in determining the amount of tax owed based on the value of the estate. It includes various sections that require detailed financial information, such as asset valuations, deductions, and applicable tax rates. Understanding this form is essential for compliance with tax regulations and ensuring accurate reporting to the Internal Revenue Service (IRS).

How to use the Onett Computation Sheet

Using the Onett computation sheet involves several steps to ensure accuracy and compliance. Start by gathering all necessary financial documents related to the estate, including asset valuations, debts, and any prior tax returns. Next, fill out the computation sheet by entering the required information in the designated fields. It is important to follow the instructions carefully to avoid errors that could lead to penalties. Once completed, review the sheet for accuracy before submitting it to the appropriate tax authority.

Steps to complete the Onett Computation Sheet

Completing the Onett computation sheet involves a systematic approach:

- Gather all relevant financial documents, including appraisals and previous tax filings.

- Identify and list all assets, including real estate, investments, and personal property.

- Calculate total liabilities, such as debts and expenses that can be deducted.

- Determine the net value of the estate by subtracting liabilities from total assets.

- Apply the appropriate tax rates to calculate the estate tax owed.

- Review the completed form for accuracy and completeness.

Legal use of the Onett Computation Sheet

The Onett computation sheet must be used in accordance with IRS regulations to ensure its legal validity. This includes adhering to deadlines for submission and providing accurate information. Failure to comply with legal requirements can result in penalties, including fines or additional taxes owed. It is advisable to consult with a tax professional to ensure that the form is completed correctly and submitted on time.

Key elements of the Onett Computation Sheet

Key elements of the Onett computation sheet include:

- Asset Listings: Detailed descriptions and valuations of all estate assets.

- Liabilities: A comprehensive list of debts and obligations that can be deducted.

- Tax Calculations: Clear instructions on how to apply tax rates to the net estate value.

- Signature Section: A place for the executor or responsible party to sign and date the form, confirming its accuracy.

Filing Deadlines / Important Dates

Filing deadlines for the Onett computation sheet are critical to avoid penalties. Generally, the estate tax return must be filed within nine months of the date of death of the decedent. Extensions may be available, but they must be requested in advance. It is essential to keep track of these dates to ensure compliance with tax obligations.

Quick guide on how to complete onett computation sheet

Complete Onett Computation Sheet effortlessly on any device

Digital document administration has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Onett Computation Sheet on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and electronically sign Onett Computation Sheet without difficulty

- Find Onett Computation Sheet and then click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to finalize your edits.

- Decide how you want to send your form - via email, text message, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Onett Computation Sheet and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is bir onett and how does it work with airSlate SignNow?

Bir onett is a powerful feature in airSlate SignNow that allows users to easily send and eSign documents online. With its user-friendly interface, businesses can streamline their document workflows, ensuring faster turnaround times and improved efficiency. This functionality integrates seamlessly with other tools, enhancing overall productivity.

-

What are the pricing plans for airSlate SignNow that include bir onett?

airSlate SignNow offers several pricing plans that incorporate bir onett functionalities, catering to various business needs. The pricing is competitive and designed to be cost-effective, providing value for organizations of all sizes. You can select a plan that best fits your document signing requirements and budget.

-

What features does bir onett provide within airSlate SignNow?

Bir onett includes features such as document templates, real-time tracking, and secure cloud storage. These features help businesses manage their document signing process more efficiently. Additionally, the platform ensures compliance with legal standards, making it reliable for business use.

-

How can bir onett benefit my business?

Utilizing bir onett through airSlate SignNow can signNowly improve your business operations by reducing the time spent on document management. It allows for faster signing processes, minimizes paper usage, and enhances collaboration among team members. Overall, it helps in achieving better operational efficiency.

-

Does bir onett integrate with other applications?

Yes, bir onett in airSlate SignNow allows integration with numerous applications, including CRM and project management tools. This capability enhances workflow automation and data synchronization across platforms. Such integrations ensure that you can manage all aspects of your business processes seamlessly.

-

Is bir onett secure for signing sensitive documents?

Absolutely, bir onett in airSlate SignNow prioritizes security, implementing advanced encryption methods to protect your sensitive documents. The platform is compliant with industry-leading security standards, giving users peace of mind while signing and managing their documents. This makes it a trusted choice for handling confidential information.

-

Can I customize bir onett features to fit my business needs?

Yes, airSlate SignNow allows customization of bir onett features to suit your specific business requirements. With the flexibility to create personalized workflows and templates, you can tailor the solution to enhance your operational efficiency. This customization ensures that the platform aligns perfectly with your organization’s unique processes.

Get more for Onett Computation Sheet

- Salary verification form for potential lease illinois

- Illinois agreement tenant form

- Illinois default 497306282 form

- Landlord tenant lease co signer agreement illinois form

- Application for sublease illinois form

- Inventory and condition of leased premises for pre lease and post lease illinois form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out illinois form

- Property manager agreement illinois form

Find out other Onett Computation Sheet

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free