32a Challan Form in Excel

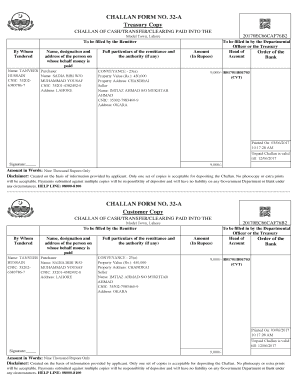

What is the 32a Challan Form In Excel

The 32a Challan form is a crucial document used primarily for tax payments in the United States. It serves as a payment receipt and is required for various transactions, including income tax and other government fees. The form is available in Excel format, making it easy for users to fill out electronically. This digital version allows for efficient data entry and calculation, streamlining the process for individuals and businesses alike.

How to use the 32a Challan Form In Excel

Using the 32a Challan form in Excel involves several straightforward steps. First, download the Excel version of the form from a reliable source. Once downloaded, open the file and enter the required information, such as taxpayer identification details and payment amounts. The Excel format allows for automatic calculations, ensuring accuracy in the total amount due. After completing the form, save your changes and prepare for submission.

Steps to complete the 32a Challan Form In Excel

Completing the 32a Challan form in Excel can be done efficiently by following these steps:

- Download the 32a Challan form in Excel format.

- Open the file and review the fields that need to be filled out.

- Enter your personal or business information, including name, address, and tax identification number.

- Input the payment details, specifying the amount and type of tax being paid.

- Check for any automatic calculations that may adjust the total based on your entries.

- Review the completed form for accuracy before saving it.

Legal use of the 32a Challan Form In Excel

The 32a Challan form is legally recognized when completed correctly and submitted according to IRS guidelines. The electronic version maintains the same legal standing as a paper form, provided it adheres to the necessary regulations for e-signatures. It is essential to ensure that all required fields are filled accurately to avoid issues with compliance and potential penalties.

Form Submission Methods (Online / Mail / In-Person)

The 32a Challan form can be submitted through various methods, depending on the requirements set by the relevant tax authorities. Common submission methods include:

- Online Submission: Many jurisdictions allow for electronic filing through their official portals.

- Mail: Completed forms can be printed and mailed to the designated tax office.

- In-Person: Some taxpayers may choose to deliver the form directly to their local tax office.

Key elements of the 32a Challan Form In Excel

Understanding the key elements of the 32a Challan form is essential for accurate completion. Important components include:

- Taxpayer Information: Name, address, and identification number.

- Payment Details: Amount owed and the type of tax.

- Signature Section: Where the taxpayer signs to validate the form.

- Date of Payment: The date when the payment is made.

Quick guide on how to complete 32a challan form in excel

Effortlessly Prepare 32a Challan Form In Excel on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed documents, as you can find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage 32a Challan Form In Excel on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The Simplest Way to Edit and Electronically Sign 32a Challan Form In Excel with Ease

- Find 32a Challan Form In Excel and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal significance as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign 32a Challan Form In Excel and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a challan in the context of document management?

A challan is a formal document used for various purposes, including payments and fee submissions. In the context of document management, a challan provides structured data that simplifies tracking and accountability. airSlate SignNow makes it easy to create, send, and eSign a challan within minutes.

-

How can airSlate SignNow help me generate a challan?

airSlate SignNow offers templates that allow you to quickly generate a challan with the necessary fields filled out. You can customize your challan to meet specific needs, ensuring it contains all required information. This feature increases efficiency by reducing the time spent on document creation.

-

What are the pricing options for using airSlate SignNow to manage a challan?

airSlate SignNow provides flexible pricing plans to accommodate businesses of all sizes. Whether you need to manage a single challan or multiple documents, there’s a plan tailored for you. Explore our website for detailed pricing information and choose the plan that best suits your needs.

-

Can I integrate airSlate SignNow with other software to manage a challan?

Yes, airSlate SignNow seamlessly integrates with various applications, including CRM and accounting software, making it easy to manage a challan alongside your existing tools. This integration enables you to streamline your workflow and enhances collaboration across your organization. Review our integration options to find what suits you.

-

What features does airSlate SignNow include for eSigning a challan?

airSlate SignNow includes robust eSigning features, allowing users to securely sign a challan electronically. This process is not only fast but also compliant with legal standards. Additionally, you can track the status of your documents in real-time to ensure timely completion.

-

Is airSlate SignNow secure for handling sensitive information on a challan?

Yes, airSlate SignNow prioritizes security and complies with industry standards to protect sensitive information. When handling a challan, your data is encrypted to prevent unauthorized access. We also provide audit trails to establish accountability for every action taken with your documents.

-

How can using airSlate SignNow benefit my business when dealing with a challan?

Using airSlate SignNow streamlines the document management process, enhancing efficiency when dealing with a challan. The ability to easily create, send, and eSign documents reduces administrative burdens and accelerates payment processes. Ultimately, this saves time and improves cash flow for your business.

Get more for 32a Challan Form In Excel

- Connecticut attorney retirement written notice form

- Connecticut sentence modification application motion and order form

- Connecticut motion to approve arbitration agreement in family cases form

- Connecticut affidavit consent to termination of parental rights form

- Connecticut order of notice petition termination parental rights form

- Connecticut small estate affidavit in lieu of administration form

- Connecticut certificate of devise descent or distribution form

- Connecticut schedule a proposed distribution final financial report of guardian or conservator form

Find out other 32a Challan Form In Excel

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word