Sc Wh 1606 2022-2026

What is the SC WH 1606?

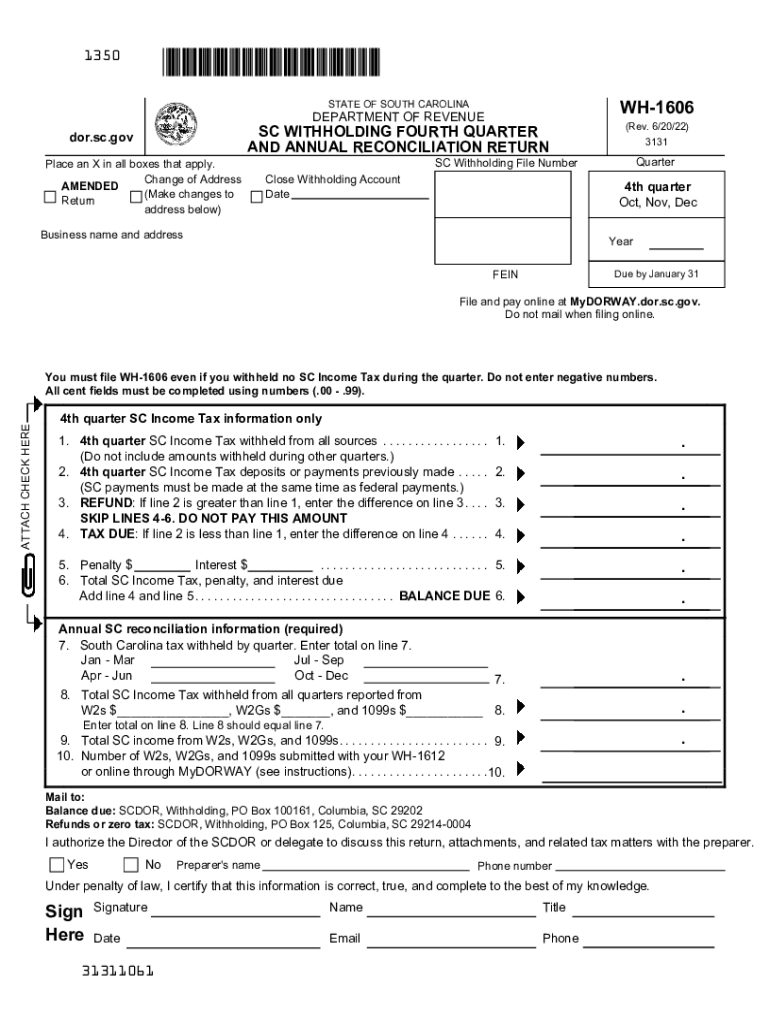

The SC WH 1606, also known as the South Carolina Withholding Quarterly Tax Return, is a form used by employers in South Carolina to report and remit state income tax withheld from employees' wages. This form is essential for maintaining compliance with state tax laws and ensuring that the appropriate amounts are paid to the South Carolina Department of Revenue. It is typically filed on a quarterly basis, reflecting the total withholding amounts for each quarter of the year.

How to Use the SC WH 1606

To effectively use the SC WH 1606, employers must first gather all relevant payroll information for the quarter. This includes total wages paid, the amount of state income tax withheld, and any adjustments that may be necessary. Once this information is compiled, it can be entered into the form. Employers should ensure that they accurately report these figures to avoid potential penalties or discrepancies with the South Carolina Department of Revenue.

Steps to Complete the SC WH 1606

Completing the SC WH 1606 involves several key steps:

- Gather payroll records for the quarter, including total wages and withholding amounts.

- Fill out the form with the required information, ensuring accuracy in all reported figures.

- Review the completed form for any errors or omissions.

- Submit the form to the South Carolina Department of Revenue by the specified deadline.

Legal Use of the SC WH 1606

The SC WH 1606 is legally binding and must be filed in accordance with South Carolina tax regulations. Employers are responsible for ensuring that they file this form accurately and on time to avoid any legal repercussions. Proper use of the form helps maintain compliance with state laws and contributes to the overall integrity of the tax system.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the SC WH 1606. The form is due on the last day of the month following the end of each quarter. For example, the deadlines are typically as follows:

- First quarter (January - March): Due April 30

- Second quarter (April - June): Due July 31

- Third quarter (July - September): Due October 31

- Fourth quarter (October - December): Due January 31 of the following year

Form Submission Methods

The SC WH 1606 can be submitted through various methods. Employers may choose to file the form electronically through the South Carolina Department of Revenue’s online portal, which offers a streamlined process for submission and payment. Alternatively, the form can be mailed directly to the appropriate department. It is important to keep records of submission methods and confirmation receipts for future reference.

Quick guide on how to complete sc wh 1606

Complete Sc Wh 1606 seamlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage Sc Wh 1606 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Sc Wh 1606 effortlessly

- Locate Sc Wh 1606 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal authority as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you want to share your form: via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and eSign Sc Wh 1606 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc wh 1606

Create this form in 5 minutes!

People also ask

-

What is the significance of the 2016 SC 1606 ruling in e-signatures?

The 2016 SC 1606 ruling reinforced the legality of electronic signatures, making them as binding as traditional handwritten signatures. This landmark decision has encouraged businesses to adopt e-signature solutions like airSlate SignNow, ensuring compliance and security in their document transactions.

-

How can airSlate SignNow help my business comply with the 2016 SC 1606 standards?

airSlate SignNow is designed to meet the requirements established by the 2016 SC 1606 ruling. Our platform provides robust security features and audit trails that ensure every e-signature is valid and compliant, helping your business meet legal standards effortlessly.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. You can choose from monthly or annual subscriptions, allowing you to pick a plan that fits your budget while benefiting from features that align with the 2016 SC 1606 ruling.

-

What key features does airSlate SignNow provide for document management?

AirSlate SignNow includes essential features such as secure e-signatures, document templates, automated workflows, and integration with third-party platforms. These features streamline your document management processes, enhancing efficiency in line with guidelines established by the 2016 SC 1606 ruling.

-

How does airSlate SignNow integrate with other software?

AirSlate SignNow supports integrations with numerous applications including CRM and project management tools. This flexibility allows your business to incorporate e-signatures seamlessly into existing workflows, ensuring compliance with the 2016 SC 1606 ruling across all platforms.

-

What benefits does airSlate SignNow offer to small businesses?

For small businesses, airSlate SignNow provides an affordable e-signature solution that enhances workflow efficiency and ensures compliance with the 2016 SC 1606 ruling. By reducing the need for printing, signing, and scanning documents, businesses can save time and reduce operational costs.

-

Is the airSlate SignNow platform user-friendly?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to send and sign documents online. This intuitive interface supports users in leveraging e-signatures in compliance with the 2016 SC 1606 ruling without requiring technical expertise.

Get more for Sc Wh 1606

- Ar sample letter form

- Lead based paint disclosure for sales transaction arkansas form

- Lead based paint disclosure for rental transaction arkansas form

- Notice of lease for recording arkansas form

- Materialmans lien notice general arkansas form

- Materialmans lien notice electrical arkansas form

- Ar lien 497296647 form

- Account affidavit form

Find out other Sc Wh 1606

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template