Guide to Withdrawal Form VISSF 2020-2026

Understanding the Guide to Withdrawal Form VISSF

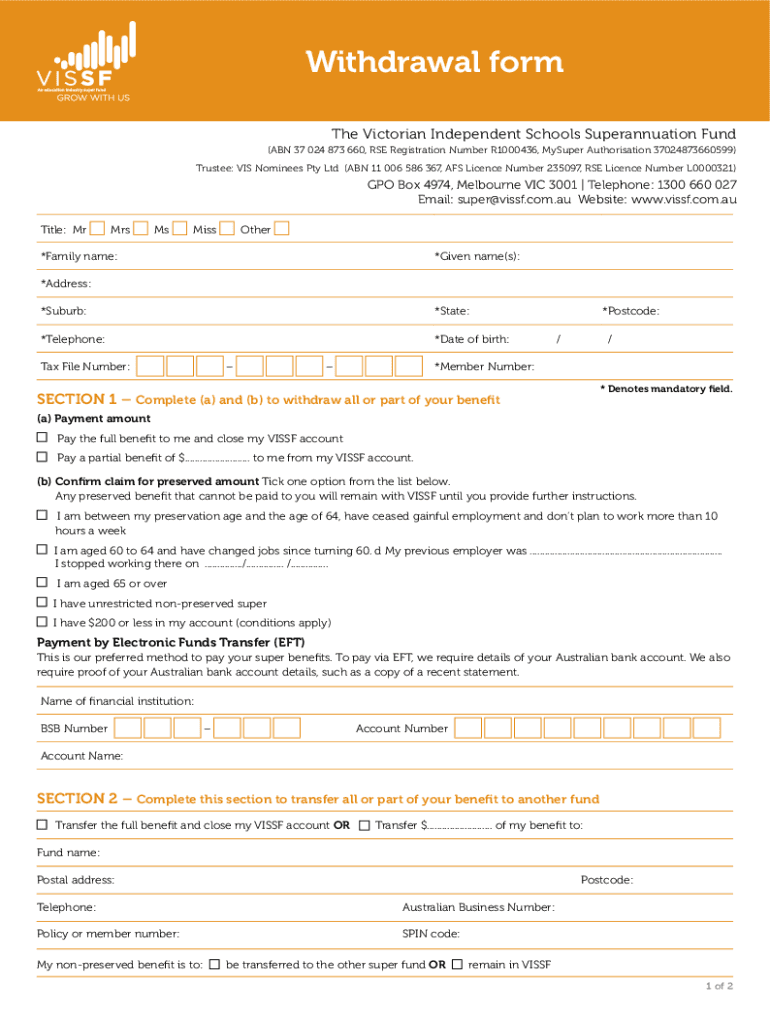

The Guide to Withdrawal Form VISSF is a crucial document for individuals looking to access their superannuation funds. It provides essential information on how to withdraw funds from a superannuation account, ensuring that users understand their rights and obligations. This guide outlines the necessary steps to complete the form accurately, which is vital for a smooth withdrawal process. Understanding the purpose of this form helps individuals navigate their financial options effectively.

Steps to Complete the Guide to Withdrawal Form VISSF

Completing the Guide to Withdrawal Form VISSF requires careful attention to detail. Here are the steps to ensure accuracy:

- Gather Required Information: Collect all necessary personal details, including your superannuation fund information, identification, and any relevant financial documents.

- Fill Out the Form: Carefully enter your details in the designated fields. Ensure that all information is accurate to avoid delays.

- Review the Form: Double-check all entries for completeness and accuracy. This step is crucial to prevent errors that could lead to complications.

- Submit the Form: Follow the submission guidelines provided in the guide, whether online, by mail, or in person.

Legal Use of the Guide to Withdrawal Form VISSF

The Guide to Withdrawal Form VISSF is legally recognized for processing superannuation withdrawals. It must comply with relevant laws and regulations governing superannuation funds. This includes adherence to the Employee Retirement Income Security Act (ERISA) and other federal guidelines. Ensuring that the form is filled out correctly and submitted in accordance with these regulations is essential for the withdrawal to be considered valid and legally binding.

Required Documents for the Guide to Withdrawal Form VISSF

When preparing to submit the Guide to Withdrawal Form VISSF, certain documents are typically required to support your application. These may include:

- Identification: A government-issued ID, such as a driver's license or passport, to verify your identity.

- Proof of Address: Recent utility bills or bank statements that confirm your current address.

- Superannuation Fund Details: Documentation that provides information about your superannuation account, including account numbers and fund names.

Form Submission Methods

There are various methods available for submitting the Guide to Withdrawal Form VISSF, making it convenient for users. These methods include:

- Online Submission: Many superannuation funds allow for electronic submissions through their websites, which can expedite the process.

- Mail: You can print the completed form and send it via postal service to the designated address of your superannuation fund.

- In-Person: Some individuals may prefer to submit the form in person at their superannuation fund's office for immediate confirmation.

Eligibility Criteria for Withdrawal

Understanding the eligibility criteria for withdrawing from a superannuation fund is essential. Typically, individuals must meet specific conditions, such as:

- Age Requirements: Most funds allow withdrawals after reaching a certain age, often around fifty-eight or sixty.

- Financial Hardship: Individuals may qualify for early withdrawal if they can demonstrate significant financial hardship.

- Permanent Departure from Employment: Leaving a job may also trigger eligibility, especially if the employment was with a specific employer.

Quick guide on how to complete guide to withdrawal form vissf

Complete Guide To Withdrawal Form VISSF effortlessly on any device

Online document management has become widely embraced by organizations and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed papers, allowing you to obtain the necessary document and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without complications. Manage Guide To Withdrawal Form VISSF on any device using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest way to alter and eSign Guide To Withdrawal Form VISSF with ease

- Locate Guide To Withdrawal Form VISSF and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or obscure confidential information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you select. Revise and eSign Guide To Withdrawal Form VISSF and assure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct guide to withdrawal form vissf

Create this form in 5 minutes!

People also ask

-

What is a superannuation fund?

A superannuation fund is a long-term investment vehicle designed to help individuals save for retirement in Australia. It accumulates funds throughout your working life, allowing your savings to grow over time, benefiting from tax advantages. Understanding superannuation funds is essential for effective retirement planning.

-

How does airSlate SignNow support superannuation fund management?

AirSlate SignNow provides an easy-to-use platform for handling important documents related to superannuation fund management. With features like e-signature capabilities and seamless document sharing, it streamlines the process of managing fund documents, ensuring compliance and efficiency. Businesses can trust SignNow for secure, compliant document management.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to fit the needs of businesses managing superannuation fund documentation. You can choose from basic to advanced plans, which include different features such as unlimited signatures and integrations. Our pricing is designed to be cost-effective, making it easy for businesses to efficiently manage their superannuation fund needs.

-

What features does airSlate SignNow offer for superannuation fund applications?

AirSlate SignNow includes powerful features tailored for superannuation fund applications, such as templates for common forms, bulk sending options, and detailed audit trails. The platform ensures that all documents are securely signed and stored, allowing for easy access and management. These features simplify workflows and enhance overall productivity.

-

Can airSlate SignNow integrate with other tools for managing superannuation funds?

Yes, airSlate SignNow offers numerous integrations with popular tools and software that help manage superannuation funds. Whether you're using accounting software or HR platforms, our integrations facilitate seamless sync and automation. This ensures that your workflow remains efficient and interconnected.

-

What benefits does e-signing provide for superannuation fund documents?

E-signing provides signNow benefits for superannuation fund documents, including speed, security, and convenience. It allows users to sign documents from any location, reducing turnaround time and improving workflows. Additionally, e-signatures are legally binding and ensure your superannuation fund documents are secure.

-

How secure is the document signing process with airSlate SignNow for superannuation funds?

airSlate SignNow prioritizes security in the document signing process, especially for sensitive superannuation fund documents. We employ advanced encryption technology and secure access controls to protect your information. You can have peace of mind knowing that all data related to your superannuation fund is handled with the highest security standards.

Get more for Guide To Withdrawal Form VISSF

Find out other Guide To Withdrawal Form VISSF

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast