Minnesota Certificate Trust Form

What is the Minnesota Certificate Trust

The Minnesota Certificate Trust is a legal instrument that allows individuals to manage and protect their assets through a trust structure. This form is particularly useful for estate planning, as it helps in the efficient transfer of assets while minimizing taxes and avoiding probate. A certificate trust can be established to hold various types of property, including real estate, investments, and personal belongings, ensuring that the trustor's wishes are honored after their passing.

How to Use the Minnesota Certificate Trust

Using the Minnesota Certificate Trust involves several steps to ensure that it is set up correctly and functions as intended. Initially, the trustor must determine the assets to be placed in the trust and select a trustee to manage those assets. The trustor then completes the Minnesota Certificate Trust form, detailing the terms of the trust, including beneficiaries and distribution instructions. Once executed, the trust must be funded by transferring ownership of the specified assets to the trust, which can involve changing titles or designations on property and accounts.

Steps to Complete the Minnesota Certificate Trust

Completing the Minnesota Certificate Trust involves a series of methodical steps:

- Identify the assets to be included in the trust.

- Select a reliable trustee who will manage the trust.

- Fill out the Minnesota Certificate Trust form accurately, specifying all necessary details.

- Sign the form in the presence of a notary public to ensure legal validity.

- Transfer the ownership of assets to the trust, updating titles and designations as needed.

Legal Use of the Minnesota Certificate Trust

The Minnesota Certificate Trust is legally recognized under state law, provided it complies with specific requirements. To be valid, the trust must have a clear purpose, identifiable beneficiaries, and must be executed according to Minnesota statutes. It is essential to ensure that the trust complies with both federal and state laws to avoid any legal disputes or challenges in the future.

State-Specific Rules for the Minnesota Certificate Trust

Each state has its own regulations regarding trusts, and Minnesota is no exception. Key state-specific rules include the requirement for the trust document to be in writing, the necessity of a notary for execution, and adherence to the Minnesota Uniform Trust Code. Understanding these rules is crucial for ensuring that the trust is enforceable and meets the legal standards set forth by the state.

Examples of Using the Minnesota Certificate Trust

There are various scenarios in which a Minnesota Certificate Trust can be beneficial. For instance, a parent may establish a trust to manage assets for their minor children, ensuring that the funds are used for their education and welfare. Additionally, individuals looking to protect their assets from creditors or those planning for long-term care needs may find this trust structure advantageous. Each example highlights the flexibility and utility of the Minnesota Certificate Trust in different financial situations.

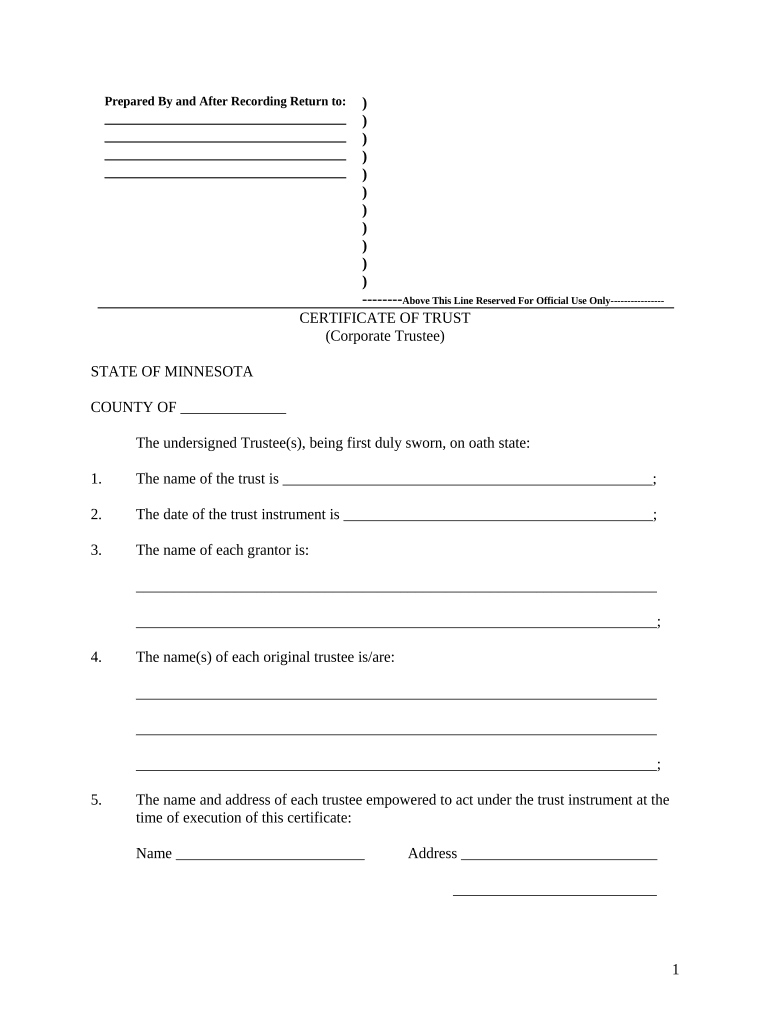

Quick guide on how to complete minnesota certificate trust 497312182

Prepare Minnesota Certificate Trust effortlessly on any device

Online document management has become favored by businesses and individuals alike. It offers an excellent environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents promptly without any delays. Handle Minnesota Certificate Trust on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Minnesota Certificate Trust with ease

- Obtain Minnesota Certificate Trust and click on Get Form to initiate.

- Use the tools we provide to complete your form.

- Emphasize key sections of the documents or obscure sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or a link invitation, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Minnesota Certificate Trust and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Minnesota certificate trust and how can it benefit my business?

The Minnesota certificate trust is a legal arrangement that allows individuals and organizations to manage and protect trust assets efficiently. Using airSlate SignNow, you can easily eSign and send necessary documents related to your Minnesota certificate trust, streamlining the process and reducing paperwork.

-

How much does airSlate SignNow cost for managing a Minnesota certificate trust?

Pricing for airSlate SignNow varies based on the plan you select. Our affordable plans cater to different business needs, allowing you to manage your Minnesota certificate trust effectively without breaking the bank. Sign up for a free trial to explore the features and find the right fit for your organization.

-

Can airSlate SignNow help me with compliance related to Minnesota certificate trusts?

Absolutely! airSlate SignNow is designed to ensure that all your documents comply with Minnesota certificate trust regulations. Our platform provides secure eSigning and tracking features, which help maintain compliance and legal integrity throughout the trust management process.

-

What features does airSlate SignNow offer for Minnesota certificate trust management?

airSlate SignNow includes features such as document templates, customizable workflows, and secure eSigning, all designed to simplify the management of your Minnesota certificate trust. These tools help you automate processes, increase efficiency, and reduce the likelihood of errors.

-

Is airSlate SignNow compatible with other software I use for Minnesota certificate trusts?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and Microsoft Office. This compatibility allows you to manage your Minnesota certificate trust documents in conjunction with existing tools, enhancing productivity and streamlining workflows.

-

How secure is airSlate SignNow in managing my Minnesota certificate trust documents?

Security is a top priority for airSlate SignNow. Our platform utilizes advanced encryption protocols and secure data storage to protect your Minnesota certificate trust documents. Additionally, we offer audit trails and user authentication features to ensure complete document security and compliance.

-

What types of documents can I eSign for a Minnesota certificate trust using airSlate SignNow?

Using airSlate SignNow, you can eSign a variety of documents related to Minnesota certificate trusts, including trust agreements, amendments, and beneficiary designations. Our user-friendly interface makes it easy to upload, sign, and send any document securely.

Get more for Minnesota Certificate Trust

- Sample cms 1450 ub 04 claim form for hymovis high molecular

- Highmark enrollment waiver form

- Mlcc eft form

- Pre settlement inspection checklist pdf form

- Seller closing costs statement form

- Contestant eligibility form toastmasters

- 1st quarter form newark payroll tax statement

- Canada pension plan death benefit application isp1200e form

Find out other Minnesota Certificate Trust

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy