or or STT 1 Fill Out Tax Template OnlineUS Legal 2022-2026

Understanding the Oregon Statewide Transit Tax Form (STT 1)

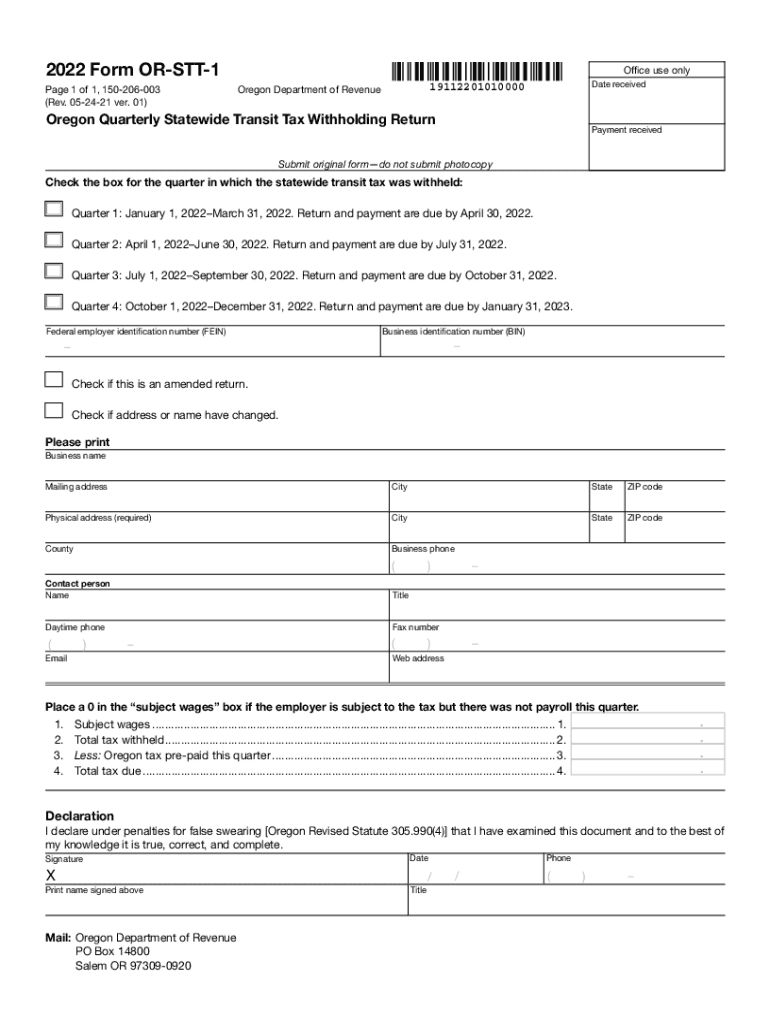

The Oregon Statewide Transit Tax, often referred to as the STT, is a tax imposed on wages earned by employees in Oregon. This tax is used to fund public transit services across the state. The STT 1 form is specifically designed for reporting and remitting this tax. It is essential for employers to understand the requirements and implications of this tax to ensure compliance and proper funding for transit services.

Steps to Complete the Oregon Statewide Transit Tax Form (STT 1)

Filling out the Oregon Statewide Transit Tax Form (STT 1) involves several key steps:

- Gather Required Information: Collect employee information, including names, Social Security numbers, and wages.

- Calculate the Tax: Determine the total wages subject to the transit tax and apply the appropriate tax rate.

- Complete the Form: Fill in the STT 1 form with the calculated tax amounts and employee details.

- Review for Accuracy: Double-check all entries to ensure accuracy before submission.

- Submit the Form: File the completed STT 1 form by the specified deadline to avoid penalties.

Filing Deadlines for the Oregon Statewide Transit Tax

Timely filing of the Oregon Statewide Transit Tax Form (STT 1) is crucial to avoid penalties. The filing deadlines typically align with the quarterly payroll tax reporting periods. Employers must submit the STT 1 form by the end of the month following the close of each quarter:

- First Quarter: Due by April 30

- Second Quarter: Due by July 31

- Third Quarter: Due by October 31

- Fourth Quarter: Due by January 31

Required Documents for Oregon Statewide Transit Tax Filing

To complete the Oregon Statewide Transit Tax Form (STT 1), employers need to prepare several documents:

- Employee wage records for the reporting period

- Documentation of any exemptions or special considerations

- Previous STT filings, if applicable

Penalties for Non-Compliance with Oregon Statewide Transit Tax Regulations

Failure to comply with the Oregon Statewide Transit Tax regulations can result in significant penalties. Employers may face fines for late submissions or incorrect filings. The penalties can include:

- Late filing fees

- Interest on unpaid taxes

- Potential audits by the state tax authority

Digital vs. Paper Version of the Oregon Statewide Transit Tax Form

Employers have the option to file the Oregon Statewide Transit Tax Form (STT 1) either digitally or via paper. The digital version offers several advantages:

- Faster processing times

- Reduced risk of errors

- Convenient access to records and submissions

Choosing the digital method can streamline the filing process and enhance compliance.

Quick guide on how to complete or or stt 1 2020 fill out tax template onlineus legal

Complete OR OR STT 1 Fill Out Tax Template OnlineUS Legal effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly without delays. Handle OR OR STT 1 Fill Out Tax Template OnlineUS Legal on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to edit and eSign OR OR STT 1 Fill Out Tax Template OnlineUS Legal with ease

- Obtain OR OR STT 1 Fill Out Tax Template OnlineUS Legal and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or black out sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign OR OR STT 1 Fill Out Tax Template OnlineUS Legal and ensure seamless communication at any step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct or or stt 1 2020 fill out tax template onlineus legal

Create this form in 5 minutes!

People also ask

-

What is the significance of the oregon statewide tax in the document signing process?

The oregon statewide tax is crucial for businesses operating within the state, as it impacts financial documentation and compliance. Using airSlate SignNow ensures that your eSignatures and documents are compliant with Oregon tax laws, facilitating smoother transaction processes.

-

How does airSlate SignNow help with oregon statewide tax compliance?

airSlate SignNow provides legally binding electronic signatures that meet Oregon's regulatory standards, ensuring your documents are compliant with the oregon statewide tax requirements. This feature is essential for businesses that want to avoid potential legal issues.

-

Is there a pricing plan that suits a small business handling oregon statewide tax issues?

Yes, airSlate SignNow offers flexible pricing plans tailored to small businesses. These plans are cost-effective and equipped with features to help manage documents relevant to oregon statewide tax efficiently.

-

What key features of airSlate SignNow are beneficial for managing oregon statewide tax documentation?

Key features include customizable templates, real-time tracking, and secure cloud storage, all of which assist in managing documentation related to the oregon statewide tax. These tools simplify the process of filing and managing tax-related forms.

-

Can airSlate SignNow integrate with other software to manage oregon statewide tax?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and tax software, enhancing your ability to manage oregon statewide tax documentation. This integration ensures that your financial data flows smoothly between applications.

-

How does airSlate SignNow improve efficiency in handling oregon statewide tax forms?

By enabling electronic signatures and providing a user-friendly interface, airSlate SignNow signNowly reduces the time spent on handling oregon statewide tax forms. Businesses can send, sign, and store documents faster than traditional methods.

-

What support does airSlate SignNow offer for clients dealing with oregon statewide tax?

airSlate SignNow provides dedicated customer support to assist clients with any questions related to the oregon statewide tax. Whether you're new to eSigning or need help with tax compliance, our team is ready to help.

Get more for OR OR STT 1 Fill Out Tax Template OnlineUS Legal

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497315586 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts effective immediately 497315587 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497315588 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts effective 497315589 form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497315590 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts where 497315591 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts effective 497315592 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497315593 form

Find out other OR OR STT 1 Fill Out Tax Template OnlineUS Legal

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template