Form or STT 1, Oregon Quarterly Statewide Transit Tax Withholding Return, 150 206 003 2021

Understanding the Oregon Quarterly Statewide Transit Tax Withholding Return

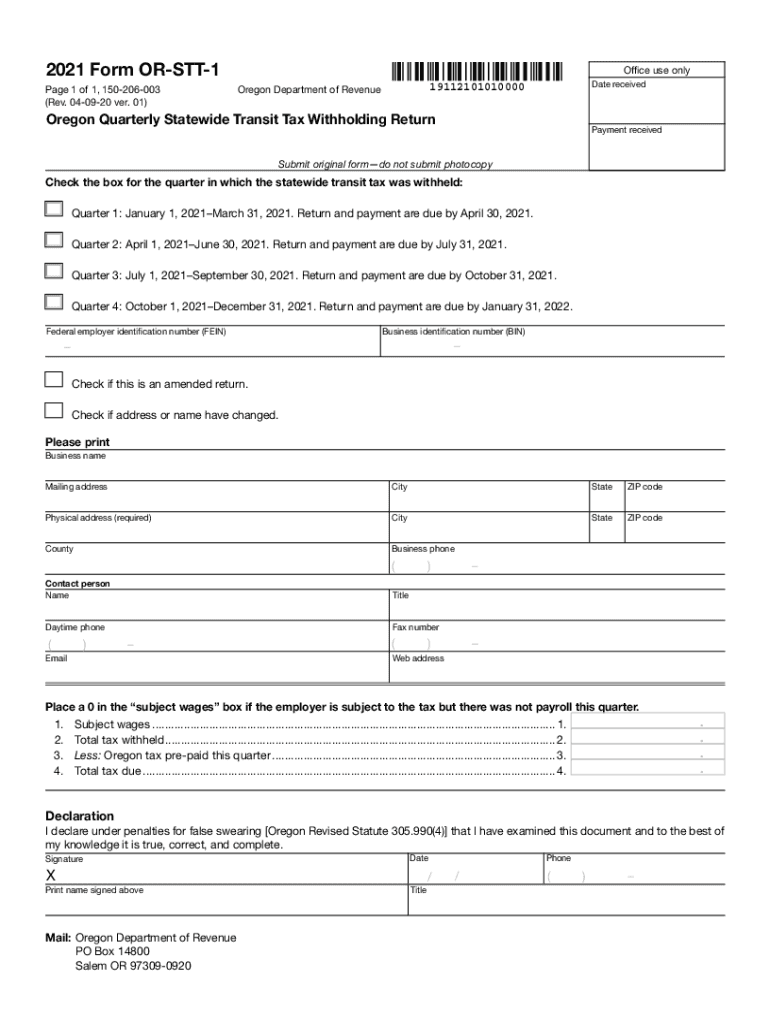

The Oregon Quarterly Statewide Transit Tax Withholding Return, known as Form OR STT 1, is a critical document for employers in Oregon. This form is designed to report and remit the statewide transit tax withheld from employees' wages. The tax is applicable to all employers operating within the state, ensuring funding for public transportation systems. Understanding the purpose and requirements of this form is essential for compliance with Oregon tax laws.

Steps to Complete the Oregon STT 1 Form

Completing the Form OR STT 1 involves several key steps:

- Gather necessary information: Collect employee wage data and the total transit tax withheld during the quarter.

- Fill out the form: Accurately enter the required information, including your business details and the amount of tax withheld.

- Review for accuracy: Double-check all entries to ensure compliance with Oregon tax regulations.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

How to Obtain the Oregon STT 1 Form

The Form OR STT 1 can be easily obtained through the Oregon Department of Revenue's official website. It is available for download in a printable format. Employers can also request physical copies by contacting the department directly. Ensuring you have the correct version of the form is crucial for compliance.

Filing Deadlines for the Oregon STT 1 Form

Timely filing of the Oregon STT 1 is essential to avoid penalties. The form must be submitted quarterly, with specific deadlines set by the Oregon Department of Revenue. Generally, the due date for filing is the last day of the month following the end of each quarter. For example, the deadline for the first quarter would be April 30.

Key Elements of the Oregon STT 1 Form

Understanding the key elements of the Form OR STT 1 is vital for accurate completion. The form includes sections for:

- Employer information: Name, address, and identification number.

- Employee wage details: Total wages paid and the amount of transit tax withheld.

- Signature: The form must be signed by an authorized representative of the business.

Penalties for Non-Compliance with the Oregon STT 1 Form

Failure to file the Oregon STT 1 on time can result in penalties. The Oregon Department of Revenue imposes fines based on the amount of tax due and the length of the delay. Additionally, late payments may accrue interest, increasing the financial burden on employers. It is crucial to adhere to filing deadlines to avoid these consequences.

Quick guide on how to complete 2021 form or stt 1 oregon quarterly statewide transit tax withholding return 150 206 003

Effortlessly Prepare Form OR STT 1, Oregon Quarterly Statewide Transit Tax Withholding Return, 150 206 003 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the essential resources to create, modify, and electronically sign your documents promptly without any delays. Manage Form OR STT 1, Oregon Quarterly Statewide Transit Tax Withholding Return, 150 206 003 on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related operation today.

How to Modify and eSign Form OR STT 1, Oregon Quarterly Statewide Transit Tax Withholding Return, 150 206 003 with Ease

- Obtain Form OR STT 1, Oregon Quarterly Statewide Transit Tax Withholding Return, 150 206 003 and click Get Form to begin.

- Utilize the features we offer to fill out your form.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign function, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced paperwork, tedious form navigation, or mistakes that necessitate reprinting new document copies. airSlate SignNow takes care of all your document management requirements within a few clicks from any device you choose. Alter and eSign Form OR STT 1, Oregon Quarterly Statewide Transit Tax Withholding Return, 150 206 003 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form or stt 1 oregon quarterly statewide transit tax withholding return 150 206 003

Create this form in 5 minutes!

How to create an eSignature for the 2021 form or stt 1 oregon quarterly statewide transit tax withholding return 150 206 003

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What is the Oregon transit tax?

The Oregon transit tax is a payroll tax that supports public transportation initiatives in the state. Employers and employees contribute a specific percentage of wages, aiming to enhance public transit services. Understanding this tax is crucial for businesses operating in Oregon.

-

How does airSlate SignNow simplify handling Oregon transit tax documents?

AirSlate SignNow streamlines the process of signing and managing documents related to the Oregon transit tax. Our platform allows you to easily send, sign, and store important tax documents electronically, reducing paperwork and enhancing efficiency. This feature helps businesses stay organized and compliant with tax regulations.

-

Are there any costs associated with using airSlate SignNow for Oregon transit tax documentation?

Yes, airSlate SignNow offers various pricing plans designed to accommodate different business sizes and needs. Our cost-effective solution means you can effectively manage your Oregon transit tax documentation without breaking the bank. Review our pricing plans to find the right fit for your organization.

-

Can I integrate airSlate SignNow with my existing payroll systems for Oregon transit tax?

Absolutely! airSlate SignNow easily integrates with many popular payroll systems. This seamless integration helps ensure that all documents related to the Oregon transit tax are processed efficiently, allowing your team to focus on other crucial tasks.

-

What are the benefits of using airSlate SignNow for managing Oregon transit tax forms?

Using airSlate SignNow to manage Oregon transit tax forms offers numerous benefits, including enhanced security, faster turnaround times, and easy document retrieval. Our platform ensures that your sensitive tax information is kept secure while making it easy to access when needed. Experience improved productivity and peace of mind with eSigning.

-

How can I ensure compliance with the Oregon transit tax using airSlate SignNow?

AirSlate SignNow's robust features help businesses maintain compliance with the Oregon transit tax regulations. You can easily track who signed what and when, ensuring that all necessary approvals are documented. This visibility helps prevent compliance issues and supports better auditing processes.

-

Is there customer support available for airSlate SignNow regarding the Oregon transit tax?

Yes, we provide excellent customer support for all users of airSlate SignNow, especially for inquiries about the Oregon transit tax. Our support team is available to assist you with any questions or concerns, ensuring you have the guidance needed to navigate tax documentation efficiently.

Get more for Form OR STT 1, Oregon Quarterly Statewide Transit Tax Withholding Return, 150 206 003

- Printable dissolution of marriage forms

- Rtb 34 form

- Proxy voting form template

- Fashion show rubric form

- Bona fide marriage exemption letter sample form

- Stable hand license qld form

- 8048 auth for use or disclosure of health inforincoming records 090220 draft form

- Junior infantshowth road national school form

Find out other Form OR STT 1, Oregon Quarterly Statewide Transit Tax Withholding Return, 150 206 003

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer