Form or Stt 1 2019

What is the Form Or Stt 1

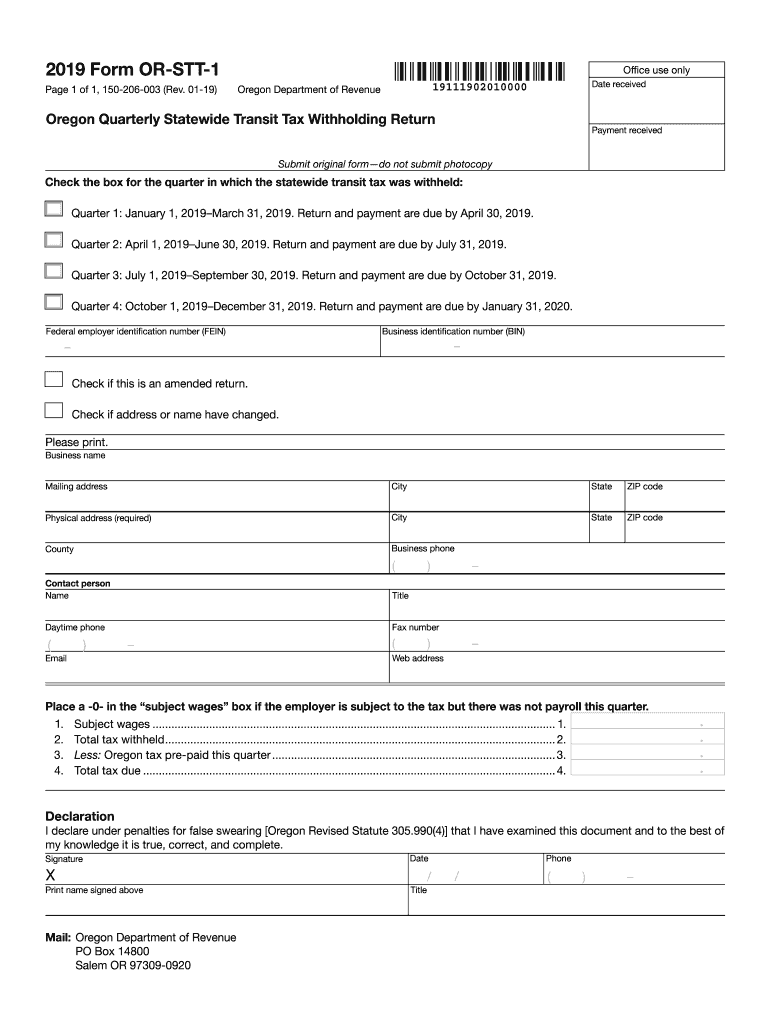

The Form Or Stt 1 is a tax document used in Oregon for the statewide transit tax. This form is essential for individuals and businesses to report their income and calculate the tax owed. The 2019 version of this form reflects updates and requirements specific to that tax year. Understanding the purpose and requirements of the Form Or Stt 1 is crucial for compliance with Oregon state tax laws.

How to use the Form Or Stt 1

Using the Form Or Stt 1 involves several key steps. First, determine your eligibility to file this form based on your income sources. Next, gather all necessary financial documents, such as W-2s or 1099s, to ensure accurate reporting. Complete the form by entering your income information, calculating the tax owed, and ensuring all sections are filled out correctly. Finally, submit the form by the designated deadline to avoid penalties.

Steps to complete the Form Or Stt 1

Completing the Form Or Stt 1 requires careful attention to detail. Follow these steps:

- Gather your income documents, including W-2 and 1099 forms.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income accurately in the designated sections.

- Calculate the statewide transit tax based on your income.

- Review the form for accuracy and completeness.

- Submit the form either electronically or by mail by the filing deadline.

Legal use of the Form Or Stt 1

The legal use of the Form Or Stt 1 is governed by Oregon state tax regulations. It is essential to ensure that the form is filled out accurately to avoid legal complications. Filing the form correctly not only fulfills your tax obligations but also protects you from potential audits or penalties. The form must be submitted by the deadline specified by the state to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form Or Stt 1 are critical for compliance. Typically, the form must be submitted by April fifteenth of the year following the tax year being reported. For the 2019 form, this means it should have been filed by April 15, 2020. It is advisable to keep track of any changes in deadlines announced by the Oregon Department of Revenue to ensure timely submission.

Required Documents

To complete the Form Or Stt 1, certain documents are required. These include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources.

- Identification information, such as your Social Security number.

Having these documents ready will streamline the completion process and help ensure accuracy.

Quick guide on how to complete 2019 form or stt 1 oregon quarterly statewide transit tax

Complete Form Or Stt 1 effortlessly on any device

Online document management has surged in popularity among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and sign your documents quickly and easily. Manage Form Or Stt 1 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The simplest way to edit and eSign Form Or Stt 1 without hassle

- Find Form Or Stt 1 and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form Or Stt 1 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form or stt 1 oregon quarterly statewide transit tax

Create this form in 5 minutes!

How to create an eSignature for the 2019 form or stt 1 oregon quarterly statewide transit tax

How to make an electronic signature for the 2019 Form Or Stt 1 Oregon Quarterly Statewide Transit Tax in the online mode

How to make an electronic signature for the 2019 Form Or Stt 1 Oregon Quarterly Statewide Transit Tax in Google Chrome

How to create an electronic signature for signing the 2019 Form Or Stt 1 Oregon Quarterly Statewide Transit Tax in Gmail

How to generate an electronic signature for the 2019 Form Or Stt 1 Oregon Quarterly Statewide Transit Tax right from your smartphone

How to create an eSignature for the 2019 Form Or Stt 1 Oregon Quarterly Statewide Transit Tax on iOS

How to make an eSignature for the 2019 Form Or Stt 1 Oregon Quarterly Statewide Transit Tax on Android devices

People also ask

-

What is airSlate SignNow, and how does it relate to 2019 or form stt?

airSlate SignNow is a powerful eSignature platform that allows users to send and sign documents electronically. The application introduces efficient solutions for document management in 2019 or form stt, streamlining the signing process and improving business workflows.

-

What features are included in the airSlate SignNow platform for 2019 or form stt?

The airSlate SignNow platform includes features like customized templates, real-time collaboration, and mobile access, specifically designed for 2019 or form stt. These features enhance user experience and ensure that businesses can efficiently manage their document signing needs.

-

How can airSlate SignNow reduce costs related to 2019 or form stt?

By utilizing airSlate SignNow for 2019 or form stt, businesses can signNowly reduce costs associated with printing, mailing, and storing paper documents. The platform provides a cost-effective solution for eSigning, enabling organizations to save on operational expenses.

-

Is airSlate SignNow easy to integrate with other tools for 2019 or form stt?

Yes, airSlate SignNow offers seamless integration with various third-party applications, enhancing its functionality for 2019 or form stt. Users can connect with CRM systems, cloud storage solutions, and productivity software, simplifying their document workflows.

-

What security measures does airSlate SignNow implement for 2019 or form stt?

airSlate SignNow prioritizes security with features such as encrypted data transmission and secure storage for all documents related to 2019 or form stt. The platform complies with various industry regulations, ensuring that sensitive information remains protected.

-

What are the benefits of using airSlate SignNow for businesses handling 2019 or form stt?

Businesses using airSlate SignNow for 2019 or form stt can enjoy faster turnaround times for document approvals and a more organized approach to document management. This leads to improved client satisfaction and enhanced operational efficiency.

-

What pricing options are available for airSlate SignNow concerning 2019 or form stt?

airSlate SignNow offers flexible pricing plans that cater to different business needs regarding 2019 or form stt. From basic packages for small businesses to advanced options for larger enterprises, there is a fit for every budget without compromising on essential features.

Get more for Form Or Stt 1

- Loan estimate form

- Vs166 form

- California id fee waiver form

- Advisement regarding a penalty assessment summons and colorado form

- On contractors contractors state license board state of california cslb ca form

- 16 25 railcard form

- Palmetto surety corporation form

- Microchip registration form dayandeveningpetcliniccom

Find out other Form Or Stt 1

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free