Application for Tax Clearance Certificate, Form a 5088 TC

What is the Application For Tax Clearance Certificate, Form A 5088 TC

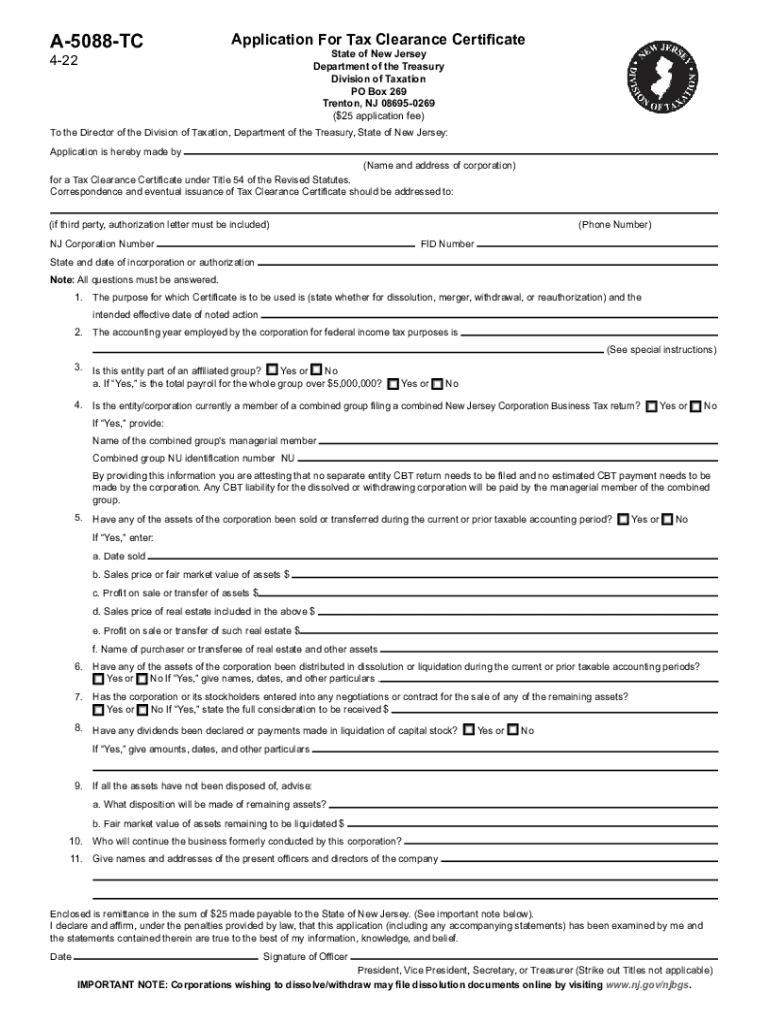

The Application for Tax Clearance Certificate, Form A 5088 TC, is a crucial document for individuals and businesses in New Jersey seeking to demonstrate their compliance with state tax obligations. This form is typically required when a taxpayer is applying for a tax clearance certificate, which verifies that all state taxes have been paid in full. The certificate is often necessary for various transactions, including business dissolutions, license applications, and other financial dealings that require proof of tax compliance.

Steps to Complete the Application For Tax Clearance Certificate, Form A 5088 TC

Completing the Application for Tax Clearance Certificate, Form A 5088 TC involves several important steps:

- Gather necessary information, including your tax identification number and details about your business or personal tax history.

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the appropriate channels, whether online, by mail, or in person.

Following these steps carefully can help ensure a smooth application process and timely receipt of your tax clearance certificate.

How to Obtain the Application For Tax Clearance Certificate, Form A 5088 TC

The Application for Tax Clearance Certificate, Form A 5088 TC can be obtained through the New Jersey Division of Taxation's official website or by contacting their office directly. The form is available in a downloadable format, allowing taxpayers to fill it out electronically or print it for manual completion. It is important to ensure that you are using the most current version of the form to avoid any issues during the application process.

Legal Use of the Application For Tax Clearance Certificate, Form A 5088 TC

The legal use of the Application for Tax Clearance Certificate, Form A 5088 TC is essential for confirming a taxpayer's compliance with New Jersey tax laws. This form serves as an official request for a tax clearance certificate, which is legally binding and necessary for various business and personal transactions. Submitting this application correctly ensures that the taxpayer can legally operate or dissolve their business without facing penalties or legal complications related to unpaid taxes.

Required Documents for the Application For Tax Clearance Certificate, Form A 5088 TC

When applying for the tax clearance certificate using Form A 5088 TC, several documents may be required to support your application:

- Proof of identity, such as a driver's license or state ID.

- Tax identification number or Social Security number.

- Documentation of any past tax filings or payments.

- Additional forms or documents as specified by the New Jersey Division of Taxation.

Having these documents ready can expedite the application process and help ensure that all necessary information is provided.

Eligibility Criteria for the Application For Tax Clearance Certificate, Form A 5088 TC

To be eligible for the Application for Tax Clearance Certificate, Form A 5088 TC, taxpayers must meet specific criteria set by the New Jersey Division of Taxation. Generally, applicants must have filed all required tax returns and paid any outstanding tax liabilities. Additionally, individuals or businesses seeking the certificate must not have any pending tax disputes or unresolved issues with the state tax authority. Meeting these eligibility requirements is crucial for a successful application.

Quick guide on how to complete application for tax clearance certificate form a 5088 tc

Effortlessly Prepare Application For Tax Clearance Certificate, Form A 5088 TC on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly and efficiently. Handle Application For Tax Clearance Certificate, Form A 5088 TC on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Method to Edit and eSign Application For Tax Clearance Certificate, Form A 5088 TC Without Stress

- Obtain Application For Tax Clearance Certificate, Form A 5088 TC and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your PC.

Say goodbye to lost or disorganized files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Application For Tax Clearance Certificate, Form A 5088 TC, ensuring outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an NJ tax clearance certificate?

An NJ tax clearance certificate is a document issued by the New Jersey Division of Taxation that confirms a business owes no taxes or debts to the state. This certificate is crucial for contractors and businesses seeking to bid on public contracts in New Jersey. Obtaining this document helps ensure compliance with state tax regulations.

-

How can airSlate SignNow assist in obtaining an NJ tax clearance certificate?

AirSlate SignNow provides a seamless way to prepare and eSign documents needed to apply for an NJ tax clearance certificate. Our platform enables businesses to quickly compile and submit the required forms electronically, streamlining the often tedious process. By using our service, you can save time and ensure that your submissions are accurate.

-

What are the costs associated with obtaining an NJ tax clearance certificate?

The cost of obtaining an NJ tax clearance certificate can vary depending on the type of application and the entity seeking it. However, using airSlate SignNow can help minimize additional costs by providing a cost-effective solution for document preparation and management. Consult the New Jersey Division of Taxation for specific fee structures as it may change.

-

What features does airSlate SignNow offer for handling NJ tax clearance certificate requests?

AirSlate SignNow offers features such as document templates, secure eSigning, and real-time status tracking for NJ tax clearance certificate requests. These tools make it easy for businesses to manage their documentation throughout the application process. Additionally, our platform offers cloud storage, ensuring all essential documents are securely accessible whenever needed.

-

What are the benefits of using airSlate SignNow for eSigning documents related to NJ tax clearance certificate?

Using airSlate SignNow for eSigning documents related to the NJ tax clearance certificate offers advantages like speed, security, and ease of use. The intuitive interface allows for quick editing and electronic signing, reducing turnaround time signNowly. Plus, the robust security features ensure that your sensitive information is protected.

-

Does airSlate SignNow integrate with other tools for managing NJ tax clearance certificate processes?

Yes, airSlate SignNow provides various integrations with popular business tools to streamline the management of the NJ tax clearance certificate process. This allows for seamless data transfer between your favorite applications and our platform, enhancing overall efficiency. These integrations facilitate a smoother workflow and help manage important documentation more effectively.

-

How long does it typically take to obtain an NJ tax clearance certificate?

The time it takes to obtain an NJ tax clearance certificate can vary based on the specifics of your application and the current workload of the New Jersey Division of Taxation. Generally, it may take anywhere from a few days to a couple of weeks. Leveraging airSlate SignNow's tools can expedite document submission, potentially shortening this timeline.

Get more for Application For Tax Clearance Certificate, Form A 5088 TC

- Sample cover letter for filing of llc articles or certificate with secretary of state mississippi form

- Supplemental residential lease forms package mississippi

- Ms landlord 497315634 form

- Subpoena duces form

- Name change form 497315638

- Name change instructions and forms package for a minor mississippi

- Mississippi family 497315640 form

- Mississippi petition change form

Find out other Application For Tax Clearance Certificate, Form A 5088 TC

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now