CLAIM for REFUND of REALTY TRANSFER TAXES by FIRST TIME 2021-2026

Understanding the claim for refund of realty transfer taxes by first-time buyers

The claim for refund of realty transfer taxes by first-time buyers is a specific process designed to assist individuals who have recently purchased property in Delaware. This form allows eligible first-time homebuyers to request a refund of the realty transfer taxes paid during the purchase. It is essential to understand the criteria that define a first-time buyer, which typically includes individuals who have not owned a home in the past three years. This initiative aims to alleviate some financial burdens associated with home buying, making it more accessible for new homeowners.

Steps to complete the claim for refund of realty transfer taxes by first-time buyers

Completing the claim for refund of realty transfer taxes involves several key steps. First, ensure that you meet the eligibility criteria as a first-time buyer. Next, gather all necessary documentation, including proof of purchase, payment receipts for the transfer taxes, and any identification required. Fill out the claim form accurately, ensuring that all information matches the supporting documents. Once completed, review the form for any errors before submission. Finally, submit the form through the appropriate channels, whether online or via mail, and keep a copy for your records.

Required documents for the claim for refund of realty transfer taxes by first-time buyers

To successfully file the claim for refund of realty transfer taxes, several documents are necessary. These typically include:

- Proof of purchase, such as a settlement statement or deed

- Receipts showing payment of the realty transfer taxes

- A completed claim form

- Identification documents, such as a driver's license or Social Security number

Having these documents prepared in advance can streamline the process and help ensure that your claim is processed without delays.

Eligibility criteria for the claim for refund of realty transfer taxes by first-time buyers

Eligibility for the claim for refund of realty transfer taxes is primarily based on the status of the buyer. To qualify, the individual must be a first-time homebuyer, which generally means they have not owned a home within the last three years. Additionally, the property purchased must be used as a primary residence. It is important to review any specific state regulations or guidelines that may apply to ensure compliance with all eligibility requirements.

Form submission methods for the claim for refund of realty transfer taxes by first-time buyers

There are multiple methods for submitting the claim for refund of realty transfer taxes. First, you can complete the form online through the designated state portal, which may offer a more efficient processing time. Alternatively, you may choose to print the completed form and submit it via mail to the appropriate state office. In some cases, in-person submissions may also be accepted. Be sure to follow the specific instructions provided with the form to ensure it reaches the correct department.

Key elements of the claim for refund of realty transfer taxes by first-time buyers

Key elements of the claim for refund include the identification of the buyer as a first-time homebuyer, the documentation of the realty transfer taxes paid, and the accurate completion of the claim form. Additionally, it is crucial to understand the timelines for submission and any potential deadlines that may apply. Familiarizing yourself with these elements can help ensure a smooth and successful claim process.

Quick guide on how to complete claim for refund of realty transfer taxes by first time

Complete CLAIM FOR REFUND OF REALTY TRANSFER TAXES BY FIRST TIME seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed files, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle CLAIM FOR REFUND OF REALTY TRANSFER TAXES BY FIRST TIME on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to adjust and eSign CLAIM FOR REFUND OF REALTY TRANSFER TAXES BY FIRST TIME effortlessly

- Obtain CLAIM FOR REFUND OF REALTY TRANSFER TAXES BY FIRST TIME and click on Get Form to begin.

- Employ the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you choose. Adjust and eSign CLAIM FOR REFUND OF REALTY TRANSFER TAXES BY FIRST TIME and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct claim for refund of realty transfer taxes by first time

Create this form in 5 minutes!

People also ask

-

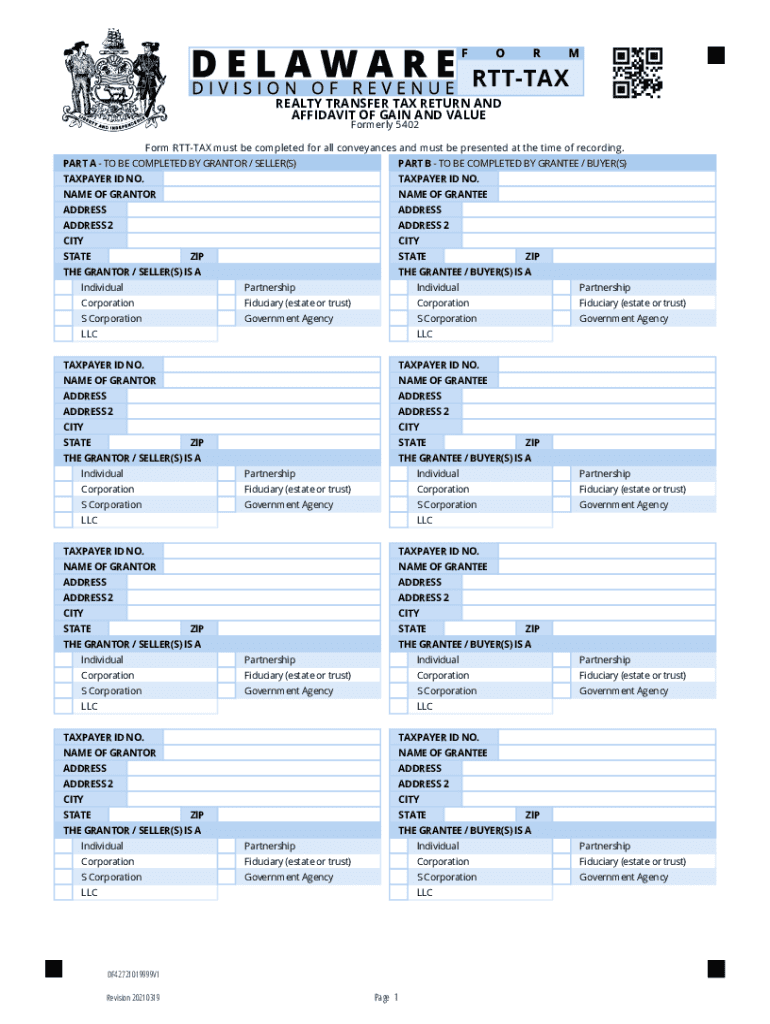

What is form 5402 and its primary purpose?

Form 5402 is a crucial document used by businesses for electronic signature processes. This form enables users to efficiently manage and sign documents online, streamlining workflows and reducing time spent on paperwork.

-

How can airSlate SignNow help with form 5402?

airSlate SignNow facilitates the use of form 5402 by providing an easy-to-use interface for eSigning and document management. Our platform allows users to upload, edit, and securely sign form 5402, ensuring compliance and efficiency in your business operations.

-

What are the pricing options for using form 5402 in airSlate SignNow?

AirSlate SignNow offers flexible pricing plans that cater to various business needs when working with form 5402. Whether you're a small business or a large corporation, we provide cost-effective solutions that ensure you only pay for the features you need.

-

Can I integrate form 5402 with other applications using airSlate SignNow?

Yes, airSlate SignNow supports integrations with a variety of applications that enhance the functionality of form 5402. This includes popular CRM and document management tools, allowing for seamless workflow automation and improved productivity.

-

What benefits does using form 5402 with airSlate SignNow offer?

Using form 5402 with airSlate SignNow provides numerous benefits, including enhanced security, faster turnaround times, and improved collaboration. Our technology ensures that all signatures are legally binding while maintaining an audit trail for compliance purposes.

-

Is it easy to send and manage form 5402 through airSlate SignNow?

Absolutely! AirSlate SignNow is designed for ease of use, making it simple to send and manage form 5402 electronically. The user-friendly interface allows you to quickly upload documents, add recipients, and track the signing process in real-time.

-

What kind of customer support does airSlate SignNow offer for form 5402?

AirSlate SignNow provides robust customer support for all inquiries related to form 5402. Our team is available via chat, email, or phone to assist you with any questions, ensuring you have a smooth experience while using our platform.

Get more for CLAIM FOR REFUND OF REALTY TRANSFER TAXES BY FIRST TIME

- Montana corporation form

- Corporate records maintenance package for existing corporations montana form

- Limited liability company llc operating agreement montana form

- Mt llc 497316076 form

- Montana disclaimer form

- Subcontractors request individual montana form

- Quitclaim deed from individual to husband and wife montana form

- Warranty deed from individual to husband and wife montana form

Find out other CLAIM FOR REFUND OF REALTY TRANSFER TAXES BY FIRST TIME

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist