Form 306 Income Tax Withholding Return North Dakota Office of State 2022-2026

What is the North Dakota Form 306?

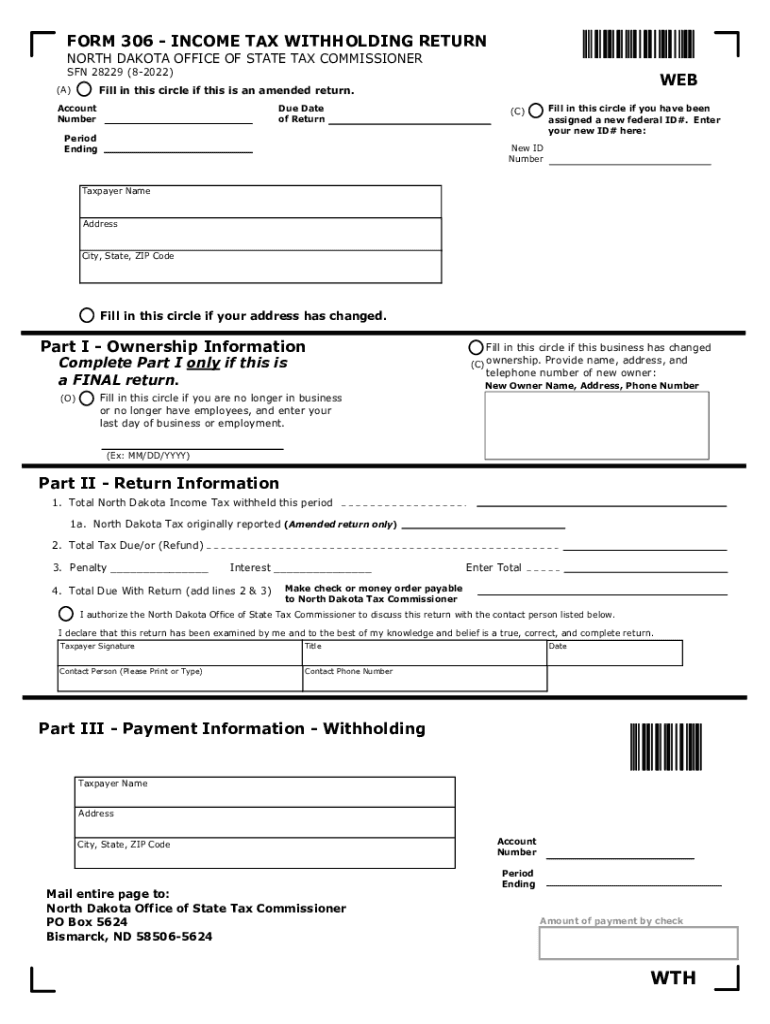

The North Dakota Form 306, officially known as the Income Tax Withholding Return, is a critical document for employers in North Dakota. This form is used to report and remit state income tax withheld from employees' wages. It ensures that employers comply with state tax regulations and helps employees fulfill their tax obligations. The form is essential for maintaining accurate records of withholding amounts and ensuring timely payments to the state treasury.

Steps to Complete the North Dakota Form 306

Completing the North Dakota Form 306 involves several key steps:

- Gather necessary information, including the total wages paid and the amount of state income tax withheld.

- Fill out the form with accurate details, ensuring all required fields are completed.

- Double-check the calculations to confirm that the amounts reported are correct.

- Sign and date the form to validate the submission.

- Submit the form by the designated deadline to avoid penalties.

How to Obtain the North Dakota Form 306

The North Dakota Form 306 can be obtained through the North Dakota Office of State Tax Commissioner’s website. It is available as a downloadable PDF, allowing employers to print and complete it manually. Additionally, many tax preparation software programs include the form, simplifying the process of filling it out electronically.

Key Elements of the North Dakota Form 306

Understanding the key elements of the North Dakota Form 306 is crucial for accurate completion. The form typically includes:

- Employer information, such as name, address, and tax identification number.

- Total wages paid to employees during the reporting period.

- Total state income tax withheld from those wages.

- Signature of the employer or authorized representative.

- Filing period information to indicate the reporting timeframe.

Legal Use of the North Dakota Form 306

The legal use of the North Dakota Form 306 is governed by state tax laws. Employers are required to file this form to ensure compliance with North Dakota's income tax withholding regulations. Accurate completion and timely submission of the form are essential to avoid legal penalties, including fines or interest on unpaid taxes. The form serves as a legal document that verifies the amounts withheld and remitted to the state.

Filing Deadlines for the North Dakota Form 306

Filing deadlines for the North Dakota Form 306 are typically aligned with the state’s tax calendar. Employers must submit the form quarterly, with specific deadlines for each reporting period. It is important to stay informed about these deadlines to ensure compliance and avoid penalties. Missing a deadline can result in additional fees and complications with state tax authorities.

Quick guide on how to complete form 306 income tax withholding return north dakota office of state

Effortlessly Prepare Form 306 Income Tax Withholding Return North Dakota Office Of State on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can easily access the right form and securely store it online. airSlate SignNow supplies you with all the resources required to create, modify, and e-sign your documents swiftly and without delays. Handle Form 306 Income Tax Withholding Return North Dakota Office Of State on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered task today.

How to Edit and eSign Form 306 Income Tax Withholding Return North Dakota Office Of State with Ease

- Locate Form 306 Income Tax Withholding Return North Dakota Office Of State and select Get Form to begin.

- Utilize the tools available to finish your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools provided specifically by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to store your changes.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form 306 Income Tax Withholding Return North Dakota Office Of State and ensure superior communication at every stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 306 income tax withholding return north dakota office of state

Create this form in 5 minutes!

People also ask

-

What is the nd form 306?

The nd form 306 is a crucial document used for various applications, particularly in the context of government and legal procedures. It ensures that all required information is gathered efficiently and accurately. With airSlate SignNow, you can easily prepare and sign the nd form 306 electronically, streamlining the process.

-

How can airSlate SignNow help with completing the nd form 306?

airSlate SignNow simplifies the process of completing the nd form 306 by providing user-friendly templates and workflows. Users can fill out the form online, make edits as needed, and ensure that all details are correct before sending it for electronic signatures. This saves time and reduces the risk of errors.

-

Is there a cost to use airSlate SignNow for the nd form 306?

Yes, airSlate SignNow offers a range of pricing plans, catering to different business sizes and needs. While there are no hidden fees, it is important to choose a plan that fits your usage, especially if you frequently handle documents like the nd form 306. Check our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other applications while handling the nd form 306?

Absolutely! airSlate SignNow supports integration with various applications, allowing you to manage your documents seamlessly. You can connect tools like Google Drive, Salesforce, and more, making it easy to handle the nd form 306 in conjunction with other workflows.

-

What are the benefits of using airSlate SignNow for the nd form 306?

Using airSlate SignNow for the nd form 306 provides several benefits, including enhanced efficiency, security, and ease of use. The platform allows users to send documents for signing quickly and securely, ensuring timely completion of important legal paperwork. Additionally, it helps reduce paper waste and storage issues.

-

What features does airSlate SignNow offer for managing the nd form 306 effectively?

airSlate SignNow provides features such as customizable templates, in-app notifications, and tracking capabilities specifically for documents like the nd form 306. These features help users keep track of the signing process and ensure that all parties complete their actions promptly.

-

Is the nd form 306 legally binding when signed through airSlate SignNow?

Yes, signatures obtained through airSlate SignNow are legally binding and compliant with electronic signature laws. This ensures that the nd form 306 holds legal validity, making it a trustworthy choice for businesses needing to finalize important documents.

Get more for Form 306 Income Tax Withholding Return North Dakota Office Of State

- Montana quitclaim deed 497316152 form

- Warranty deed from individual to llc montana form

- Montana code annotated form

- Husband wife corporation 497316156 form

- Warranty deed from husband and wife to corporation montana form

- Divorce worksheet and law summary for contested or uncontested case of over 25 pages ideal client interview form montana

- Construction lien notice corporation or llc montana form

- Acknowledgment of satisfaction of lien individual montana form

Find out other Form 306 Income Tax Withholding Return North Dakota Office Of State

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free