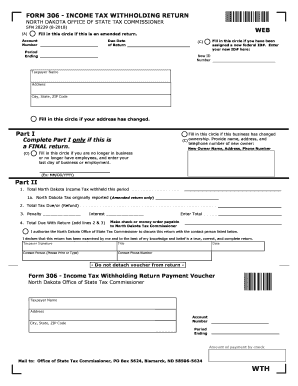

North Dakota Form 306 Income Tax Withholding 2018

What is the North Dakota Form 306 Income Tax Withholding

The North Dakota Form 306, also known as the income tax withholding form, is a crucial document for employees and employers in North Dakota. This form is used to determine the amount of state income tax to withhold from employees' paychecks. By accurately completing this form, employees ensure that the correct amount of tax is deducted, which helps avoid underpayment or overpayment at the end of the tax year. It is essential for both parties to understand the implications of this form to maintain compliance with state tax laws.

Steps to complete the North Dakota Form 306 Income Tax Withholding

Completing the North Dakota Form 306 involves several straightforward steps:

- Gather necessary personal information, including your Social Security number, address, and filing status.

- Determine your expected annual income to estimate the appropriate withholding amount.

- Fill out the form by providing the required information in the designated fields.

- Review the completed form for accuracy to ensure all details are correct.

- Submit the form to your employer, who will use it to calculate your withholding amount.

Following these steps carefully will help ensure that your tax withholding is accurate and compliant with North Dakota regulations.

How to obtain the North Dakota Form 306 Income Tax Withholding

The North Dakota Form 306 can be easily obtained through various channels. It is available for download on the North Dakota Office of State Tax Commissioner’s website. Additionally, employers may provide copies of the form to their employees during onboarding or upon request. If you prefer a physical copy, you can also visit local tax offices or libraries that may have the form available.

Key elements of the North Dakota Form 306 Income Tax Withholding

Key elements of the North Dakota Form 306 include:

- Personal Information: This section requires your name, address, and Social Security number.

- Filing Status: You must indicate your filing status, such as single, married, or head of household.

- Withholding Allowances: This part allows you to claim allowances based on your personal and financial situation.

- Signature: You must sign and date the form to validate it.

Understanding these elements is vital for accurately completing the form and ensuring proper tax withholding.

Legal use of the North Dakota Form 306 Income Tax Withholding

The North Dakota Form 306 is legally required for employers to withhold the appropriate amount of state income tax from employee wages. Both employees and employers are obligated to adhere to the guidelines set forth by the North Dakota tax authorities. Failure to complete and submit this form can result in penalties for both parties, including fines and increased tax liabilities. Therefore, it is essential to understand the legal implications of this form and ensure compliance with state regulations.

Form Submission Methods (Online / Mail / In-Person)

The North Dakota Form 306 can be submitted through various methods, depending on employer preferences and local regulations. Common submission methods include:

- Online: Some employers may allow electronic submission of the form through payroll systems.

- Mail: You can send the completed form to your employer via postal mail.

- In-Person: Submitting the form directly to your employer’s HR or payroll department is also an option.

Choosing the appropriate submission method ensures that your withholding information is processed efficiently and accurately.

Quick guide on how to complete nd state tax withholding 2018 2019 form

Your assistance manual on how to prepare your North Dakota Form 306 Income Tax Withholding

If you’re eager to discover how to generate and dispatch your North Dakota Form 306 Income Tax Withholding, here are some brief guidelines to facilitate tax processing.

Initially, you simply need to register for your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, create, and finalize your tax paperwork effortlessly. Utilizing its editor, you can alternate between text, check boxes, and eSignatures and revert to modify responses when necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and intuitive sharing.

Adhere to the steps below to complete your North Dakota Form 306 Income Tax Withholding in a few minutes:

- Establish your account and start working on PDFs within moments.

- Utilize our library to obtain any IRS tax form; browse through versions and schedules.

- Press Get form to access your North Dakota Form 306 Income Tax Withholding in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and rectify any mistakes.

- Preserve modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes digitally with airSlate SignNow. Please be aware that submitting on paper may increase return inaccuracies and delay reimbursements. Certainly, before e-filing your taxes, check the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct nd state tax withholding 2018 2019 form

FAQs

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Do I need to fill out the state admission form to participate in state counselling in the NEET UG 2018?

There is two way to participate in state counseling》Fill the state quota counseling admission form(for 15% quota) and give the preference to your own state with this if your marks are higher and if you are eligible to get admission in your state then you will get the college.》Fill out the form for state counseling like karnataka state counseling has started and Rajasthan counseling will start from 18th june.In 2nd way you will fill the form for 85% state quota and has higher chances to get college in your own state.NOTE= YOU WILL GET COLLEGE IN OTHER STATE (IN 15% QUOTA) WHEN YOU WILL CROSS THE PARTICULAR CUT OFF OF THE NEET AND THAT STATE.BEST OF LUCK.PLEASE DO FOLLOW ME ON QUORA.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can I figure out if I’m withholding sufficient taxes to avoid a nasty IRS tax bill next spring (2019) by myself?

By and in large, if you have a “normal” return (no unusual income or deductions), if you follow the formula laid out by the IRS on the W-4 you will out when you start with the employer, you will end up just about right.However, if you have unusual income or deductions, that may not be right, so you need to make a good estimate. This is how I make my estimates, note that I’m not a tax professional, I’m just a guy who hates writing a check in April.Determine your expected annual income. Take a typical paycheck and multiply the GROSS PAY (the top line number) by (one of: 52 (If you are paid weekly), 26 (biweekly), 24 (twice a month) or 12 (monthly)), this will give you your annual income. If you have more than one job, add up all of the sums. If you have irregular income, average a couple of months worth to make your best guess.If you are married, do the same drill for your spouse and add the numbers togetherSubtract from that the deductions everyone gets automatically $12,000 if you are single, $24000 if you are married filing jointlyCalculate the amount of tax that will be due on that amount:There are tax charts avaialble at 2018 Federal Income Tax Brackets and New Tax Rates - NerdWalletThat’s your tax DueMultiple the amount of tax withheld from your check for FEDERAL INCOME TAX ONLY (do not count Social security, state taxes, or any other dedutions) by the same number you used for incomeCompare the two numbers. Hopefully you will be close to zero. If you are likely to owe more than you want, bump your withholding up (file a new W-4, taking less deductions or having additional withheld from each check). If you’re getting too much back…my advice (which is not professional!) is to let that ride until the end of this year and verify the accuracy of your estimate…then and only then adjust if appropriate.

Create this form in 5 minutes!

How to create an eSignature for the nd state tax withholding 2018 2019 form

How to make an electronic signature for the Nd State Tax Withholding 2018 2019 Form in the online mode

How to make an electronic signature for your Nd State Tax Withholding 2018 2019 Form in Chrome

How to create an electronic signature for putting it on the Nd State Tax Withholding 2018 2019 Form in Gmail

How to make an eSignature for the Nd State Tax Withholding 2018 2019 Form from your mobile device

How to make an electronic signature for the Nd State Tax Withholding 2018 2019 Form on iOS devices

How to generate an eSignature for the Nd State Tax Withholding 2018 2019 Form on Android OS

People also ask

-

What is the ND Form 306 and how can airSlate SignNow assist with it?

The ND Form 306 is a necessary document for various legal and administrative purposes. airSlate SignNow streamlines the process of signing, sending, and managing ND Form 306, making it easy for businesses to handle documents electronically without hassle.

-

Is there a cost associated with using airSlate SignNow for ND Form 306?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Each plan includes features tailored to help you efficiently manage ND Form 306 and other documents, ensuring you get great value for your investment.

-

What features does airSlate SignNow offer for processing ND Form 306?

airSlate SignNow provides a variety of features specifically designed for handling ND Form 306. These include customizable templates, secure eSignature options, and automated workflows which enhance the efficiency of document management and ensure compliance.

-

How can airSlate SignNow enhance the signing experience for ND Form 306?

With airSlate SignNow, the signing experience for ND Form 306 becomes seamless and intuitive. Users can sign documents from any device, track signature progress in real-time, and receive notifications when actions are completed, all while ensuring document security.

-

Can I integrate airSlate SignNow with other software to manage ND Form 306?

Absolutely! airSlate SignNow supports integrations with numerous applications and platforms, allowing you to connect your existing tools for a streamlined workflow. This capability enhances the management of ND Form 306 alongside your favorite productivity software.

-

What benefits does airSlate SignNow offer for businesses dealing with ND Form 306?

Using airSlate SignNow for ND Form 306 offers multiple benefits, including increased efficiency, reduced turnaround times, and improved compliance. The platform ensures easy document tracking and management, letting businesses focus on core operations rather than paperwork.

-

Is airSlate SignNow secure for handling ND Form 306?

Yes, security is a priority for airSlate SignNow, especially when dealing with sensitive documents like ND Form 306. The platform employs encryption, multi-factor authentication, and advanced security protocols to protect your data and ensure confidentiality.

Get more for North Dakota Form 306 Income Tax Withholding

- Iamwmw inc form

- Health coverage amp help paying costs kynect form

- Notice of non submission form yolo county board of realtors

- The marketeramp39s prismatic palette stevens institute of form

- Cystic fibrosis donation form

- Fee schedule revize form

- Online winter springs fl online arbor form

- Az792535 vo msecnd netcmsstorageassetsimportant notice to applicant certificates of insurance form

Find out other North Dakota Form 306 Income Tax Withholding

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will