Instructions for Preparing Form F 1065 R 0119 Florida 2019

Key elements of the Instructions For Preparing Form F 1065 R 0119 Florida

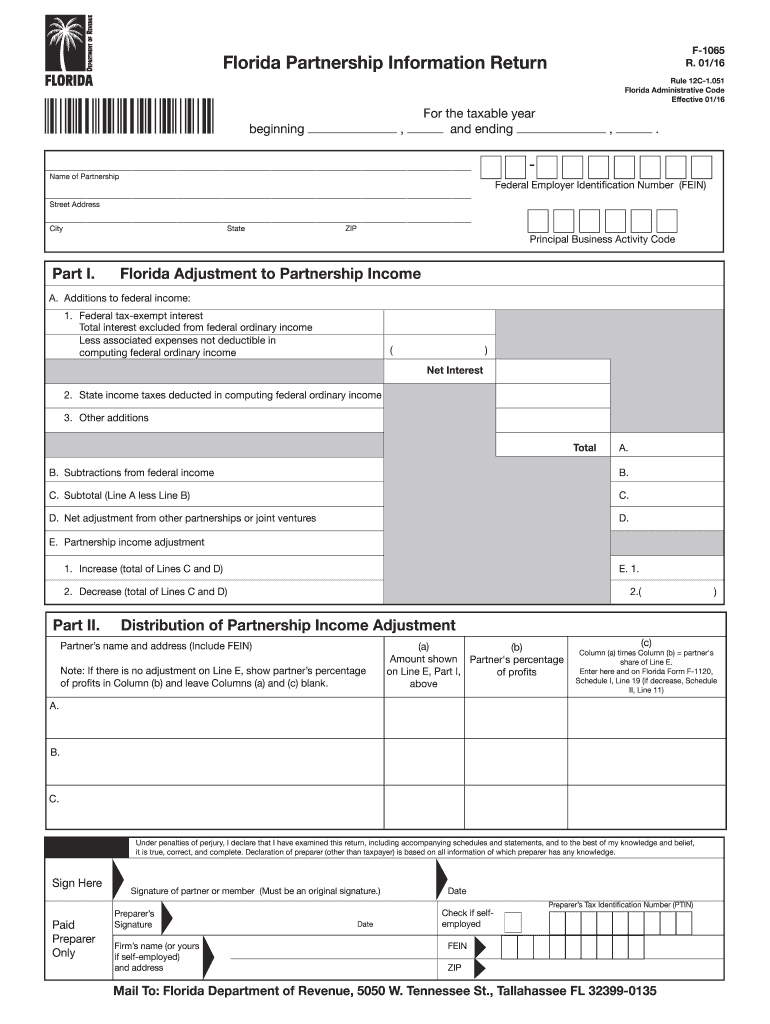

The Instructions For Preparing Form F 1065 R 0119 Florida provide essential guidance for partnerships operating in the state. Key elements include:

- Filing Requirements: Partnerships must file Form F 1065 if they have income, deductions, or credits.

- Information Needed: Gather all relevant financial data, including income statements and expense reports.

- Signature Requirements: Ensure that the form is signed by an authorized individual within the partnership.

- Submission Guidelines: Follow the specific instructions for submitting the form electronically or by mail.

Steps to complete the Instructions For Preparing Form F 1065 R 0119 Florida

Completing Form F 1065 involves several systematic steps to ensure accuracy and compliance:

- Collect necessary financial documents, including income and expense records.

- Fill out the form with accurate information regarding the partnership's financial activities.

- Review the completed form for any errors or omissions.

- Sign the form as required and prepare it for submission.

- Submit the form by the designated deadline, ensuring it is sent to the correct address.

Filing Deadlines / Important Dates

Understanding the filing deadlines for Form F 1065 is crucial for compliance. The typical deadline for submitting the form is:

- March 15 for calendar year partnerships.

- For fiscal year partnerships, the deadline is the 15th day of the third month after the end of the fiscal year.

Extensions may be available, but it is important to file for an extension before the original deadline.

Required Documents

To accurately complete Form F 1065, certain documents are necessary:

- Partnership Agreement: This outlines the terms and conditions of the partnership.

- Financial Statements: Include income statements, balance sheets, and cash flow statements.

- Previous Year’s Tax Returns: These can provide a helpful reference for current filings.

- Schedule K-1s: Required for each partner to report their share of income, deductions, and credits.

Legal use of the Instructions For Preparing Form F 1065 R 0119 Florida

The legal use of Form F 1065 is governed by Florida state tax laws. Proper adherence to the instructions ensures:

- Compliance with state tax regulations, reducing the risk of penalties.

- Accurate reporting of partnership income and deductions.

- Protection of partners' rights and responsibilities as outlined in the partnership agreement.

Digital vs. Paper Version

When preparing Form F 1065, partnerships have the option to submit digitally or via paper. Each method has its advantages:

- Digital Submission: Typically faster processing times and immediate confirmation of receipt.

- Paper Submission: May be preferred by those who are more comfortable with traditional filing methods.

Regardless of the method chosen, ensure that all information is complete and accurate to avoid delays.

Quick guide on how to complete instructions for preparing form f 1065 r 0119 florida

Complete Instructions For Preparing Form F 1065 R 0119 Florida effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can easily locate the necessary form and securely archive it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents swiftly without hold-ups. Manage Instructions For Preparing Form F 1065 R 0119 Florida on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to modify and eSign Instructions For Preparing Form F 1065 R 0119 Florida without any hassle

- Find Instructions For Preparing Form F 1065 R 0119 Florida and click Get Form to initiate.

- Utilize the features we offer to complete your document.

- Emphasize critical parts of your documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details thoroughly and click on the Done button to save your modifications.

- Select how you wish to submit your form—via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes necessitating new document printouts. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Instructions For Preparing Form F 1065 R 0119 Florida and guarantee excellent communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for preparing form f 1065 r 0119 florida

Create this form in 5 minutes!

People also ask

-

What is form f 1065 and why is it important?

Form f 1065 is a tax form used by partnerships to report income, deductions, gains, and losses. It's crucial for ensuring compliance with IRS regulations and can impact your business's tax responsibilities. Completing form f 1065 accurately is essential for maintaining the financial health of your partnership.

-

How can airSlate SignNow assist in completing form f 1065?

airSlate SignNow offers a seamless solution for eSigning and managing documents, including form f 1065. With its user-friendly interface, you can easily fill out and electronically sign your tax forms from anywhere. This not only saves time but also enhances collaboration among partners.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow provides robust features like eSignature capabilities, document templates, and real-time tracking. These tools streamline the process of completing critical documents such as form f 1065, ensuring that all parties are informed and that deadlines are met efficiently.

-

Is there a cost associated with using airSlate SignNow for form f 1065?

Yes, airSlate SignNow operates on a subscription model with various pricing plans to suit different needs. These plans are designed to be cost-effective, especially when you need to manage multiple forms, including form f 1065, throughout the year. You can choose a plan that aligns with your business size and volume of document handling.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow integrates seamlessly with many accounting software platforms. This integration makes it easier to manage documents like form f 1065 directly from your accounting system, improving efficiency and reducing the potential for errors.

-

How secure is the information I upload when filling out form f 1065?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance standards to protect sensitive information, including data on form f 1065. You can trust that your documents are secure during the signing process and beyond.

-

What are the benefits of using airSlate SignNow for eSigning form f 1065?

Utilizing airSlate SignNow for eSigning form f 1065 offers several benefits, including faster processing times and enhanced convenience. You and your partners can sign from any device, which accelerates the completion of important tax documents like form f 1065. Additionally, it reduces the reliance on physical paperwork.

Get more for Instructions For Preparing Form F 1065 R 0119 Florida

- Individual credit application montana form

- Interrogatories to plaintiff for motor vehicle occurrence montana form

- Interrogatories to defendant for motor vehicle accident montana form

- Llc notices resolutions and other operations forms package montana

- Montana estate form

- Notice of dishonored check civil keywords bad check bounced check montana form

- Notice check bad form

- Mutual wills containing last will and testaments for unmarried persons living together with no children montana form

Find out other Instructions For Preparing Form F 1065 R 0119 Florida

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free