Form IL 8633 I, Application to File Illinois Individual Income 2024-2026

Overview of Form F 1065 in Florida

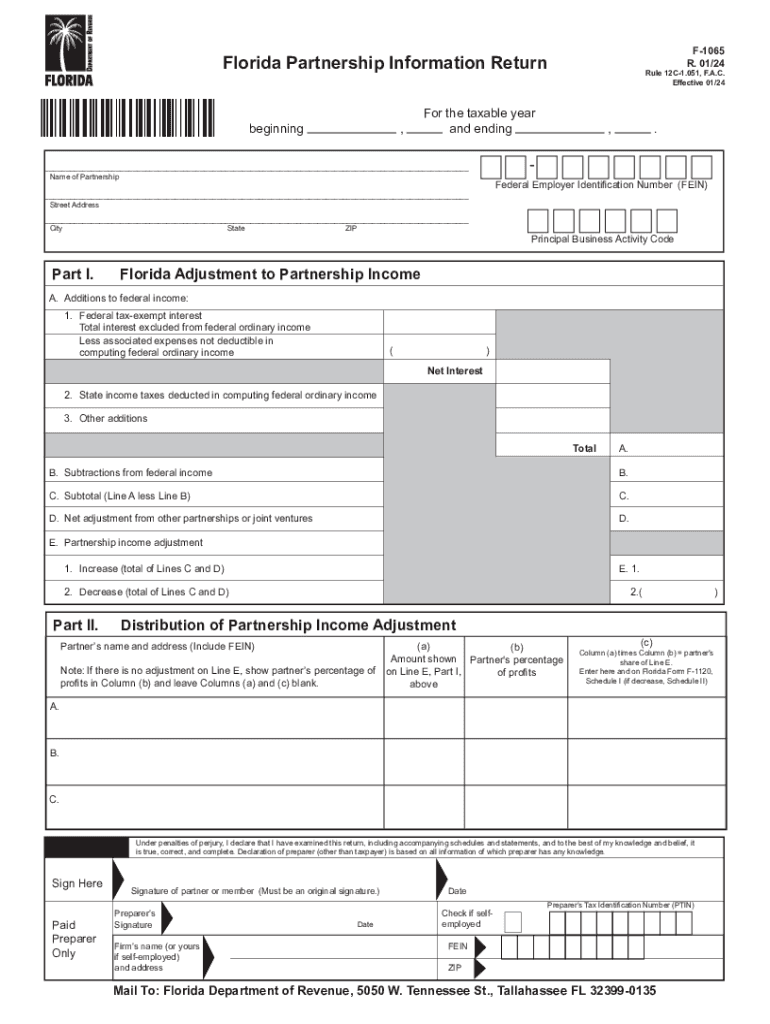

The Florida Form F 1065 is used for filing the partnership information return for partnerships operating in the state. This form is essential for reporting the income, deductions, and credits of a partnership. It provides a comprehensive overview of the partnership's financial activities for the tax year, ensuring compliance with state tax laws.

Steps to Complete Form F 1065

Completing Form F 1065 involves several key steps:

- Gather necessary financial documents, including income statements, expense reports, and prior year tax returns.

- Fill out the identifying information section, including the partnership's name, address, and federal employer identification number (EIN).

- Report income and deductions accurately on the form, ensuring all figures are supported by documentation.

- Complete the K-1 schedules for each partner, detailing their share of income, deductions, and credits.

- Review the completed form for accuracy before submission.

Filing Deadlines for Form F 1065

Partnerships must file Form F 1065 by the 15th day of the fourth month following the close of the tax year. For partnerships operating on a calendar year basis, this typically means the deadline is April 15. Extensions may be available, but it is important to file the necessary forms to avoid penalties.

Required Documents for Filing

When preparing to file Form F 1065, certain documents are necessary:

- Financial statements, including profit and loss statements and balance sheets.

- Records of all partnership income and expenses.

- Partner information, including names, addresses, and Social Security numbers or EINs.

- Any prior year tax returns for reference.

Legal Use of Form F 1065

Form F 1065 is legally required for partnerships operating in Florida. It serves as an official record of the partnership's financial activities and is used by the Florida Department of Revenue to assess tax liabilities. Failure to file this form can result in penalties and legal repercussions.

Understanding Florida K-1 Equivalent

In conjunction with Form F 1065, partnerships must also issue K-1 forms to each partner. The Florida K-1 equivalent details each partner's share of income, deductions, and credits from the partnership. This information is crucial for partners when filing their individual tax returns, as it directly impacts their tax obligations.

Submission Methods for Form F 1065

Form F 1065 can be submitted through various methods:

- Online submission through the Florida Department of Revenue's e-filing system.

- Mailing a paper copy of the form to the appropriate state tax office.

- In-person submission at designated tax offices, if necessary.

Quick guide on how to complete form il 8633 i application to file illinois individual income

Prepare Form IL 8633 I, Application To File Illinois Individual Income effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as a superb eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents promptly without delays. Manage Form IL 8633 I, Application To File Illinois Individual Income on any device with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest way to edit and eSign Form IL 8633 I, Application To File Illinois Individual Income with ease

- Locate Form IL 8633 I, Application To File Illinois Individual Income and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and hit the Done button to save your modifications.

- Choose your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form IL 8633 I, Application To File Illinois Individual Income to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form il 8633 i application to file illinois individual income

Create this form in 5 minutes!

How to create an eSignature for the form il 8633 i application to file illinois individual income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form f1065 and why do I need it?

The form f1065 is used by partnerships to report income, deductions, gains, and losses from their operations. It is essential for ensuring compliance with IRS regulations. Businesses using airSlate SignNow can easily eSign and submit this form, streamlining the filing process.

-

How can airSlate SignNow help me with filing form f1065?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending your form f1065. With features like templates and automated workflows, you can ensure that your documentation is completed accurately and submitted on time. This helps minimize the risk of errors that can delay processing.

-

Is there a cost associated with using airSlate SignNow for form f1065?

Yes, airSlate SignNow offers various pricing plans that are designed to meet the needs of different businesses. While specific pricing may vary, the solution is cost-effective when compared to traditional methods of sending documents. You can choose a package based on workload and features required for filing form f1065.

-

Are there any integrations available for airSlate SignNow when working with form f1065?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and document management systems. This allows you to manage your form f1065 and other essential documents in one place, enhancing your productivity and efficiency.

-

What features does airSlate SignNow offer for managing the form f1065?

With airSlate SignNow, you can take advantage of features like customizable templates, audit trails, and multi-party signing for your form f1065. These features ensure that all necessary information is captured correctly and that the signing process is compliant and transparent.

-

Can I store my completed form f1065 securely with airSlate SignNow?

Yes, airSlate SignNow prioritizes the security of your data. All completed forms, including your form f1065, are securely stored with encryption and access controls, ensuring that your sensitive information remains confidential and safe from unauthorized access.

-

How does airSlate SignNow compare to traditional methods for submitting form f1065?

Compared to traditional methods, airSlate SignNow offers a more efficient and cost-effective solution for submitting form f1065. It eliminates the need for printing, faxing, or mailing, saving time and reducing errors. This modern approach facilitates faster processing and better record-keeping.

Get more for Form IL 8633 I, Application To File Illinois Individual Income

- In witness whereof this assignment was executed by the undersigned assignor on this the form

- How to get out of a month to month lease without a 30 day 30 day notice community actiontenant didnt move out at the end of the form

- Notice of furnishing of labor or materials corporation form

- 2017 fall parade of homessm guidebook issuu form

- This conditional waiver and release of lien upon progress payment is form

- Under south dakota law the notice to pay form

- This note is made in the city of state of south dakota and the form

- South dakota known as form

Find out other Form IL 8633 I, Application To File Illinois Individual Income

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy